The muni market saw a frantic flurry of deals come in Thursday and the market got technically stronger, the secondary was active and new muni yield lows were reached in both the 10- and 30-year maturities.

“Before COVID-19 munis were already seeing a ton of demand and now we are seeing the extra, safe harbor and flight-to-quality demand with people moving money from equities to munis,” a New York trader said. “[The virus] isn’t going away anytime soon and now it is impacting the supply chain, which can only negatively affect equities.”

"Munis are stronger today across the curve with yields lower by one to three basis points. High-yield is stronger too with yields lower by one to two basis points,” ICE Data Services said in a Thursday market comment. “Treasury yields are moving lower again today, down three to five basis points mid-morning. Ten-year yields are currently three bps below the three-month bill (1.55% vs 1.52%), with the low point of the ‘U-shaped’ curve occurring at the three-year point. (1.36%). Stocks are drifting lower today, after closing at record highs yesterday, as global economic weakness is winning out over a string of high-profile deals in the U.S.”

Meanwhile, a New York trader noted that next week is shaping up to the biggest week all year in terms of issuance.

“We are looking at a huge week next week and there should be something for everybody and with yields at all-time lows, issuers will be kicking themselves if they don’t sell debt at this current levels,” he said.

A quick look at the calendar will tell you all you need to know: Just to name a few of the deals coming next week: Buckeye Tobacco Settlement Financing Authority’s $5.2 billion refunding; University of California Regents’ $1.5 billion of taxable bonds; Los Angeles Department of Airports’ $739 million; Dormitory Authority of New York State’s $413 million; West Virginia University Board of Governors’ $376 million; And Baltimore County’s $596 million spanning three competitive sales.

Primary market

Barclays priced the largest deal of the week — District of Columbia’s (Aa1/AAA/AA+/ ) $1.035 billion of income tax secured revenue and revenue refunding bonds on Thursday. The deal was upsized from its original size of $961 million.

The deal was repriced and saw significant bumps, including a bump of 15 basis points in half of the split 2045 maturity to 1.99% from 2.14%.

Jefferies priced a total of $695.335 million for the Texas Transportation Commission (A3/A/A/NR) for the central Texas turnpike system.

The tax-exempt tranche was for $180.565 million and priced as 5s to yield 1.92% in 2039 and as 3s to yield 2.42% in 2040.

The taxable pricing wires were not available as of press time.

Wells Fargo priced California Infrastructure and Economic Development Bank’s (Aa2/NR/NR/NR) $100 million of green revenue bonds for the

Competitively, the New York State Thruway Authority sold $450 million in two separate sales.

JP Morgan won $292.18 million of general revenue bonds with a true interest cost of 2.8928%.

Bank of America Securities $157.82 million of general revenue bonds with a TIC of 2.7093%.

Secondary market

Recent highly rated issuers were trading better in the secondary, moving AAA benchmarks. Maryland 5s of 2030 were trading at 1.19% to 1.22%. Boston 10-years with a 5% coupon were trading 1.08%-1.09%. DC income tax 10-years with 5% coupon re-priced at 1.27%, a four basis point bump from an initial pricing wire.

Out longer, El Paso, Texas ISD (AAA with PSF insurance) 4s of 2045 traded at 2.15%-2.14% Wednesday and 2.12%-2.11% Thursday. Large blocks of Iowa Finance Authority green bonds, 5s of 2049, traded at 1.88%. They originally priced to yield 1.95% last week. The long DC income tax bond, 4s of 2045 repriced to yield 1.99%, a 15 basis point drop from an earlier pricing wire, as 4s out long continue to see high demand.

JPMorgan Securities received the written award on the Public Energy Authority of Kentucky’s (A1/NR/NR/NR) $552.02 million of Series 2020A gas supply revenue bonds.

The bonds were freed to trade on Thursday. The 4s of 2050, originally priced at 115.225 were trading at a high price of 115.725 in 41 trades on volume of $147/5 million, according to the MSRB’s EMMA website.

