A flurry of secondary trading in the 10-year spot was being driven on Tuesday by the volatility in the equity market, as well as the attractive percentage to Treasuries, as the new issues started to find their way to the Street.

“In the 10-year sweet spot, munis are trading 83% of Treasuries, which is attractive,” a New York trader said. “We continue to be strong and the constant inflows have not stopped us at all. Some of the equity volatility is stemming from the lack of trade talks — which is being further delayed by President Trump until after the Presidential Election, he said.

“Equities are down 500 basis points in two days,” the trader said. But, he said, munis are not in full sympathy with the taxable counterparts.

“We are not slacking Treasuries 100% — Treasuries are down 11 basis points,” he said at 2 p.m. Tuesday as municipals were following Treasuries down in yield and the 10-year muni was stronger by four basis points and tracking stocks, he said. Several high-grade names were trading in the belly of the curve, including blocks of Georgia, Maryland, North Carolina and other AAA bellwether munis directing benchmarks lower.

In the primary market, even though many of the larger new issues recently have been taxable, the huge calendar is being very well received, the New York trader said.

He said the market is in need of more tax-exempt supply. “December is usually a period of a lot of issuance. This week’s $18 billion is heavy, but a lot of it is taxable,” he said, noting that the volume should have no trouble being absorbed as municipals “are getting more attractive.”

The muni issuance swarm commenced on Tuesday, with some small- to medium-sized deals including four large competitive deals. The year-end rush is officially on, as issuers and bankers alike are trying to get deals done and finished before the calendar flips to 2020.

"We do expect another heavy calendar for next week also," said one Texas trader. "Year-end supply should continue to stretch further and heavier into December than past years due to low rates, current refundings, advanced refundings (taxable) etc."

He added that with customers closing books and dealers protecting year-end, one would think that supply could cause spot yields and trading spreads to back up.

"On the flip side tax-exempt munis remain in strong demand evidenced by strong inflows due to tax shelters, etc.," he said. "There is an outside chance we are surprised by the amount of demand going into year end."

He noted that on Monday he saw very good interest from traditional buyers despite a big line up in supply.

"Typically they would be patient and wait for the supply," he said. "It causes me to question my earlier statement, however, it's just two days post holiday."

Buoyed by strength in the primary and secondary markets, the buyside seemed eager — ready and waiting to sink its teeth into the $18 billion post-holiday bonanza earmarked to price this week, municipal players said Monday.

The new-issue and secondary markets were strong heading into the first large deals of the week, which are expected Wednesday and Thursday.

“The muni market is firm going into the supply,” a Florida trader said. “Early inquiry demand is surprising considering the size of calendar."

Everyone was eyeing what is to be one of the largest slates for weekly volume year to date, the Florida trader said, adding the secondary trading was also gaining traction.

“Dealers and arbs don't appear nervous as there is a solid bid side for secondary items,” he said.

While there are differences between the issuance surge we have seen this second half of the year and the one we saw leading up to tax reform, this time around should make for an exciting start to the year — unlike back when we started 2018, participants said.

"While the tax reform rush at the end of 2017 stole issuance away from the start of 2018, I think this time around we will see the opposite effect," said Pat Luby, senior municipal strategist at CreditSights. "I think the ripple effect will be positive, with all the success of the taxable advance refundings and taxable deals in general, it will carry over into the New Year and we will see a good amount of issuance to start the year, something we aren't necessarily accustomed to."

Going back to 2010, the months of January and February have only see $30 billion and greater issuance four times — Jan. 2010 ($32.66), Feb. 2015 ($33.16), Feb. 2016 ($31.66) and Jan. 2017 ($36.05).

