Municipal bond yields were mixed ahead of this week’s hefty supply slate. Treasuries strengthened as stock prices fell on renewed trade worries, halting the post-jobs report rally.

Overshadowing trading, the Federal Open Market Committee meets in Washington to decide on interest rates this week. While the Fed is not expected to lower rates, market participants will be looking at the “Dot Plot” data to divine any signs of easing next year.

Primary market

About $13.2 billion of new paper will come to market this week in a calendar composed of $11.6 billion of negotiated deals and $1.6 billion of competitive sales.

On Monday, Citigroup priced the Eagle Mountain-Saginaw Independent School District, Tarrant County, Texas’ (PSF: NR/AAA/AAA/AAA) $135.945 million of Series 2019 unlimited tax school building bonds.

On Tuesday, JPMorgan Securities is set to price the Texas Private Activity Bond Surface Transportation Corp.’s (Baa2/NR/BBB/NR) $1.2 billion of senior lien revenue refunding bonds, featuring non-alternative minimum tax private activity bonds and taxable bonds for the

Goldman Sachs is expected to price the

And Citigroup is set to price the Illinois State Toll Highway Authority’s (A1/NR/AA-/NR) $703.4 million of senior revenue refunding bonds on Tuesday.

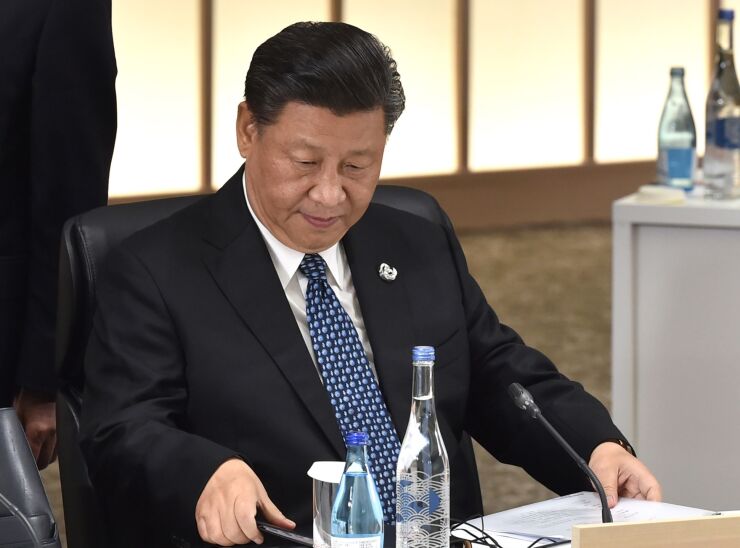

Sino-U.S. trade in focus

U.S. stocks and bonds are moving in lock-step with the Chinese yuan and virtually every move can be traced to trade-related headlines, according to the latest report from Academy Securities.

“We continue to see a ‘Trade Truce’ as the likely outcome. The U.S. will not impose new tariffs, which is good, however, a groundbreaking comprehensive deal will not be reached either,” Academy said in a report released Friday. “At the moment (though that shifts on a daily basis), the market seems more pessimistic than we are.”

Academy said the U.S. is treating China as a "strategic competitor." While the Trump administration takes this view seriously, it is highly likely that all future administrations will too, the report said.

“The national security issues we face need to be addressed in any deal — this makes it harder to reach,” Academy said.

The firm said the U.S. is engaged with China on an economic front, a risky proposition for both sides.

“While China is known for long-term planning, the evolution of a middle class has made them more susceptible to unrest on any economic slowdown. Chinese debt is growing far faster than its GDP, yet another reason that China wants to come to a deal,” the report said. “China has intellectual property now that it too wants to protect, so we may not be as far apart on that issue as is commonly believed (whether any IP protection will be truly enforceable is another issue for another day).”

Secondary market

Munis were mixed on the MBIS benchmark scale, with yields rising by one basis point in the 10-year maturity and falling by less than a basis point in the 30-year maturity. High-grades were weaker, with yields on MBIS AAA scale falling by two basis points in the 10-year maturity and by two basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO fell two basis points to 1.46% while the 30-year dropped two basis points to 2.05%.

“The ICE muni yield curve is down one basis point as it is moving in sympathy with Treasuries,” ICR Data Services said in a Monday market comment. “Tobaccos are flat to down one basis point. Taxables are also down one basis point.”

The 10-year muni-to-Treasury ratio was calculated at 79.7% while the 30-year muni-to-Treasury ratio stood at 90.5%, according to MMD.

Stocks were slightly lower as Treasuries strengthened.

The Dow Jones Industrial Average was down about 0.3% as the S&P 500 Index slipped around 0.2% while the Nasdaq fell 0.2%.

The Treasury three-month was yielding 1.543%, the two-year was yielding 1.621%, the five-year was yielding 1.664%, the 10-year was yielding 1.832% and the 30-year was yielding 2.267%.

Previous session's activity

The MSRB reported 32,200 trades Friday on volume of $13.12 billion. The 30-day average trade summary showed on a par amount basis of $11.38 million that customers bought $6.31 million, customers sold $3.07 million and interdealer trades totaled $2 million.

California, Texas and New York were most traded, with the Golden State taking 15.072% of the market, the Lone Star State taking 10.781% and the Empire State taking 8.397%.

The most actively traded security was Illinois’ Metropolitan Pier and Exposition Authority revenue 5s of 2050, which traded 11 times on volume of $48.75 million.

Previous week's actively traded issues

According to

Some of the most actively traded munis by type in the week were from Texas, Illinois and New Jersey issuers.

In the GO bond sector, the Crowley Independent School District, Texas 4s of 2044 traded 26 times. In the revenue bond sector, the Chicago, Illinois’ Metropolitan Pier and Exposition Authority 5s of 2050 traded 65 times. In the taxable bond sector, the New Jersey Transportation Trust Fund Authority 4.131s of 2042 traded 103 times.

Treasury auctions notes, bills

The Treasury Department auctioned $38 billion of three-year notes with a 1 5/8% coupon at a 1.632% high yield, a price of 99.985419. The bid-to-cover ratio was 2.56.

Tenders at the high yield were allotted 89.20%. All competitive tenders at lower yields were accepted in full. The median yield was 1.600%. The low yield was 1.520%.

Tender rates for the Treasury's latest 91-day and 182-day discount bills were lower, as the $42 billion of three-months incurred a 1.520% high rate, down from 1.560% the prior week, and the $36 billion of six-months incurred a 1.520% high rate, down from 1.565% the week before. Coupon equivalents were 1.551% and 1.557%, respectively. The price for the 91s was 99.615778 and that for the 182s was 99.231556.

The median bid on the 91s was 1.480%. The low bid was 1.450%. Tenders at the high rate were allotted 43.97%. The bid-to-cover ratio was 2.77. The median bid for the 182s was 1.490%. The low bid was 1.465%. Tenders at the high rate were allotted 3.51%. The bid-to-cover ratio was 2.98.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.