The muni market rallied as much as five basis points as yields continued to drop following Treasuries, with global concerns over the coronavirus creating a severe flight-to-quality market.

The 10-year muni read hit an all-time low of 1.18% on Monday, beating the previous MMD record low of 1.21% set on Aug. 28, 2019. The 30-year on Monday tied its previous low of 1.83% also set on Aug. 28 last year.

"How low can they go?" said one New York trader. "The market right now is just crazy, that's the only word I can use. I am sure the issuers are happy to see the yields move even lower but it's making it even harder on the Street."

Secondary market

Munis were stronger on the MBIS benchmark scale, with yields falling by four basis points in the 10-year and also by four basis points in the 30-year maturity. High-grades were also stronger with yields on MBIS AAA scale decreasing six basis points in the 10-year maturity and by less than one basis point in the 30-year maturity.

On the MMD benchmark scale, the yield on both the 10- and 30-year were five basis points lower to 1.18% and 1.83%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 73.5% while the 30-year muni-to-Treasury ratio stood at 89.1%, according to MMD.

“The ICE muni yield curve is down two to four basis points,” ICE Data Services said in a Monday market comment. “Tobaccos and high yield are also following with a three basis points decline. Taxable yields are as much as seven basis points lower and Puerto Rico is mixed.”

Stocks were in the red while Treasury yields mostly dropped.

The Dow Jones Industrial Average was down about 1.28%, the S&P 500 Index fell around 1.20% and the Nasdaq lost about 1.55%.

The Treasury three-month was yielding 1.564%, the two-year was yielding 1.435%, the five-year was yielding 1.437%, the 10-year was yielding 1.611% and the 30-year was yielding 2.062%.

Primary market

Siebert Williams Shank & Co. priced Southern California Metropolitan Water District of Southern California’s (NR/AAA//AA+) $208.310 million water revenue bonds.

The action will pick up Tuesday as two of the biggest deals of the week are expected to price.

Bank of America Securities is expected to price the Escambia County Health Facilities Authority, Florida’s (Baa2/BBB+/BBB/ ) $589.42 million of health care facilities revenue and taxable revenue bonds for Baptist Health Care Corp. Obligated Group on Tuesday. The tax-exempt portion is expected at $523.91 million, while the taxable portion is seen at $65.51 million.

Goldman Sachs is scheduled to price NYU Langone Hospital’s (A3/A / / ) $571.2 million of taxable corporate CUSIP bonds on Tuesday after indications of interest on Monday. Goldman is also slated to price the Dormitory Authority of the State of New York’s (A3/A / / ) $473.92 million of revenue bonds for NYU Langone on Tuesday.

Last week’s actively traded issues

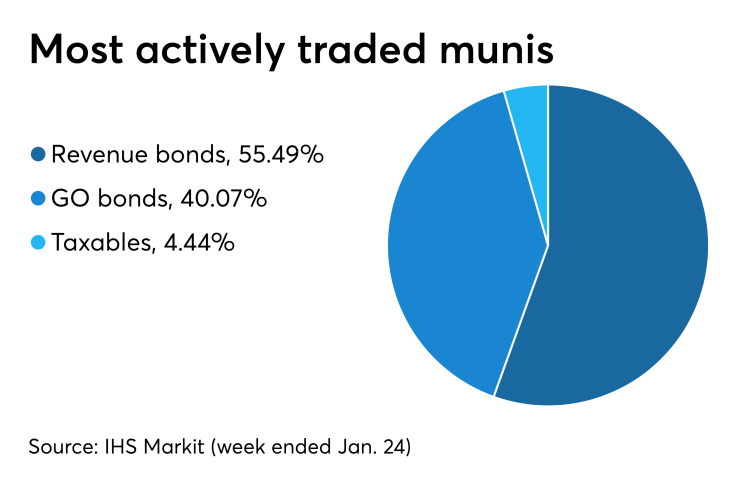

According to

Some of the most actively traded munis by type in the week were from Illinois, New Hampshire and Texas issuers, according to

In the GO bond sector, the Chicago 5s of 2027 traded 41 times. In the revenue bond sector, the National Finance Authority, New Hampshire 4.125s of 2034 traded 42 times. In the taxable bond sector, the Red River Education Finance Corp. 3.397s of 2045 traded 82 times.

Previous session's activity

The MSRB reported 30,721 trades Friday on volume of $14.23 billion. The 30-day average trade summary showed on a par amount basis of $11.10 million that customers bought $5.64 million, customers sold $3.60 million and interdealer trades totaled $1.86 million.

Texas, California and New York were most traded, with the Lone Star State taking 15.107% of the market, the Golden State taking 12.428% and the Empire State taking 11.255%.

The most actively traded security was the JobsOhio Beverage System revenue taxable 2.833s of 2038, which traded 20 times on volume of $46.140 million.

Treasury auctions

The Treasury Department Monday auctioned $41 billion of five-year notes, with a 1 3/8% coupon, a 1.448% high yield, a price of 99.649132.

The bid-to-cover ratio was 2.33.

Tenders at the high yield were allotted 94.84%. All competitive tenders at lower yields were accepted in full.

The median yield was 1.400%. The low yield was 1.320%.

Treasury also auctioned $40 billion of two-year notes with a 1 3/8% coupon at a 1.440% yield, a price of 99.872307.

The bid-to-cover ratio was 2.65.

Tenders at the high yield were allotted 75.06%.

The median yield was 1.414%. The low yield was 1.250%.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed, as the $45 billion of three-months incurred a 1.530% high rate, unchanged from 1.530% the prior week, and the $39 billion of six-months incurred a 1.535% high rate, up from 1.520% the week before.

Coupon equivalents were 1.562% and 1.573%, respectively. The price for the 91s was 99.613250 and that for the 182s was 99.223972.

The median bid on the 91s was 1.495%. The low bid was 1.450%.

Tenders at the high rate were allotted 83.72%. The bid-to-cover ratio was 2.66.

The median bid for the 182s was 1.490%. The low bid was 1.470%.

Tenders at the high rate were allotted 41.60%. The bid-to-cover ratio was 2.76.

Gary E. Siegel and Chip Barnett contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.