-

It has been a couple of years since the market has seen an active January to start the year.

January 13 -

Demand for municipal bonds is much stronger in 2020 than it was to end 2019, illustrated by record inflows into the asset class in the latest reporting week.

January 10 -

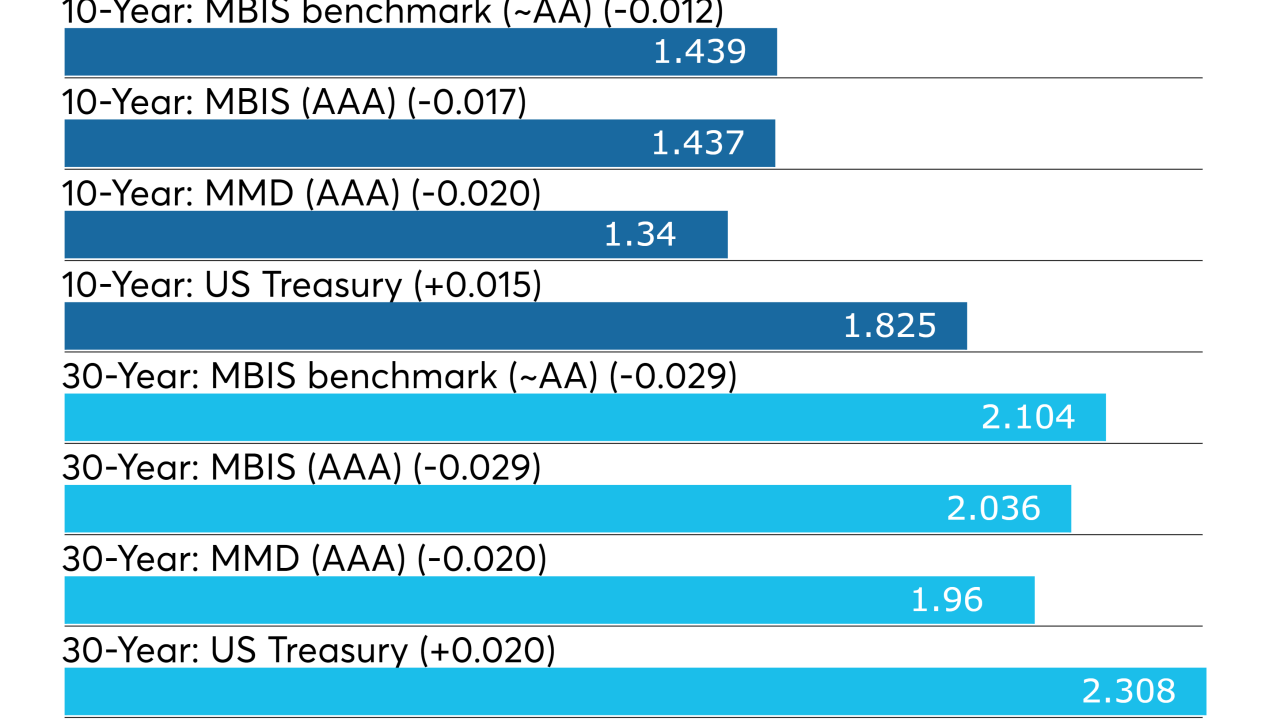

The muni market saw the last issuance of the week come and go; the front end of the curve were stronger than the long-end.

January 9 -

It's been a few weeks since the market has seen "normal" issuance, but investor demand picked up right where it left off before the holidays.

January 8 -

Four large competitive deals stole the show on Tuesday, including New Jersey's first general obligation sale in a little more than three years.

January 7 -

The municipal bond market started off the week adopting a cautious tone, eyeing issuance and world events.

January 6 -

Texas closed out a record year of sales tax collections with a strong kick in December, state Comptroller Glenn Hegar said.

January 6 -

Municipal bond buyers have plenty of cash in hand and will have various options as to where to put that money to work.

January 3 -

Municipals look to be well positioned entering 2020 against a strong backdrop of market technicals and stable credit outlook.

January 2 -

The municipal bond market eclipsed the $400 billion mark for the fourth time since 2010, thanks to taxable trend that led to a vault in fourth quarter volume.

December 31