The Federal Open Market Committee kept rates at a range of 1.50% to 1.75%, and offered little guidance about its next move. Munis meanwhile, still have strong technicals and are not succumbing to sticker shock.

“The Committee judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation returning to the Committee's symmetric 2 percent objective,” the panel said in a statement.

There was no mention of how it will manage its balance sheet going forward or when it will stop adding liquidity to the repo market. The panel raised the interest rate on excess reserves to 1.60% from 1.55%, a technical move to keep the funds rate in the specified range.

“The Fed has been clear that a material change in its outlook is necessary for it to react, in either direction. Looking ahead, we see a much higher bar for hikes than cuts,” said Margaret Steinbach, fixed income investment specialist at Capital Group. “It would take materially higher inflation on a sustained basis for them to hike again, while it’s not hard to envision a scenario that requires additional cuts. In addition, the upcoming change to their inflation targeting framework will further bias them toward an easier policy stance.”

She added that she thinks it pays to be defensive in fixed income right now.

“High-quality, short-dated bonds like Treasuries look attractive, whereas we see less opportunity in corporate credit — we don’t think investors are getting rewarded adequately given current valuations.”

As far as the muni market is concerned, a lot of issuers stayed away from pricing on Fed day.

Despite the fact that tax-exempts are expensive and Treasury securities look more attractive, investors have not yet succumbed to sticker shock. As the first month of the year wraps up wrap up the first month of the year, participants are optimistic that strong technicals will extend into February, according to Jeffrey Lipton, managing director and head of municipal research and strategy at Oppenheimer & Co.

“Muni returns are running close to 1.5% and are beginning the first quarter from a position of strength,” he said. “While we believe that this muni backdrop has ample life left to it, it is advisable to stay focused and preserve portfolio flexibility with individual security selection anchoring the investment strategy.”

He added that while tax-exempts have spent much of January outperforming U.S. Treasuries, he notes recent trailing performance by munis has ceded Treasuries the lead, likely due to geopolitically driven demand for Treasuries and munis simply just taking a breath.

“Despite the noted drop in muni yields, negative muni yields are not likely to ensue as the appeal for tax efficiency would essentially evaporate,” Lipton said. “We would also contend that a negative funds rate would not necessarily catalyze negative muni yields, although they would likely decline further, thus extending fertile ground for issuers.”

Lipton said that the rise of taxable issuance, given the compelling economics, shows no signs of abating any time soon.

“While we do not see a supplanting of traditional tax-exempt issuance, the market efficiencies now being demonstrated by the taxable wave provide a receptive and orderly backdrop for subsequent issuance,” he said. “The appeal of taxable munis has extended to foreign buyers who are not seeking tax-efficiency, yet who are strategizing to boost investment performance with a view to investing in U.S. infrastructure.”

Primary market

Municipals and Treasuries remained steady after the Federal Reserve Board left the overnight bank lending rate unchanged and declared its current policy appropriate, a New York trader said Wednesday.

With a steady backdrop and light calendar, one of the week’s largest deals — the Dormitory Authority of New York on behalf of Langone NYU — was well received [on Tuesday], he said just before the end of trading.

“A number of investors are getting very cautious — especially maturities out to five to seven years, which are expensive to taxables, making little sense to own munis,” he said. “With a light calendar, the secondary is quiet as well, and bid wanted lists are very manageable.”

Citi priced Wisconsin’s (Aa2/ /AA) $623.320 million of general fund appropriation refunding taxable bonds.

Citi also priced Ohio’s $458.315 million of turnpike revenue refunding and junior lien revenue refunding taxable bonds. The senior lien is rated Aa2 by Moody’s Investors Service, AA- by S&P Global Ratings and AA by Fitch Ratings, while the junior lien is rated Aa3 from Moody’s, A+ from S&P and A+ from Fitch.

Morgan Stanley priced Port of Beaumont Navigation District of Jefferson County, Texas’ (NR/NR/NR/NR) $184.92 million of dock and wharf facilities revenue bonds for the Jefferson Gulf Coast Energy Project.

