Demand for municipal bonds is actually much stronger so far in 2020 than it was to end 2019, illustrated by record inflows into the asset class in the latest reporting week.

In the week ended Jan. 8, weekly reporting tax-exempt mutual funds added a record $2.89 billion of inflows, marking the 53rd consecutive week of inflows. Ten of the past 12 weeks, those inflows have exceeded $1 billion and the hunger for bonds is not expected to end anytime soon.

“There are a lot of positive, great things happening for munis right now, but easily the most incredible story is the inflows and how they have accelerated,” said Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management. “At this rate, it is going to be nearly impossible for the supply to catch up with the demand.”

He added that inflows are more likely than not to continue, as investors have not shown the willingness to move their cash in hand to other asset classes.

He also noted that with net calls and maturities, plus the new issuance that is coming up it, is equating to net negative supply.

“Right now, the market is replaying 2019,” he said. “The calendar has changed, but the market dynamics and fundamentals have not changed.”

Heckman says that in terms of pace of issuance, 2019 and 2020 will be reversed.

“Last year, we started off so slow and issuance didn’t pick up until the taxable boom commenced,” he said. “This year, I think the first half will be robust — thanks again to the taxable trend — and things will most likely slow down as we get closer and into and through the election.”

This past week, all major deals did not have any trouble getting done, but there seemed to be a trend of investors being more interested in the shorter end of the curve. Heckman doesn’t see why that was or is the case.

“For us, the short end is not too attractive, and for some reasons investors are gathering there,” he said. “Usually when the crowd is bunched up in one spot, they are not going to be right.”

Primary market

IHS Ipreo is estimating supply will come in at $6.64 billion in a calendar composed of $5.91 billion of negotiated deals and $734 million of competitive sales. There are 14 deals scheduled $100 million or larger, all negotiated. Four of those deals are either taxable or partially taxable.

“The interest of taxable deals is growing and is now the new normal,” Heckman said. “As if it wasn’t already hard enough for a tax-exempt buyer, this taxable craze is making it harder, as it is stripping away from the exempt issuance, as it is getting converted to taxable.”

Goldman Sachs is expected to price the Chicago Sales Tax Securitization Corp.’s ( /AA-/ ) $911.975 million of second lien refunding bonds on Thursday. The tax-exempt portion is anticipated to be roughly $602.90 million, while the taxable tranche should be about $309.075 million.

Citi is scheduled to price the National Finance Authority, New Hampshire’s $454.891 million of municipal certificates.

There is one deal on the calendar that is a bit yieldier, with ratings in the BBB range and Heckman said that investors need to be careful here, given where we are in the economic cycle.

JP Morgan is slated to price the City of Chicago’s (NR/BBB+/BBB-/A) $346.875 million of general obligation refunding bonds on Wednesday.

“With all the geopolitical mess, now is not the time to be reaching for yield,” Heckman said. “If anything, we would go higher in quality.”

Jefferies is expected to price Red River Education Finance Corp.’s (Aa3/ /AA-) $313.255 million of higher education revenue refunding and improvement taxable bonds for the Texas Christian University Project.

While there are no scheduled competitive deals $100 million or larger, there is one on the day-to-day schedule. A $210 million offering of public education capital outlay refunding bonds from the Florida Board of Education could potentially find its way to the market, given the lack of competition in the competitive space.

Lipper sees inflows for 53rd consecutive week

For the 53rd week in a row, investors put their money to work in the municipal bond arena as they continued to flood cash into tax-exempt mutual funds.

In the week ended Jan. 8, weekly reporting tax-exempt mutual funds added $2.888 billion of inflows, after inflows of $280.585 million in the previous week, according to data released by Refinitiv Lipper late on Thursday.

Exchange-traded muni funds reported inflows of $557.555 million, after inflows of $136.257 million in the previous week. Ex-ETFs, muni funds saw inflows of $2.331 billion after inflows of $144.328 million in the prior week.

The four-week moving average remained positive at $1.605 billion, after being in the green at $1.272 billion in the previous week.

