Municipal bond issuers are taking note after tax-exempt yields have been been falling to historic lows. Twice in the past week, yields on Refinitiv Municipal Market Data’s AAA benchmark scale set record lows.

Primary market

IHS Ipreo estimates the week’s volume at $7.06 billion in a calendar composed of $5.80 billion of negotiated deals and $1.26 billion of competitive sales.

In January, a 177% rise in taxable sales propelled

“There are a fair number of deals from a variety of states that are all taxables,” said John Hallacy, contributing editor for The Bond Buyer.

And looking at the sectors, he said there continued to be a lot of healthcare issues on the calendar.

“Healthcare issuers are very savvy,” he said. “They watch markets closely and tend to pick opportune times to get into the market with their issues.”

Topping the week’s slate is the California State University’s (Aa1/AA-/NR/NR) $813 million of Series 2020B taxable systemwide revenue bonds. B of A Securities is set to price the revenue bond deal on Wednesday. Proceeds will be used to improve school facilities and to refund some debt for savings.

Raymond James & Associates is expected to price the New York City Municipal Water Finance Authority’s (Aa1/AA+/AA+/NR) $465 million of Fiscal 2020 Series DD water and sewer second general resolution revenue bonds.

Proceeds will be used to fund capital projects and refund certain outstanding bonds for savings.

The Anaheim Housing and Public Improvement Authority, Calif., (NR/AA-/AA-/NR) is selling $307 million of bonds in two deals.

JPMorgan Securities is set to price on Thursday the authority’s $236.6 million of electric utility distribution system Series 2020A revenue bonds, Series 2020B taxable revenue refunding bonds and Series 2020C revenue refunding bonds. Wells Fargo Securities is set to price the authority’s $71 million of Series 2020A water system project revenue refunding bonds and Series 2020B water system taxable refunding bonds. Anaheim is home to DisneyLand.

JPMorgan is slated to price the Reedy Creek Improvement District, Fla.’s (Aa3/AA-AA-/NR) $337 million of Series 2020A taxable ad valorem tax refunding bonds on Tuesday. DisneyWorld is the major property owner in the district.

“Even Mickey and Minnie are going taxable muni,” Hallacy said.

Secondary market

While the overall market calmed down a bit on Friday, even as stocks took a steep dive on continued fears of the CoronaVirus spread, there was some spirited action of note in some specialty names.

Recent trading of gilt-edged, bellwether credit Delaware GOs are helping to move the AAA along to lower yields. Large blocks of the 9- and 10-year traded this week, with 5s of 2029 trading today at 1.09% from a 1.20% original yield on Jan. 22 when it priced. Blocks of 5s of 2030 traded at 1.16% today, 1.19% on Jan. 29, 1.22% on Jan. 24 after the original yield of 1.28% on Jan. 22.

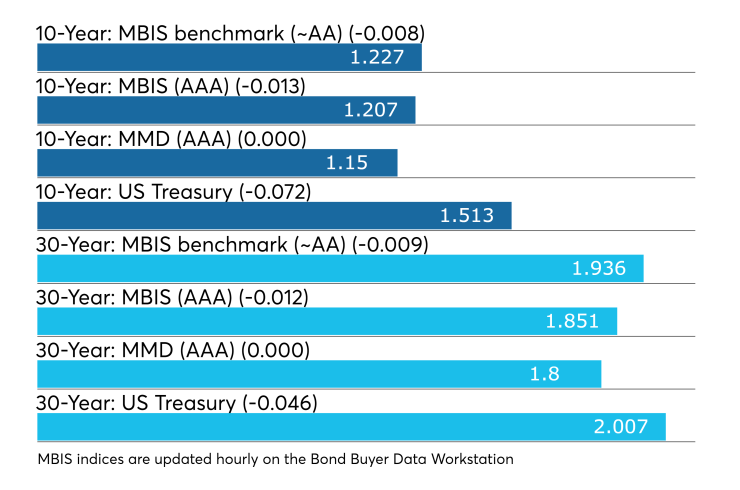

Munis were stronger Friday on the MBIS benchmark scale, with yields falling by less than one basis point in the 10- and 30-year year maturities. High-grades were also stronger, with yields on MBIS AAA scale falling one basis point in the 10- and 30-year maturities.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO remained steady at 1.15% while the 30-year was unchanged at 1.80%.

“As you go down in rates, there is more resistance, so the moves lower become smaller,” Hallacy said.

“The ICE muni yield curve is unchanged from yesterday’s levels with an active morning, but very quiet towards midday,” ICE Data Services said in a Friday market comment. ”High-yield and tobaccos are mixed. Taxable yields are down three basis points as the sector takes its direction from Treasuries.”

The 10-year muni-to-Treasury ratio was calculated at 75.7% while the 30-year muni-to-Treasury ratio stood at 89.7%, according to MMD.

Stocks were sharply lower as Treasuries strengthened. The Dow Jones Industrial Average was down about 1.95%, the S&P 500 Index lost around 1.53% and the Nasdaq was off about 1.40%.

The Treasury three-month was yielding 1.556%, the two-year was yielding 1.335%, the five-year was yielding 1.322%, the 10-year was yielding 1.513% and the 30-year was yielding 2.007%.

Previous session's activity

The MSRB reported 30,825 trades Thursday on volume of $11.62 billion. New York, California and Texas were most traded, with the Golden State taking 13.884% of the market, the Empire State taking 12.977% and the Lone Star State taking 12.818%.

The most actively traded security was the Port Beaumont Navigation District, Texas, 4s of 2050, which traded 36 times on volume of $45.29 million.

Week’s actively traded issues

Some of the most actively traded munis by type in the week ended Jan. 31 from New York, Florida and Ohio issuers, according to

In the GO bond sector, the New York City zeros of 2042 traded 29 times. In the revenue bond sector, the Escambia County Health facilities Authority, Fla., 3s of 2050 traded 68 times. In the taxable bond sector, the Ohio Turnpike Commission 3.216s of 2048 traded 56 times.

Week’s actively quoted issues

Puerto Rico and New York and California bonds were among the most actively quoted in the week ended Jan. 31, according to IHS Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 5s of 2058 were quoted by 35 unique dealers. On the ask side, the New York State Metropolitan Transportation Authority revenue 4s of 2043 were quoted by 124 dealers. Among two-sided quotes, the COFINA revenue 5s of 2058 were quoted by 11 dealers.

Lipper reports 56th week of inflows

For the 56th straight week, investors poured cash into the municipal market continuing the streak as the money flowing into cash-exempt mutual funds seems to be never ending.

In the week ended Jan. 29, weekly reporting tax-exempt mutual funds added $1.825 billion of inflows, after inflows of $1.999 billion in the previous week, according to data released by Refinitiv Lipper late on Thursday.

Exchange-traded muni funds reported inflows of $82.548 million, after inflows of $62.224 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.742 billion after inflows of $1.937 billion in the prior week.

The four-week moving average remained positive at $2.263 billion, after being in the green at $1.877 billion in the previous week.

Long-term muni bond funds had inflows of $1.438 billion in the latest week after inflows of $1.418 billion in the previous week. Intermediate-term funds had inflows of $289.330 million after inflows of $203.819 million in the prior week.

National funds had inflows of $1.592 billion after inflows of $1.731 billion while high-yield muni funds reported inflows of $656.406 million in the latest week, after inflows of $490.462 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.