Citi priced Connecticut Housing Finance Authority’s (Aaa/AAA/ ) $114.15 million of housing mortgage finance program bonds, featuring alternative

minimum tax, non-AMT and taxable bonds.

Boenning & Scattergood received the written award on Penn Hill School District, Pennsylvania’s (A2/ / ) $101.78 million of general obligation refunding bonds. The entire deal is insured by Build America Mutual and is rated AA by S&P.

Goldman Sachs priced the Community Preservation Corp.’s ( /AA-/ ) $150 million of sustainability taxable corporate CUSIP bonds.

ICI: Muni funds see $3.1B inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $3.098 billion in the week ended Jan. 22, the Investment Company Institute reported on Wednesday.

It was the 55th straight week of inflows into the tax-exempt mutual funds reported by ICI. The previous week ended Jan. 15 saw $3.275 billion of inflows into the funds.

Long-term muni funds alone had an inflow of $2.934 billion after an inflow of $2.618 billion in the previous week; ETF muni funds alone saw an inflow of $165 million after an inflow of $656 million in the prior week.

Taxable bond funds saw combined inflows of $12.965 billion in the latest reporting week after revised inflows of $13.664 billion in the previous week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $20.200 billion after inflows of $15.837 billion in the prior week.

Domestic Equity funds declined the most, falling $3.451 billion for the week after losing $4.519 billion in the prior week.

Secondary market

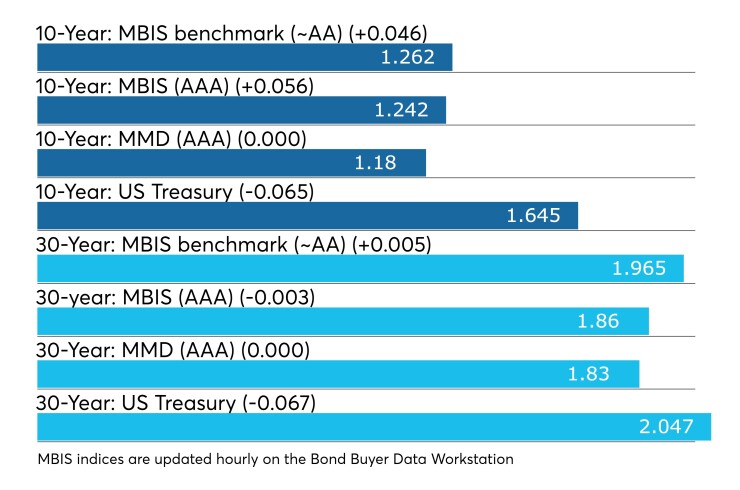

Munis were weaker on the MBIS benchmark scale, with yields rising by four basis points in the 10-year and rising by less than a basis point in the 30-year maturity. High-grades were mixed with yields on MBIS AAA scale increasing by five basis points in the 10-year maturity and decreasing by less one basis point in the 30-year maturity.

On the MMD benchmark scale, the yield on both the 10- and 30-year were unchanged from a record low of 1.18% and 1.83%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 73.8% while the 30-year muni-to-Treasury ratio stood at 89.3%, according to MMD.

Stocks were in the green as corporate earnings overshadowed worries about the coronavirus while the majority of Treasury yields were up.

The Dow Jones Industrial Average was up about 0.42%, the S&P 500 Index rose around 0.37% and the Nasdaq gained about 0.49%.

The Treasury three-month was yielding 1.559%, the two-year was yielding 1.427%, the five-year was yielding 1.411%, the 10-year was yielding 1.594% and the 30-year was yielding 2.047%.

Previous session's activity

The MSRB reported 32,086 trades Tuesday on volume of $10.95 billion. The 30-day average trade summary showed on a par amount basis of $10.74 million that customers bought $5.41 million, customers sold $3.52 million and interdealer trades totaled $1.80 million.

California, New York and Texas were most traded, with the Golden State taking 14.302% of the market, the Empire State taking 10.885% and the Lone Star State taking 10.196%.

The most actively traded security was the Montgomery County, Maryland bond anticipation notes 1s of 2020, which traded 12 times on volume of $60 million.

Christine Albano and Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.