Long-term muni bond funds had inflows of $1.886 billion in the latest week after inflows of $76.066 million in the previous week. Intermediate-term funds had inflows of $467.608 million after inflows of $151.192 million in the prior week.

National funds had inflows of $2.608 billion after inflows of $275.471 million while high-yield muni funds reported inflows of $611.643 million in the latest week, after outflows of $38.564 million the previous week.

Secondary market

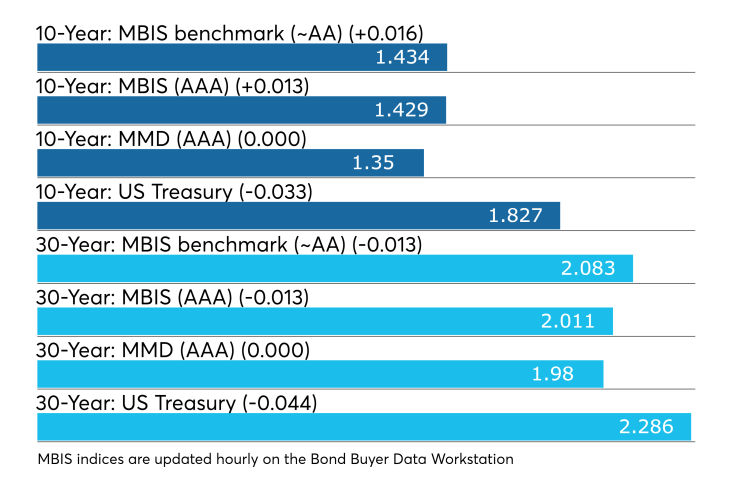

Munis were mixed on the MBIS benchmark scale, with yields rising by a basis point in the 10-year maturity and falling by one basis point in the 30-year. High-grades were also mixed, with yields on MBIS AAA scale increasing by no more than one basis points in the 10-year and decreasing by one basis point in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and 30-year GO were unchanged from 1.35% and 1.98%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 73.9% while the 30-year muni-to-Treasury ratio stood at 86.7%, according to MMD.

Stocks were in the red after reaching highs early in the day and Treasuries yields mostly moved lower. The Treasury three-month was yielding 1.543%, the two-year was yielding 1.572%, the five-year was yielding 1.635%, the 10-year was yielding 1.827% and the 30-year was yielding 2.286%.

The Dow Jones hit 29,000 for the first time ever but overall was down 0.33%, The S&P 500 decreased by about 0.13% and the Nasdaq was up 0.09%.

“The end of the first full trading week of the year finds ICE muni yield curve down almost one basis point,” ICE Data Services said in a Friday market comment. “Taxable yields are down three basis points. Tobaccos are one basis point lower along with high yield. Puerto Rico is mixed with the PREPA power revenue bonds down 7/8 point as they give back some of this week’s gains, while the 2011 Public Buildings Authority revenue bonds are up 2 1/8 points.”

Week’s actively traded issues

Some of the most actively traded munis by type in the week were from California and New York issuers, according to

In the GO bond sector, the State of California zeros of 2033 traded 23 times. In the revenue bond sector, the Metropolitan Transportation Authority 4s of 2022 traded 56 times. In the taxable bond sector, the State of California 2.375s of 2026 traded 26 times.

Week’s actively quoted issues

Puerto Rico, New York and California bonds were among the most actively quoted in the week ended Jan. 10, according to IHS Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 5s of 2058 were quoted by 27 unique dealers. On the ask side, the City of New York GO 3s of 2041 were quoted by 188 dealers. Among two-sided quotes, the State of California taxable 7.25s of 2043 were quoted by 18 dealers.

Previous session's activity

The MSRB reported 35,513 trades Thursday on volume of $15.191 billion. The 30-day average trade summary showed on a par amount basis of $10.66 billion that customers bought $5.62 billion, customers sold $3.23 billion and interdealer trades totaled $1.79 billion.

California, New York and Texas were most traded, with the Golden State taking 15.546% of the market, the Empire State taking 11.945% and the Lone Star State taking 9.844%.

The most actively traded security was the Metropolitan Washington Airport Authority revenue subordinate lien refunding 4s of 2049, which traded 10 times on volume of $46.500 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.