-

JPMorgan's move to acquire First Republic and its muni portfolio eases the risk of nearly $20 billion of munis flooding the market.

May 1 -

While Nuveen is a storied and well-respected institution in our business, it did not define John Miller.

April 25 Consultant

Consultant -

Except for the riskiest sectors, high-yield credit fundamentals appear to be strong, but rising interest rates and fund outflows are dampening primary and secondary market activity.

April 24 -

James Pruskowski, a nearly 30-year veteran of BlackRock, will be CIO and head of business development for 16Rock Asset Management LLC, a newly formed affiliate of 16th Amendment Advisors LLC.

April 19 -

Illinois' $2.45 billion GO sale should attract a wider investor audience with the higher ratings as the state seeks to raise new money for capital projects, fund ongoing pension buyout programs, and refund some debt for present value savings.

April 18 -

A John Miller-less speculative bond market may mean more diversification and price transparency, say some investors.

April 14 -

The announcement came as a global settlement agreement that resolves Preston Hollow Capital LLC's litigation against Miller and Nuveen was disclosed.

April 10 -

The publicly offered tax-exempt debt product is new for the firm and the collateralized debt obligation structure may be one of the first for the market since the 2008 financial crisis.

March 29 -

Ceffalio is taking on a newly created position at the Chicago-based firm.

January 25 -

After "carnage" in 2022, a munis should see a "positive environment" this year, according to analysts.

January 25 -

The value of the municipal bond market decreased by 4.3% in the third quarter of 2022, said Pat Luby, a strategist at CreditSights.

December 30 -

2022 saw rising rates, low issuance, massive fund outflows and overall volatility.

December 29 -

Nearly 20% of respondents to a HilltopSecurities high-yield team survey ranked liquidity and equity as their major concern for 2023.

December 27 -

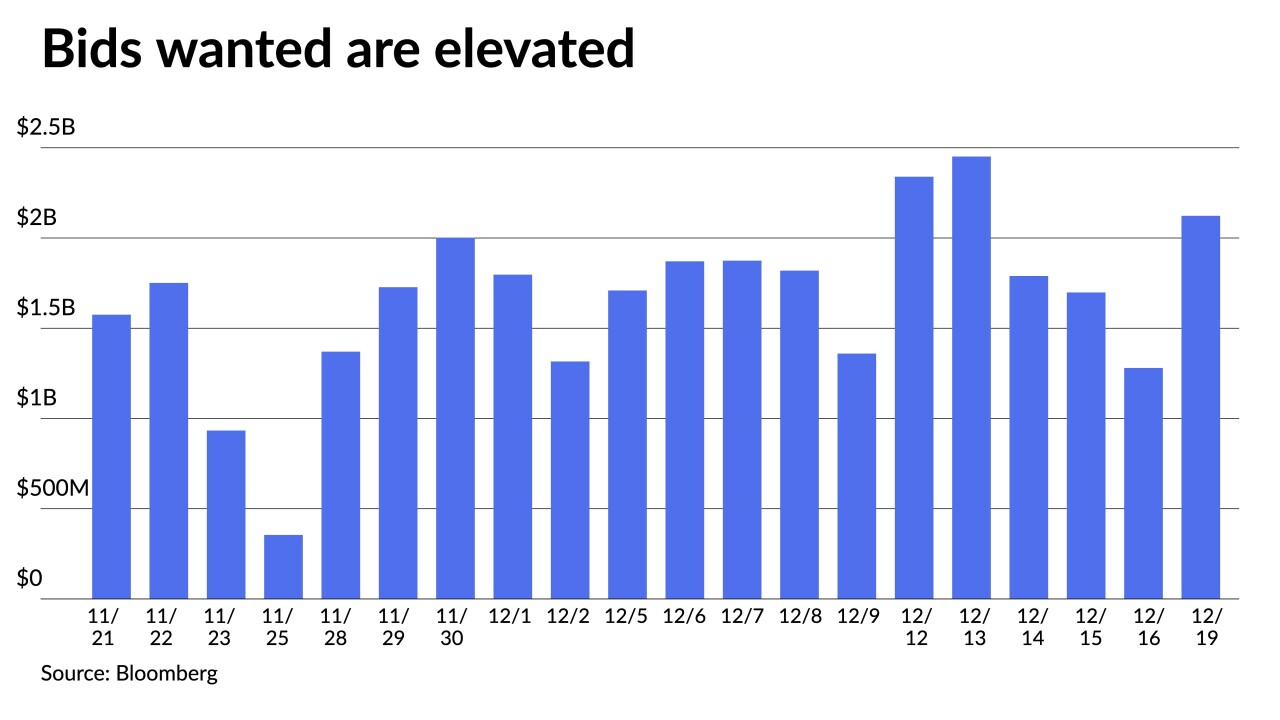

Secondary selling pressure was concentrated most heavily on the one-year Tuesday, but sellers pushed yields higher across the curve by five to seven. Bids wanteds were on the rise again with Monday's total hitting $2.122 billion.

December 20 -

Branding experts argue against ditching ESG. Instead, they say, the finance industry needs to better explain what ESG is.

December 20 -

"This week will likely have been the last active week of the year, but it turned out to be quite eventful," according to Barclays PLC.

December 16 -

The new video-sharing app will combine social media technology with crowdsourced content to inform on all things investing, says founder Charles Qi.

October 6 -

The October event will feature private and public sector experts on education, community development and ESG.

September 30 -

"We really have worked hard during this strong stretch here of economic performance over the last 18 months or so to really kind of address some of those lingering debts we inherited," said Illinois Office of Management and Budget Director Alexis Sturm.

September 23 -

Retail investors may be moving out of municipal bond mutual funds and into separately managed accounts, largely due to the headline shock of the massive outflows from the funds, participants say.

September 23