The muni market got significantly weaker on Monday, ahead of the biggest issuance week in nearly two years.

The biggest volume week of the year awaits, with IHS Ipreo estimating bond supply will come in at $17.4 billion in a calendar composed of $14.8 billion of negotiated deals and $2.7 billion of competitive sales.

Previously, the week of Nov. 4 was the biggest of 2019 when volume was estimated at $12.9 billion.

The record for the largest issuance week occurred almost two years ago. Back during the week of Dec. 15, 2017, the muni market saw $23.5 billion as issuers were rushing to get deals in to beat the tax reform clock.

It has been a while since the market has seen this much of an influx of issuance; so how will it handle it?

“December 2017 was a last chance week for tax-exempt advance refundings and market clearing levels and the market had to get cheaper to absorb all of the 2017 year end issuance,” said one southern trader, noting the difference between that week and this week. “I think the current marketplace can absorb this amount, especially since this week’s offerings has a good mix of taxable, AMT, high yield and tax-exempt offerings — potentially something for everyone.”

However, he added that it remains to be seen if the market can continue to grind lower with Treasuries backing up and enormous supply.

“My feeling is that spreads will have to widen to accommodate this deluge of issuance,” he said.

One New York trader said that when it comes to the weekly issuance, it’s important to remember that a fair amount of the issuance is taxable.

“Tax-exempt landscape has enjoyed positive inflows for quite some time and the supply the last five weeks has been handled relatively well and I don’t see that changing,” the New York trader said. “You have to respect the supply, but I do think there is a disposition to most wanting to be longer than short going into year end.”

He also said that all geopolitical “situations” aside, he suspects rates to be range bound and muni interest to be decent.

“With that said, all bets could be off depending on trade talk, sanctions, Hong Kong, Impeachment, etc. There are a lot of cross currents that could throw a wrench in things.”