Secondary market

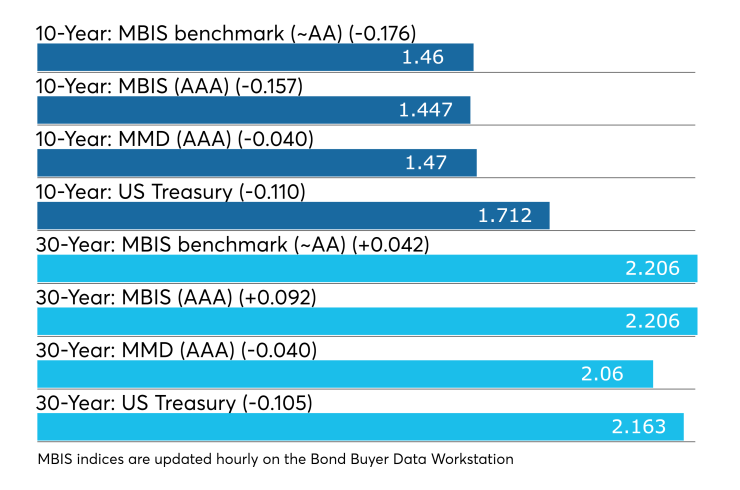

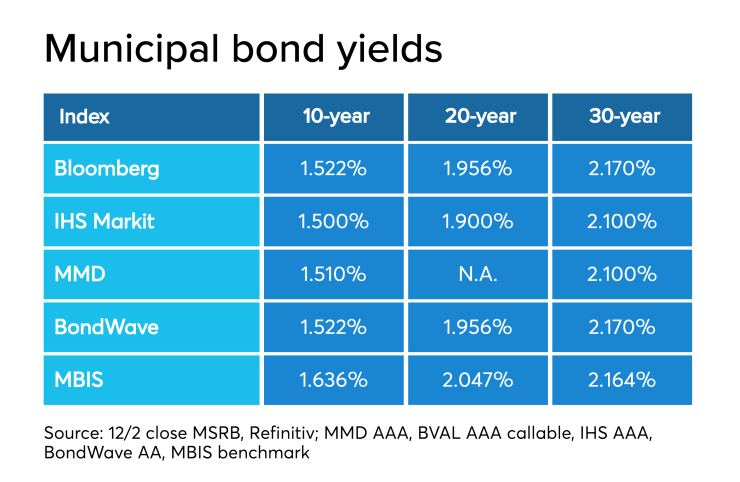

Munis were mixed on the MBIS benchmark scale, with yields falling by 17 basis points in the 10-year maturity and rising by four basis points in the 30-year maturity. High-grades were also mixed, with yields on MBIS AAA scale decreasing by 15 basis points in the 10-year maturity and increasing by nine basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year GO and 30-year were four basis points lower to 1.47% and 2.06%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 90.0% while the 30-year muni-to-Treasury ratio stood at 99.7%, according to MMD.

Treasuries were much lower and stocks slumped in the red after President Trump hinted that there will be no trade deal with China in 2019. "Might be better to wait utill after the election," Trump said about a possible China deal. The Dow Jones Industrial Average was lower by about 1.24%, the S&P 500 Index fell 0.92% and the Nasdaq lost almost 0.88%. The S&P 500 and Nasdaq suffered their worst loses since October.

The Treasury three-month was yielding 1.572%, the two-year was yielding 1.540%, the five-year was yielding 1.538%, the 10-year was yielding 1.712% and the 30-year was yielding 2.163%.

Primary market

Goldman Sachs priced Metropolitan Pier and Exposition Authority, Illinois' (NR/BBB/BBB-) $881.905 million of refunding bonds for the McCormick Place Expansion Project one day earlier than expected.

"Makes sense that the deal came a day early, taking advantage of the news headline rally, which could go poof at any second," said one Chicago trader. "We struggled with pricing the forward delivery aspect of the deal but from my indications the deal seems to have gone well, with bumps. There were probably a fair number of investors that stayed away due to the forward delivery who would be comfortable upon actual delivery, opening the door for other investors — which I am sure was welcomed in this food fight market."

Bank of America Securities priced the Oklahoma Water Resources Board's ( /AAA/AAA) $154.42 million of revolving fund revenue refunding taxable bonds.

BofAS prices the Indianapolis Local Public Improvement Bond Bank's ( /SP-1/ ) $134.115 million of notes for the Fieldhouse Project on Tuesday.

JP Morgan priced Lee County, Fla.'s (Aa2/AA+/AA+) $105.10 million of taxable water and sewer refunding revenue bonds.

Goldman priced Orange County Water District, Calif.'s ( /AAA/AAA) $99.82 million of refunding revenue bonds.

In the competitive arena, the State of West Virginia (Aa2/AA/AA) sold a total of $600 million in two separate sales. Jefferies won $319.715 million of general obligation state road bonds with a true interest cost of 2.3765%.

Citi won $280.285 million of GO state road bonds with a TIC of 3.4131%.

The Board of Regents of Texas A&M (Aaa/AAA/AAA) University sold $351.89 million of taxable permanent university fund bonds. The bonds were won by Morgan Stanley with a TIC of 3.1002%.

Dallas Independent School District ( / /AA+) sold $311.975 million of unlimited tax school building bonds, which were won by JP Morgan with a TIC of 2.3654%.

