-

Citi sees volume growing in 2020 to $440 billion with $95 billion of taxables on tap for next year.

December 13 -

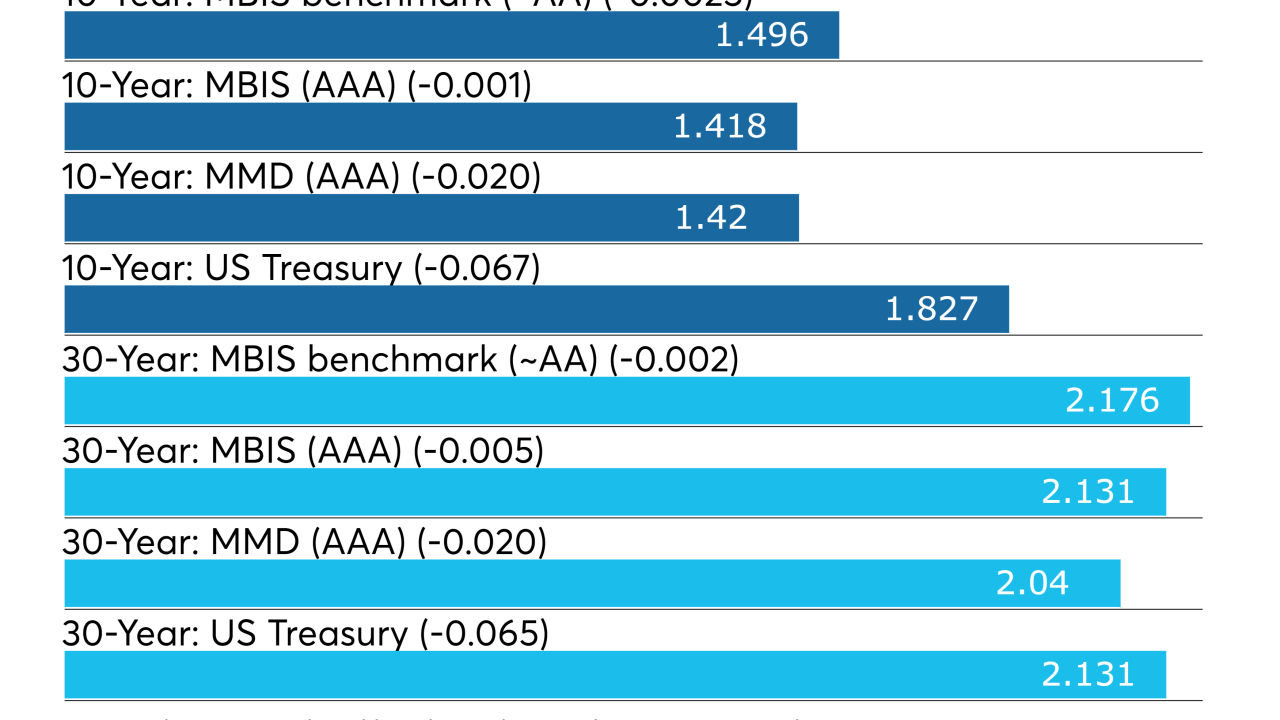

Muni yields rose as more bonds hit the marketplace in the last big supply rush of the week.

December 12 -

The Federal Open Market Committee left rates unchanged and looked likely to keep monetary policy on a steady course for the near term.

December 11 -

"What, me worry?" was the slogan of the muni market on Tuesday as participants forged ahead to price and buy bonds.

December 10 -

Trade worries returned among investors as the Fed meets this week to decide on interest rates.

December 9 -

If anyone had doubts about the market's ability to digest the largest weekly issuance influx in nearly two years, those can be put to bed now that all the deals have come and gone.

December 5 -

The muni primary was busier than expected, as two mega deals priced one day early to take advantage of market conditions.

December 4 -

The state should allocate $4 billion, the majority of its 2020 private activity bond allocation, to affordable housing, said the California Housing Consortium.

December 4 -

A flurry of secondary trading in the 10-year spot was being driven on Tuesday by the volatility in the equity market — as well as the attractive percentage to Treasuries.

December 3 -

The municipal market is bracing for the biggest issuance week in nearly two years, led by three billion-plus deals.

December 2