Secondary market

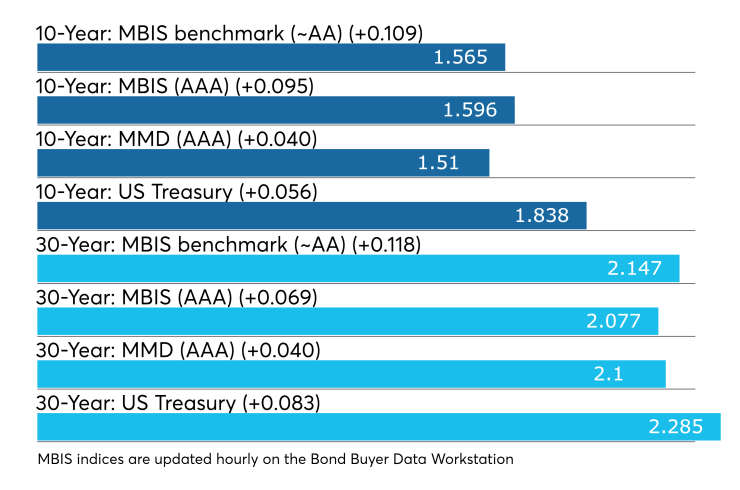

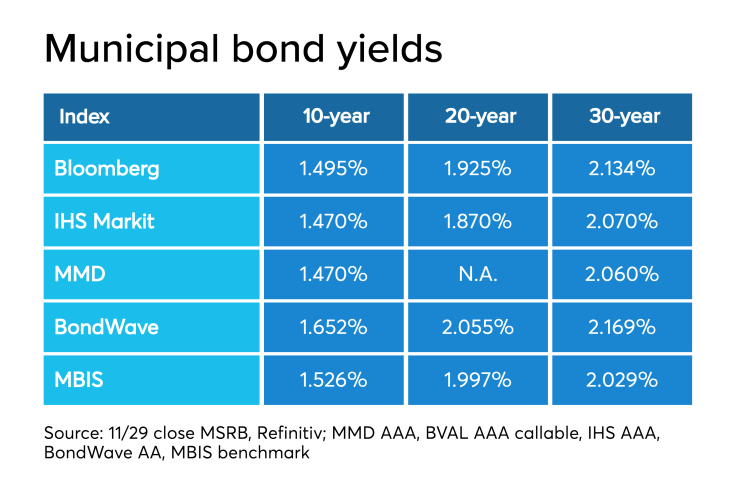

Munis were weaker on the MBIS benchmark scale, with yields rising by 10 basis points in the 10-year maturity and by 11 basis points in the 30-year maturity. High-grades were also weaker, with yields on MBIS AAA scale increasing by nine basis points in the 10-year maturity and by seven basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year GO and 30-year were four basis points higher to 1.51% and 2.10%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 85.8% while the 30-year muni-to-Treasury ratio stood at 96.2%, according to MMD.

Treasuries were higher and stocks were down on the weak manufacturing report. The Dow Jones Industrial Average was lower by about 0.73%, the S&P 500 Index fell 0.59% and the Nasdaq lost almost 0.98%.

The Treasury three-month was yielding 1.577%, the two-year was yielding 1.612%, the five-year was yielding 1.654%, the 10-year was yielding 1.838% and the 30-year was yielding 2.285%.

Primary market

With all eyes on the mammoth new-issue calendar this week, which is expected to top $18 billion, Monday’s municipal bond market was largely quiet, according to municipal bond sources.

“The Treasury market is off on the day approximately five basis points in 10 years,” a New York trader said.

“Muni secondary activity is very quiet but off on the day as well in sympathy with Treasuries,” he added.

Given the consistent and record fund flows thus year, demand will be voracious for this week’s new issues — which will be dominated by the $2.3 billion New Jersey Transportation Trust Fund Authority deal, the trader said.

“Even though the calendar is heavy, Lipper had another week of strong cash flow of over $2 billion last week,” he said, adding that the record inflows have remained unabated year to date.

In the competitive arena, Nassau County, N.Y., (A2/A+/A/NR) sold $325.94 million of notes and bonds in three offerings on Monday. The deals consisted of $105.93 million of Series 2019B general improvement general obligation bonds, which were won by Jefferies with a true interest cost of 3.2367%

The $120 million of Series 2019A tax anticipation notes were won by Morgan Stanley with a net interest cost of 1.1765%. And $100 million of Series 2019B BANs were won by JP Morgan with a NIC of 1.1767%. Proceeds from the deals will fund various county purposes and refinance outstanding notes.

Most of the larger deals are scheduled to come Wednesday and Thursday.

The biggest issuer of the week will be the New Jersey Transportation Trust Fund Authority (Baa1/BBB+/A-/NR), which is coming to market with $2.3 billion of transportation system bonds. The deal consists of $1.689 billion of Series 2019B taxable and $634.455 million of tax-exempts. RBC Capital Markets is set to price the bonds on Thursday. Proceeds will refund outstanding debt.

The District of Columbia’s Metropolitan Washington Airports Authority (Baa2/A-/NR/NR) is coming to market with $1.7 billion of revenue and refunding bonds in two deals on Thursday.

Goldman Sachs is lead underwriter on the $1.3 billion of Series 2019B subordinate lien revenue and refunding bonds for the Dulles Metrorail and capital improvement projects, while Wells Fargo Securities will price the $364 million of Series 2020A forward delivery AMT and Series 2020B non-AMT bonds.

And BofA Securities will price the Michigan Finance Authority’s (Aa3/AA-/AA-/NR) $1.119 billion of taxable hospital revenue refunding bonds for the Trinity Health Credit Group on Wednesday.

Some medium-sized deals will hit on Tuesday, as the issuance will start to come down like snow hit New York on Monday.

Piper Jaffray is scheduled to price Riverside Unified School District, California’s (Aa2/AA-/ ) $172 million of election of 2016 general obligation bonds.

BofAS is expected to price Oklahoma Water Resources Board’s ( /AAA/AAA) $157.09 million of revolving fund revenue refunding taxable bonds.