Previous week's actively traded issues

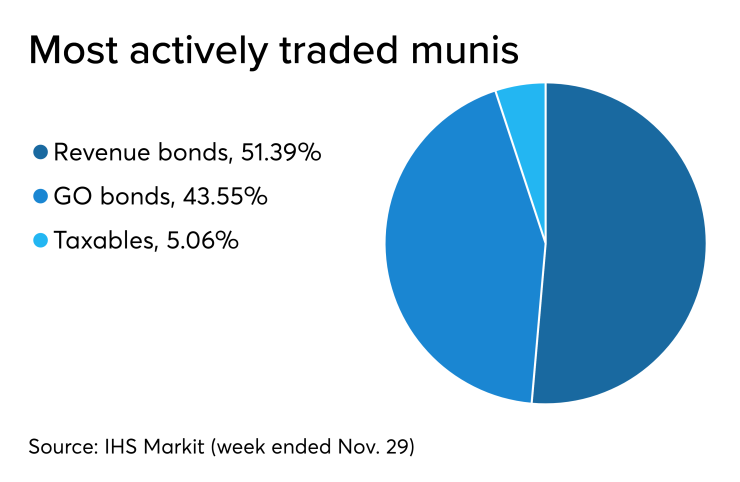

Some of the most actively traded munis by type in the week ended Nov. 29 were from California, Wisconsin and New York issuers, according to

In the GO bond sector, the El Rancho Unified School District, Calif., 3s of 2046 traded 18 times. In the revenue bond sector, the Wisconsin Health and Educational Facilities Authority, 3.125s of 2049 traded 59 times. In the taxable bond sector, the New York State Dormitory Authority, 3.142s of 2043 traded 52 times.

Revenue bonds made up 51.39% of total new issuance in the week ended Nov. 15, down from 51.63% in the prior week. General obligation bonds were 43.55%, up from 43.44%, while taxable bonds accounted for 5.06%, up from 4.93%.

Last week's actively quoted issues

Puerto Rico, New York and Illinois bonds were among the most actively quoted in the week ended Nov. 29, according to IHS Markit.

On the bid side, Puerto Rico Sales Tax Financing Corp., revenue 5s of 2058 were quoted by 17 unique dealers. On the ask side, New York State Thruway Authority revenue, 3s of 2053 were quoted by 103 dealers. Among two-sided quotes, the State of Illinois taxable, 5.1s of 2033 were quoted by 12 dealers.

NYC TFA to sell $1.2B bonds

The New York City Transitional Finance Authority said Monday that it will sell about $1.18 billion of future tax-secured subordinate bonds next week.

The deal will be made up of $880 million of tax-exempt fixed rate bonds and $300 million of taxable fixed rate bonds.

The tax-exempts are expected to be priced on Thursday, Dec. 12 in a negotiated sale by book-running lead manager JPMorgan Securities with BofA Securities, Citigroup, Goldman Sachs, Jefferies, Loop Capital Markets, Ramirez & Co., RBC Capital Markets and Siebert Williams Shank & Co. serving as co-senior managers.

There will be a two-day retail order period on Dec. 10 and 11.

Also on Dec. 12, the TFA will competitively sell $300 million of taxable fixed-rate bonds.

Proceeds from the sale will be used to fund capital projects with the exception of proceeds from about $30 million of tax-exempt bonds which will be used to convert existing variable-rate demand bonds to fixed-rate.

Previous session's activity

The MSRB reported 32,588 trades Monday on volume of $9.80 billion. The 30-day average trade summary showed on a par amount basis of $10.61 million that customers bought $5.84 million, customers sold $2.89 million and interdealer trades totaled $1.88 million.

New York, California and Texas were most traded, with the Empire State taking 13.993% of the market, the Golden State taking 12.69% and the Lone Star State taking 10.864%.

The most actively traded security was the Nassau County, New York revenue anticipation notes 2s of 2020, which traded 7 times on volume of $29.965 million.

Year-bills auctioned

The Treasury Department Tuesday auctioned $26 billion of 364-day bills at a 1.525% high yield, a price of 98.458056.

The coupon equivalent was 1.569%. The bid-to-cover ratio was 3.39.

Tenders at the high rate were allotted 15.64%. The median yield was 1.500%. The low yield was 1.475%.

Treasury to sell $40B 4-week bills

The Treasury Department said it will sell $40 billion of four-week discount bills Thursday. There are currently $40.012 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.