The muni market primary was busier than expected, as two mega deals priced one day early to take advantage of current market conditions.

"Coming into today, we thought we would get one billion-dollar deal but we ended up getting three," said one New York trader. "The food fight continues and now as for tomorrow, it now looks like it will be scraps/leftovers. All the bellwether deals are gone, leaving much to be desired on Thursday."

RBC priced New Jersey Transportation Trust Fund Authority’s (Baa1/BBB+/A-) $1.69 billion of transportation system federally taxable bonds, one day earlier than expected.

RBC also priced NJTTFA’s $619.28 million of transportation system tax-exempt bonds.

Goldman Sachs priced Metropolitan Washington Airports Authority’s (Baa2/A-/ ) $1.27 billion of Dulles toll road subordinate lien revenue and refunding bonds for the Dulles Metrorail Project and capital projects, also one day earlier than scheduled. The 2050 and the second half of a split 2053 maturity totaling $300 million are insured by Assured Guaranty Municipal Corp. and carry a rating of AA by S&P Global Ratings.

"We have had continued strong interest from investors throughout the marketing process and we are confident we can achieve our objectives in this market," said Andrew Roundtree, CPA and vice president for finance and CFO for the MWAA.

He added that the decision to come one day earlier than anticipated was based on investor interest and our joint bookrunning senior managers, Goldman Sachs and Bank of America Securities, confidence in this market.

"We are definitely seeing the strong demand we anticipated," Roundtree said.

The deals that priced a day early were well received, according to market sources.

Underwriters of the NJTFTA and Dulles had such positive feedback on the preliminary price talk on Tuesday that they opted to accelerate before any more market adjustments, two municipals sources told The Bond Buyer.

“There are two long maturities on Dulles that are insured,” noted Amy Raymond, manager of the fixed income department at Cumberland Advisors, who says the firm put in orders for those maturities Wednesday afternoon.

“The acceleration does not seem to have an effect on the market as a whole,” she added.

Elsewhere, a New York trader said the deals were inviting and benefited from fluctuations in the taxable market.

“They moved the deals up because of the volatility in the Treasury market selling off today,” he said.

And BofA Securities priced the Michigan Finance Authority’s (Aa3/AA-/AA-/NR) $1.09 billion of taxable hospital revenue refunding bonds for the Trinity Health Credit Group on Wednesday.

Siebert Williams Shank & Co priced New York City Municipal Water Finance Authority’s (Aa1/AA+/AA+) $638.53 million of water and sewer system second general resolution revenue bonds. Proceeds will be used to fund capital projects and refund certain outstanding bonds for savings.

Morgan Stanley priced New York State Housing Finance Agency's (Aa2/NR/NR) $444.12 million of affordable housing revenue climate bond certified, sustainability bonds and taxable bonds.

JP Morgan priced department of airports of the City of Los Angeles' (Aa3/AA-/AA-) $405.88 million of subordinate revenue bonds for Los Angeles International Airport.

BofAS priced Trinity Health Credit Group’s (Aa3/AA-/AA-) $316.56 million of hospital revenue refunding tax-exempt bonds.

Morgan Stanley priced Rhode Island Infrastructure Bank’s (NR/AAA/AAA) $113.04 million of water pollution control refunding revenue taxable bonds.

Alexandria, Virginia sold $205.24 million of general obligation capital improvement bonds, which were won by JP Morgan with a true interest cost of 2.6746%.

The New York Metropolitan Transportation Authority (MIG 1/SP-1/F1+/K1+) sold $200 million of revenue bond anticipation notes, which were won by Bank of America Securities with a net interest cost of 1.3846%.