There will also be a few competitive deals on Tuesday.

The State of West Virginia (Aa2/AA/AA) is expected to sell a total of $600 million in two separate sales.

The Board of Regents of Texas A&M (Aaa/AAA/AAA) University is scheduled to sell $351.91 million of permanent university fund bonds.

Dallas Independent School District ( / /AA+) is set to sell $315 million of unlimited tax school building bonds.

Lipper sees eighth consecutive billion-dollar inflow

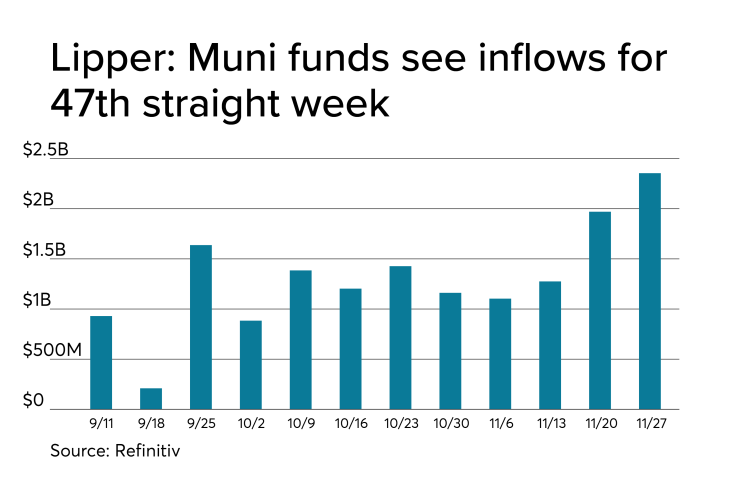

For 47 weeks in a row investors have poured cash into municipal bond funds, according to the latest data released by Refinitiv Lipper on Wednesday.

Tax-exempt mutual funds that report weekly received $2.355 billion of inflows in the week ended Nov. 27 after inflows of $1.970 billion in the previous week. This marks the eighth week in a row and ninth time in the past 12 weeks inflows have exceeded $1 billion.

Exchange-traded muni funds reported inflows of $397.663 million after inflows of $368.233 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.957 billion after inflows of $1.602 billion in the previous week.

The four-week moving average remained positive at $1.676 million, after being in the green at $1.377 billion in the previous week.

Long-term muni bond funds had inflows of $1.534 billion in the latest week after inflows of $1.231 billion in the previous week. Intermediate-term funds had inflows of $497.841 million after inflows of $358.234 million in the prior week.

National funds had inflows of $2.139 billion after inflows of $1.779 billion in the previous week. High-yield muni funds reported inflows of $477.878 million in the latest week, after inflows of $470.625 million the previous week.

Previous session's activity

The MSRB reported 7,314 trades Friday on volume of $2.95 billion. The 30-day average trade summary showed on a par amount basis of $10.69 million that customers bought $5.90 million, customers sold $2.88 million and interdealer trades totaled $1.91 million.

California, New York and Texas were most traded, with the Golden State taking 16.516% of the market, the Empire State taking 13.682% and the Lone Star State taking 10.389%.

The most actively traded security was the Commonwealth of Puerto Rico GOs of 2014A 8s of 2035, which traded 8 times on volume of $15.10 million.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed, as the $42 billion of three-months incurred a 1.560% high rate, unchanged from 1.560% the prior week, and the $36 billion of six-months incurred a 1.565% high rate, down from 1.580% the week before.

Coupon equivalents were 1.592% and 1.604%, respectively. The price for the 91s was 99.605667 and that for the 182s was 99.208806.

The median bid on the 91s was 1.530%. The low bid was 1.500%.

Tenders at the high rate were allotted 16.23%. The bid-to-cover ratio was 3.03.

The median bid for the 182s was 1.540%. The low bid was 1.515%.

Tenders at the high rate were allotted 36.22%. The bid-to-cover ratio was 3.11.

Christine Albano and Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.