-

It was a big day for the municipal bond market as billions of dollars of new deals hit the screens.

September 10 -

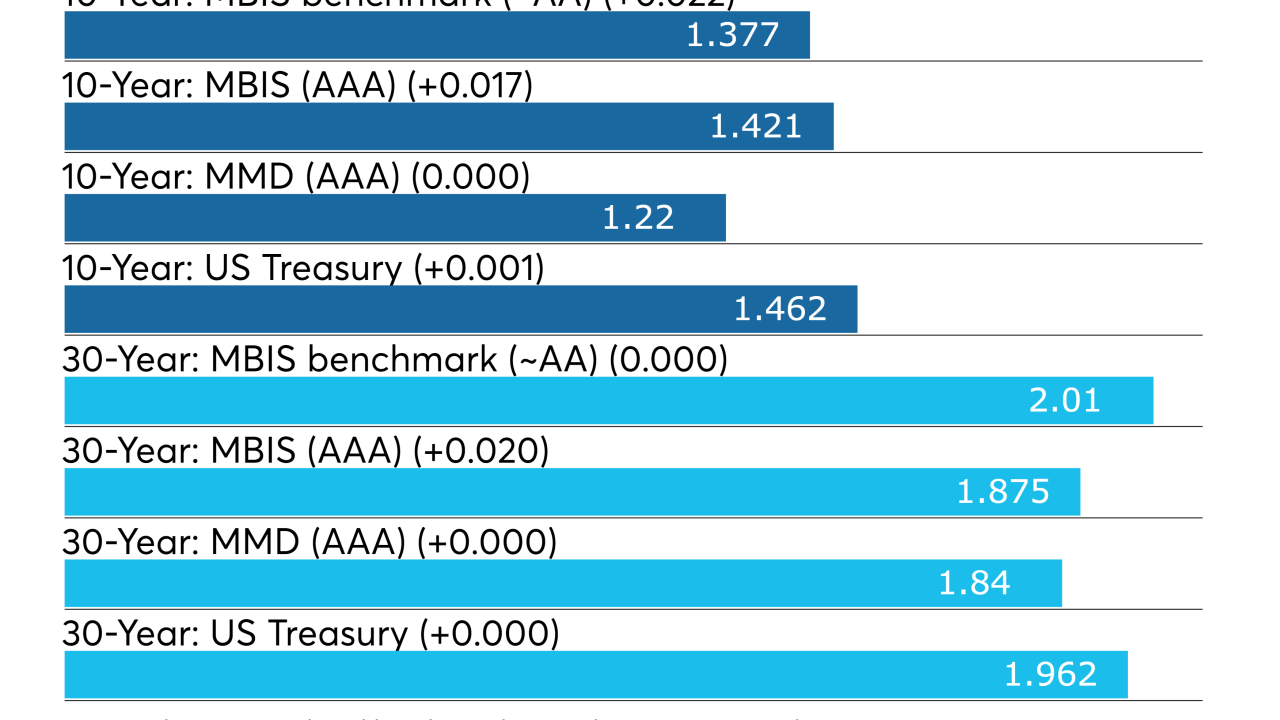

Issuers jump into the market as yields remain near record low levels.

September 9 -

With supply looking up, traders and analysts expect new issues to be well absorbed even if Treasuries correct futher.

September 6 -

The Chicago Public Schools also came to market with a $349 million GO deal.

September 5 -

California's $2.4 billion GO deal was priced for retail investors on Wednesday.

September 4 -

California's Legislative Analyst's Office wants state lawmakers to have a framework to evaluate cash borrowing proposals.

September 3 -

A pre-marketing scale was released on California's $2.3 billion GO deal.

September 3 -

It's the first week after Labor Day and investors are facing a hefty calendar with some big names.

September 3 -

The market will see $7.6 billion of bonds plus a $1 billion note sale coming up in a holiday-shortened week.

August 30 -

Volume bounced back from second lowest monthly total of the year in July as yields plunged to historic lows and issuers came out in droves.

August 30