Secondary market

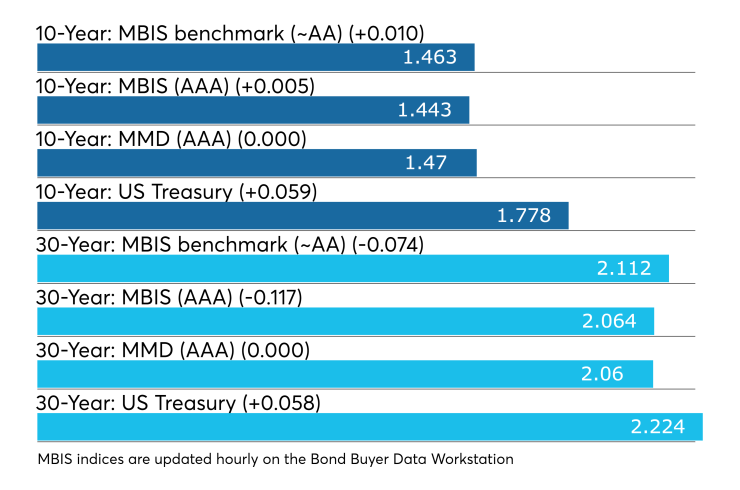

Munis were mixed on the MBIS benchmark scale, with yields rising by a basis point in the 10-year maturity and falling by seven basis points in the 30-year maturity. High-grades were also mixed, with yields on MBIS AAA scale increasing by less than one basis point in the 10-year maturity and decreasing by nine basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year GO and 30-year were unchanged from 1.47% and 2.06%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 82.7% while the 30-year muni-to-Treasury ratio stood at 92.5%, according to MMD.

Treasuries were higher and stocks were in the green after a report that China and the U.S. are still working toward a phase one trade deal, offsetting fears of a delay yesterday. The Dow Jones Industrial Average was higher by about 0.71%, the S&P 500 Index gained 0.76% and the Nasdaq improved 0.64%.

The Treasury three-month was yielding 1.551%, the two-year was yielding 1.576%, the five-year was yielding 1.608%, the 10-year was yielding 1.778% and the 30-year was yielding 2.224%.

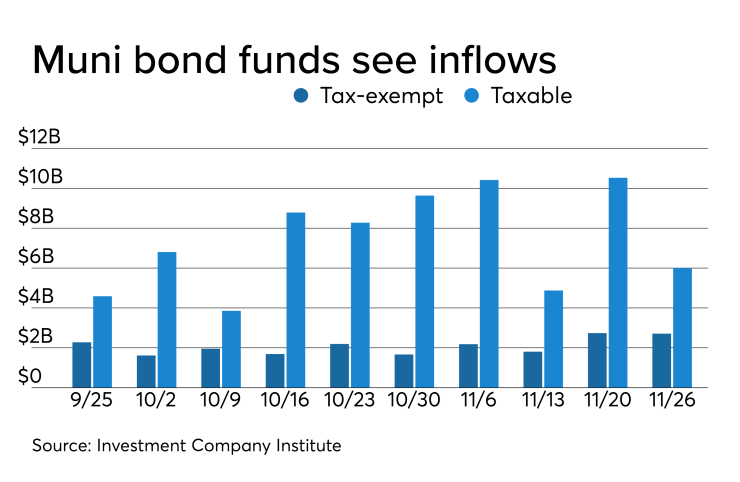

ICI: Muni funds see $2.71B inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $2.711 billion in the week ended Nov. 26, the Investment Company Institute reported on Wednesday.

It was the 47th straight week of inflows into the tax-exempt mutual funds and followed an inflow of $2.738 billion in the previous week.

Long-term muni funds alone saw an inflow of $2.343 billion after an inflow of $2.309 billion in the previous week; ETF muni funds alone saw an inflow of $322 million after a revised inflow of $279 million in the prior week.

Taxable bond funds saw combined inflows of $6.005 billion in the latest reporting week after revised inflows of $10.527 billion in the previous week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $8.189 billion after inflows of $6.933 billion in the prior week.

Previous session's activity

The MSRB reported 39,725 trades Tuesday on volume of $12.59 billion. The 30-day average trade summary showed on a par amount basis of $10.82 million that customers bought $5.94 million, customers sold $2.96 million and interdealer trades totaled $1.92 million.

New York, Texas and California were most traded, with the Empire State taking 12.894% of the market, the Lone Star State taking 11.928% and the Golden State taking 10.955%.

The most actively traded security was the California State various purpose GO refundings 5s of 2037, which traded 13 times on volume of $41.9 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.