-

Municipal bonds yields continued their descent and once again rewrote the record books, as the flight to safety on fears of COVID-19 that took place Friday picked up right where it left off.

February 24 -

The market got technically stronger and the new-issue calendar builds.

February 20 -

New deals started to flow in and take advantage of historic lows of muni yields and rates.

February 19 -

Issuance is set to seesaw, as new-issue volume was the heaviest of the year last week, at almost 40% larger than 2019 weekly average. And this is expected to be one of the lowest-volume weeks of the year to date.

February 18 -

Lack of supply continues while professional money keeps market liquid.

February 14 -

The municipal market started off the week like gangbusters, but was ending very quietly on Thursday as the holiday-shortened week approaches.

February 13 -

The municipal primary saw billions of new deals hit the market, but the final yields on the biggest deal of the day result in something that the market hadn’t seen in a while — a repricing to higher yields.

February 12 -

The muni primary saw a flood of issuance on Tuesday, with the majority of it being from Texas issuers including one deal that got majorly upsized.

February 11 -

Issuers are coming to market in droves this week as they try to take advantage of excellent market conditions and get deals done before upcoming holiday shortened week.

February 10 -

Municipal investors should go long as the short end is expensive, strategists say.

February 7 -

It's a win-win situation for both buyers and sellers as volume continues to flow into the market.

February 6 -

The muni market was weaker again on Wednesday with yields on the rise, yet that did not slow down the primary. It did not matter if it was tax-exempt or taxable — they were gone in a flash.

February 5 -

After a record year of sales tax revenue, Texas continued to grow collections in the first month of 2020.

February 5 -

The municipal market has been on a tear in terms of fundamentals and technicals that are driving the market and there isn’t much in the near-term likely to stymie that tone.

February 4 -

Municipal bond buyers will see a $7 billion new-issue calendar ahead.

January 31 -

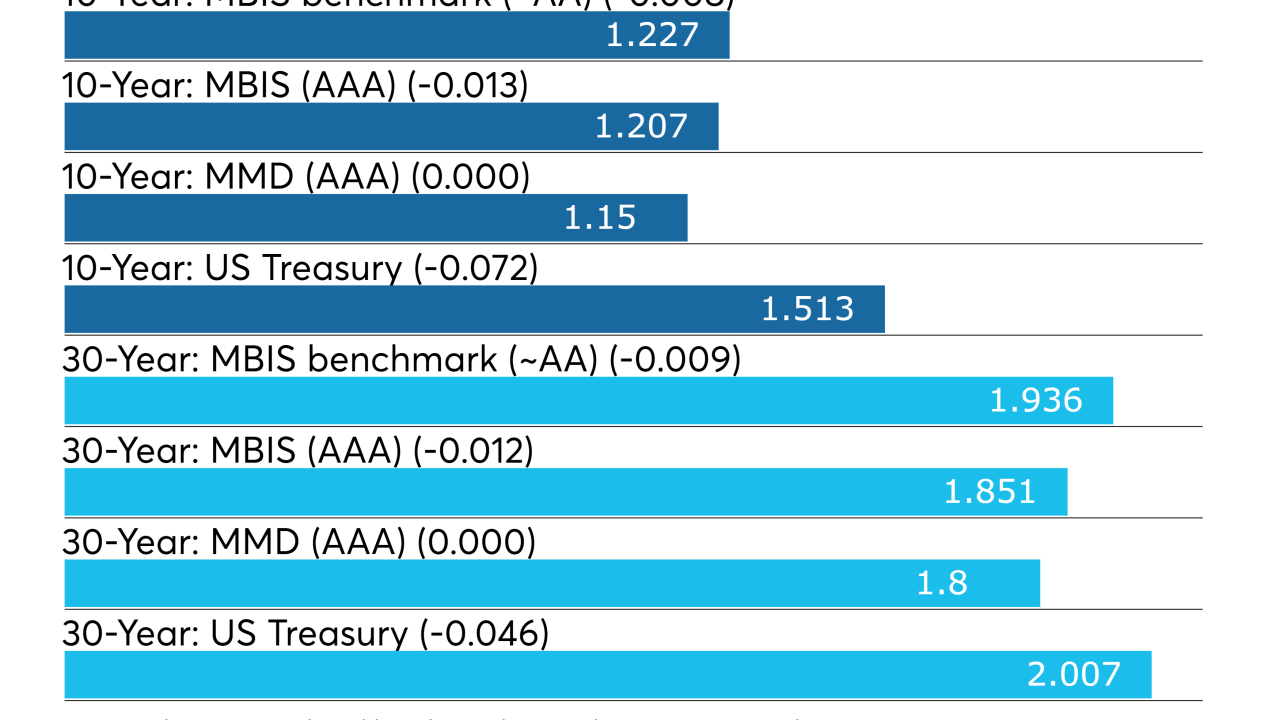

It was a record day in the market in a couple of different ways, as yields descended further to new record lows on both the 10- and 30-year and the market saw the lowest yield ever for a century bond.

January 30 -

Despite tax-exempts being expensive, strong technicals are likely to extend into February.

January 29 -

Debate over taxables, climate, ESG, possible infrastructure bill hang over 2020.

January 28 -

The muni market strengthened, following treasuries, as yields continued to drop.

January 27 -

With demand at an all-time high and record inflows that is continuing to come into the market, one would think there would be more issuance.

January 24