-

Market Intelligence analyst Jeff Lipton analyzes how varied state funding priorities and overall charter school support, shifting enrollment patterns, policy uncertainty, charter renewal risk, and varied pension practices affect charter school bond security—and outlines what issuers, advisors and investors should be communicating to the market.

February 3 -

Market Intelligence analyst Jeff Lipton uses the Federal Reserve's latest Flow of Funds data to show how households still dominate municipal bond ownership even as ETFs surge and banks and insurance companies trim exposure, reshaping muni demand heading into 2026.

January 29 -

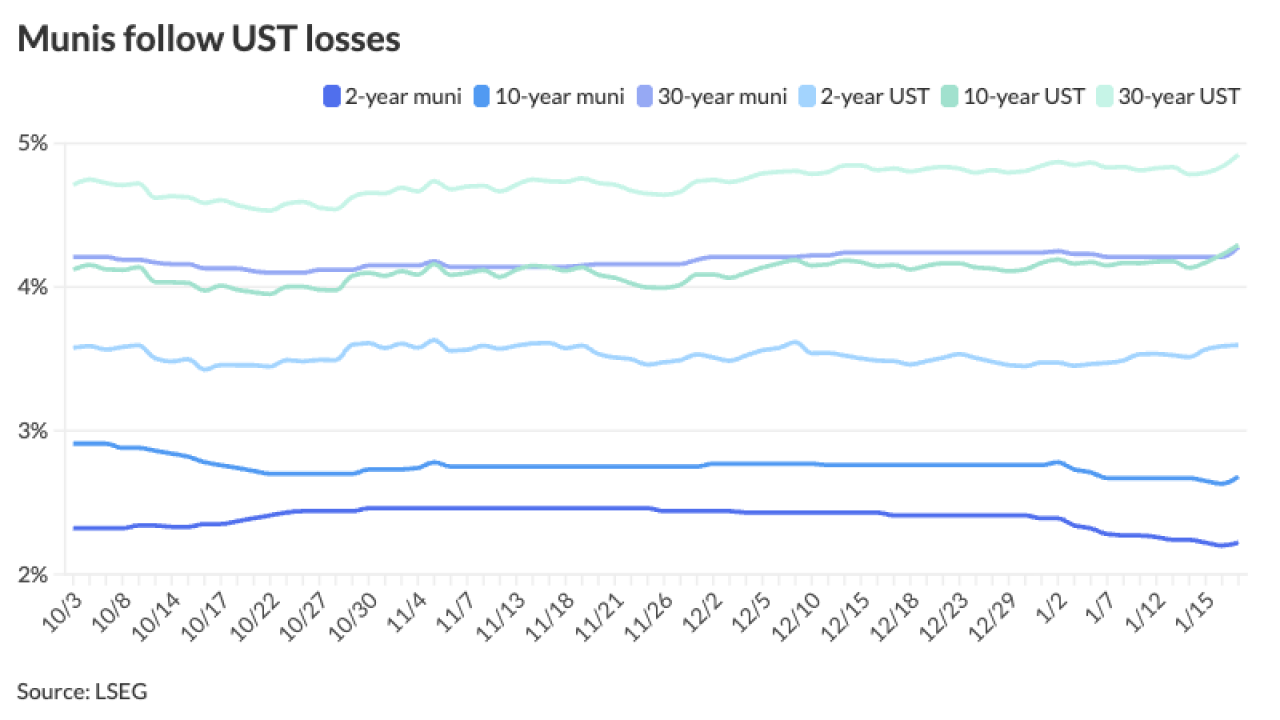

The rates market is "on edge" as global fiscal and geopolitical pressures collide, said James Pruskowski, managing director at Hennion & Walsh.

January 20 -

Fitch's three-notch senior bond downgrade reflects "substantial credit risk."

January 20 -

The Florida train is struggling to generate enough revenue to pay its debt.

January 16 -

"There are big credit differences between Chicago and New York City," said an investor.

January 16 -

Eurostar veteran Nicolas Petrovic will oversee the Florida system while Mike Reininger will focus exclusively on Brightline West.

January 14 -

Munichain says its product will simplify and vastly improve the ordering process.

January 9 -

Average trade size continued to decline in 2025, "consistent with a market that is becoming increasingly more electronic," the MSRB said.

January 9 -

In this third of a three-part 2026 municipal bond outlook series, Market Intelligence analyst Jeff Lipton explains how another year of heavy supply, surging ETF and SMA assets, climate and cyber risk, and growing use of bond insurance will drive muni market structure and strategy for both sell-side and buy-side stakeholders.

January 8 The Bond Buyer

The Bond Buyer -

Market Intelligence analyst Jeff Lipton, in the second installment of his three-part 2026 outlook series, maps out quality-centric portfolio shifts, barbell and long-end strategies, and sector tilts across hospitals, higher education and housing as record supply and net inflows drive the muni market.

January 7 The Bond Buyer

The Bond Buyer -

In the first of his three-part 2026 municipal outlook series, Market Intelligence analyst Jeff Lipton forecasts for sub-5% returns, continued demand, possibly more curve steepening as the Fed eases slowly, the economy skirts recession, and AI, tariffs and midterm politics potentially reshaping risks across public finance sectors.

January 6 The Bond Buyer

The Bond Buyer -

Unless there is a massive selloff in the next two weeks, there will not be a major spike in market participants using tax-loss harvesting through year-end, said Ben Barber, director of municipal bonds at Franklin Templeton.

December 23 -

The company has the option to defer interest payments three times without triggering a formal default.

December 17 -

AllianceBernstein hired four municipal credit special situations analysts based in its Dallas office.

December 10 -

Concerns about Brightline have dragged down performance in the high yield sector this year.

December 9 -

Fortress Investment Group bought the property in 2021 after it was largely destroyed by Hurricanes Irma and Maria and financed a major renovation that featured reinforcement standards designed to protect against a category 5 hurricane.

December 3 -

The new debt is a "bridge loan" until the company can raise fresh financing, a bondholder said.

December 1 -

Bonds have traded up since the company last week announced a tentative bondholder deal and project update and financing details.

November 24 -

The deal would give the company time to seek additional equity, debt and federal funds.

November 21