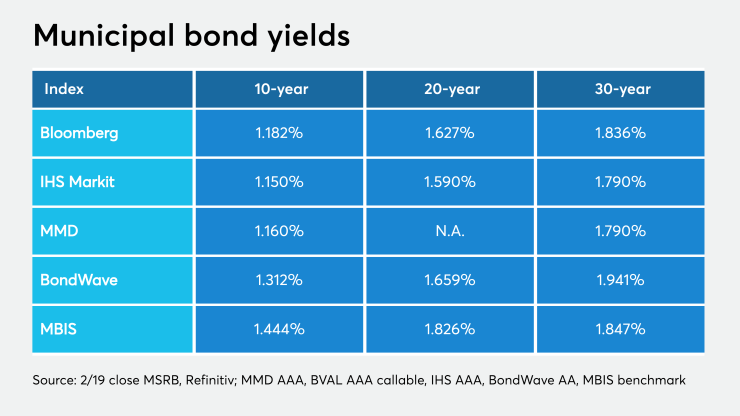

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield the 10-year GO was two basis points lower to 1.14%, setting a record low. The previous record was 1.15%, set back on Jan. 30.

The 30-year GO fell three basis points to a record of 1.76%, beating the previous low of 1.79% that was set this past Tuesday.

The 10-year muni-to-Treasury ratio was calculated at 74.8% while the 30-year muni-to-Treasury ratio stood at 89.3%, according to MMD.

All three major indexes were in the red and Treasury yields were lower.

The Dow Jones Industrial Average was down about 0.58%, the S&P 500 index was lower by 0.47% and the Nasdaq fell roughly 0.87%.

The 3-month Treasury was yielding 1.574%, the Treasury two-year was yielding 1.391%, the five-year was yielding 1.365%, the 10-year was yielding 1.527% and the 30-year was yielding 1.973%.

BlackRock: Demand for munis remains robust

Municipal bonds showed strong performance in January as demand remained firm while fund flows extended their winning streak, says Peter Hayes, head of BlackRock’s municipal bonds group in a report released Thursday.

“We anticipate that robust demand for muni bonds will continue to outpace moderate supply in the near term,” Hayes said.

New issuance remained solid at $26.6 billion for the month, said BlackRock, which oversees more than $163 billion in municipal assets.

“However, seasonal trends typically turn slightly less favorable in February, and as recent event risks fade (i.e., coronavirus, Iran, impeachment), investors will likely turn their focus to the fundamentals of the U.S. economy. Some caution may be warranted given the incredible rally in interest rates, strong performance, and tight relative valuations in muni bonds today.”

The S&P Municipal Bond Index returned 1.63% in January, the highest monthly return since January 2014, BlackRock said, as worries around the U.S.-Iran conflict, impeachment proceedings and COVID-19 pandemic drove investors into higher-quality assets. This pushed interest rates materially lower over the month. Despite this, the asset class remained firm in January, with muni mutual funds extending their streak to 56 consecutive weeks of inflows.

Muni money market funds see outflows

Tax-exempt municipal money market fund assets decreased by $844.2 million, lowering their total net assets to $134.91 billion in the week ended Feb. 17, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds increased to 0.69% from 0.62% in the previous week.

Taxable money-fund assets lost $2.80 billion in the week ended Feb. 18, bringing total net assets to $3.440 trillion. The average, seven-day simple yield for the 799 taxable reporting funds slipped to 1.25% from 1.26% the prior week.

Overall, the combined total net assets of the 986 reporting money funds decreased $3.64 billion to $3.575 trillion in the week ended Feb. 18.

Bond Buyer indexes move lower

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 3.50% from 3.52% the week before.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields was lower by five basis points to 2.46% from 2.51% the week before.

The 11-bond GO Index of higher-grade 11-year GOs decreased five basis points to 1.99% from 2.04% the prior week.

The Bond Buyer's Revenue Bond Index was down five basis points to 2.96% from 3.01% from the previous week.

The yield on the U.S. Treasury's 10-year note dropped to 1.52% from 1.62% the week before, while the yield on the 30-year Treasury declined to 1.97% from 2.07%

Previous session's activity

The MSRB reported 36,490 trades Wednesday on volume of $10.88 billion. The 30-day average trade summary showed on a par amount basis of $12.12 million that customers bought $6.16 million, customers sold $3.93 million and interdealer trades totaled $2.02 million.

Texas, California and New York were most traded, with the Lone Star State taking 13.457% of the market, the Golden State taking 12.753% and the Empire State taking 12.076%.

The most actively traded security was the Commonwealth of Puerto Rico GO bonds 2014A, 8s of 2035, which traded 30 times on volume of $69.050 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.