The last of the week's municipal bond issuers hit the screens as issuers continued to take advantage of near-record low interest rates. The market was little changed after getting hit the past two days with some weakness. Issuers pricing Thursday saw bumps in repricings and both exempts and taxables were well received.

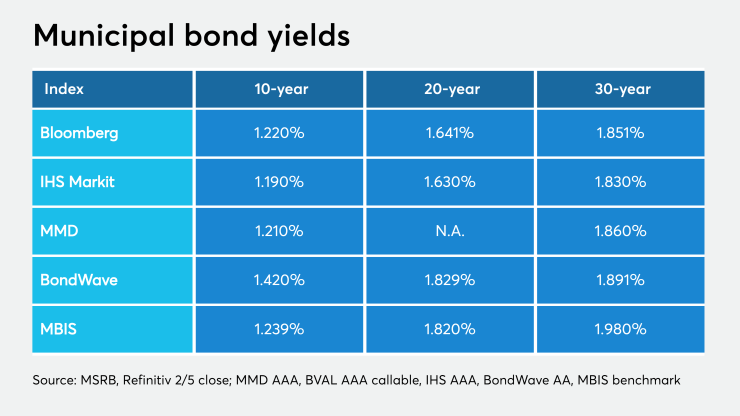

Taking a look at this week’s new deals, one cannot deny the tighter yields across the curve and what a different market it is from just a year ago. Today on Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and 30-year GO were 1.21% and 1.86%, respectively. On Feb. 6, 2019 the MMD 10-year was at 2.17% and the 30-year at 3.03%.

It pays to be an issuer right now.

Primary market

JPMorgan Securities priced the Tarrant County Cultural Education Facilities Finance Corp., Texas’ (Aa2/AA/NR/NR) $201.93 million of hospital revenue bonds for the Cook Children's Medical Center.

The deal was priced to yield from 0.94% with a 5% coupon in 2020 to 2.06% with a 4% coupon in 2036 (a 7 basis point bump); terms were priced as 3s to yield 2.60% in 2040 (2 bp bump), as 4s to yield 2.33% (10 bp bump) in 2045 and as 3s to yield 2.76% in 2050, a 5 basis point bump from a pricing earlier this morning. The 10-year with a 5% coupon yielded 1.51%.

Proceeds will be used for hospital construction costs and refunding some outstanding bonds.

JPMorgan also priced the Anaheim Housing and Public Improvements Authority, Calif.’s (NR/AA-AA-/NR) $121.795 million of taxable Series 2020B revenue refunding bonds.

Proceeds will be used for an electric utility distribution system refunding and the authority’s $101.555 million Series 2020A revenue and Series 2020C refunding revenue bonds.

A few more new-issues from this week to look at:

Taxables:

A $130 million tranche of the long bond for AAA-rated Harris County, Texas Metropolitan Transportation Authority, taxable bonds in 2041 priced at par at 2.986% while the 10-year priced at par at 2.249%.

AA-rated Pennsylvania State University’s taxable $89 million long bond (2050) priced at par at 2.88%.

The Reedy Creek Improvement District, Florida’s (Aa3/AA-/AA-/NR) $338.03 million of ad valorem tax refunding taxable bonds saw the long bond, $73 million tranche of 2038s priced at par at 2.73% The 10-year priced at par at 2.197%.

Meanwhile in the exempt space:

The Dormitory Authority of New York’s tax-exempt 3s of 2050 yielded 2.66% while a $130 million tranche of 4s of 2050 yielded 2.76%.

Secondary market

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO remained steady at 1.21% while the 30-year was unchanged at 1.86%.

The 10-year muni-to-Treasury ratio was calculated at 73.5% while the 30-year muni-to-Treasury ratio stood at 87.9%, according to MMD.

“Muni yields are unchanged today, but continue to hover near record low levels,” ICE Data Services said in a Thursday market comment. “The appetite for new issues remains strong; markets are already turning their attention to next week’s deals, including a GO for Washington State.”

Stocks were higher as Treasuries strengthened.

The Dow Jones Industrial Average was up about 0.30%, the S&P 500 Index gained around 0.35% and the Nasdaq was up about 0.67%.

The Treasury two-year was yielding 1.451%, the five-year was yielding 1.460%, the 10-year was yielding 1.641% and the 30-year was yielding 2.111%.

Previous session's activity

The Municipal Securities Rulemaking Board reported 35,739 trades Wednesday on volume of $14.16 billion. California, New York and Texas were the most active states.

Most Bond Buyer indexes reverse course

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was lower to 3.52% from 3.53% the week before.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields was higher by six basis points to 2.53% from 2.47% the week before.

The 11-bond GO Index of higher-grade 11-year GOs increased six basis points to 2.06% from 2.00% the prior week.

The Bond Buyer's Revenue Bond Index was up six basis points to 3.03% from 2.97% from the previous week.

The yield on the U.S. Treasury's 10-year note was higher to 1.64% from 1.57% the week before, while the yield on the 30-year Treasury rose to 2.11% from 2.04%

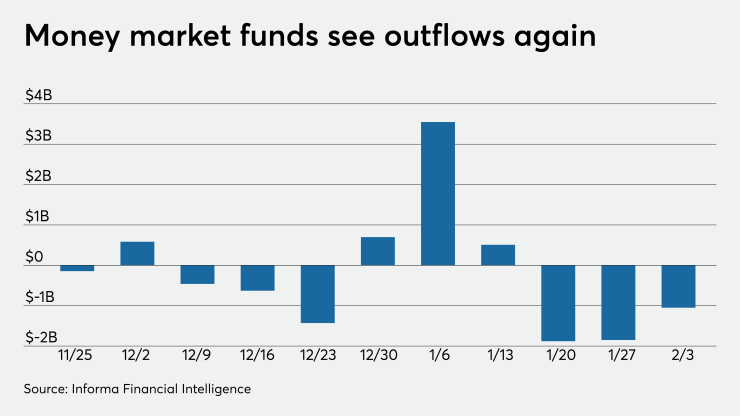

Muni money market funds see outflows

Tax-exempt municipal money market fund assets decreased by $1.05 billion, lowering their total net assets to $136.38 billion in the week ended Feb. 3, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds jumped to 0.59% from 0.49% in the previous week.

Taxable money-fund assets fell $6.23 billion in the week ended Feb. 4, bringing total net assets to $3.431 trillion. The average, seven-day simple yield for the 802 taxable reporting funds increased to 1.26% from 1.25% in the prior week.

Overall, the combined total net assets of the 989 reporting money funds decreased $7.28 billion to $3.567 trillion in the week ended Feb. 4.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.