-

Dealers and muni advisors think the loyalties of solicitor MAs should be clearly disclosed.

June 18 -

The proposed changes are part of the MSRB's ongoing retrospective rule review.

May 17 -

The White House and a bipartisan cadre of lawmakers appear committed to getting infrastructure, including top muni market lobbying goals, achieved.

May 11 -

The MSRB will retire 15 pieces of guidance, though those will still be available online for historical purposes.

April 26 -

The bonds would include a subsidy rate of 28% and would be exempt from sequestration.

April 23 -

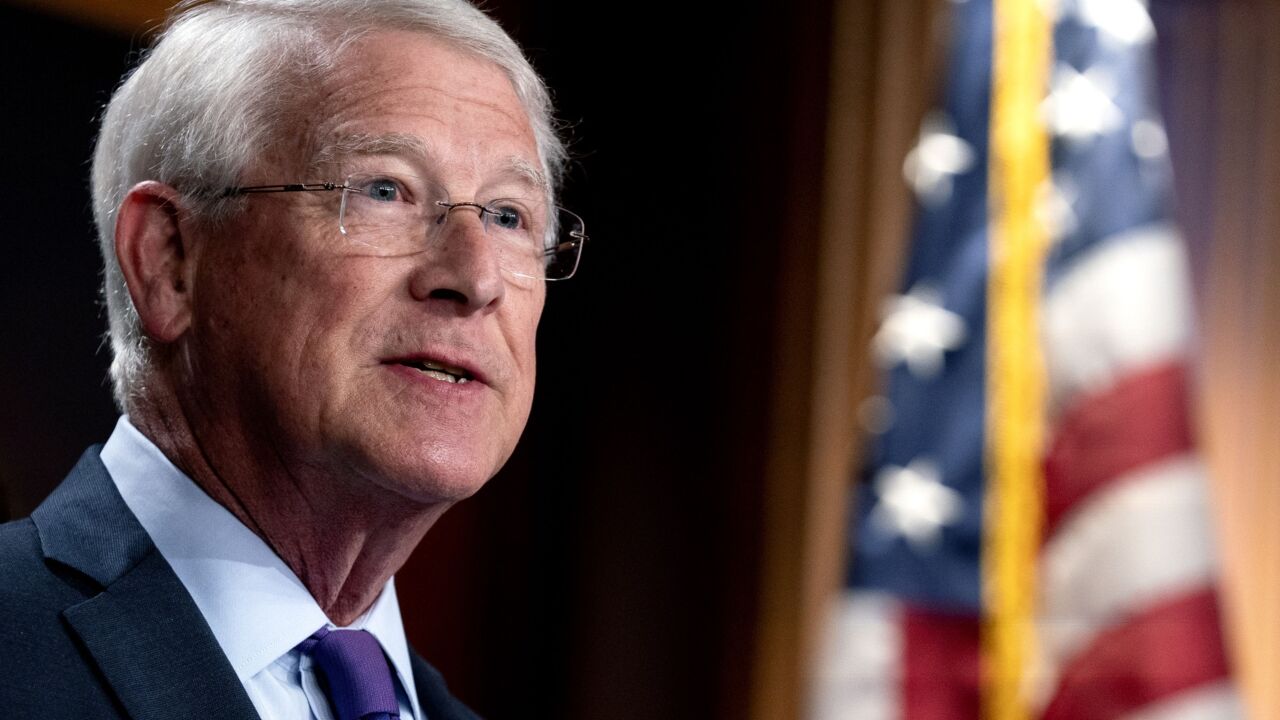

His departure comes as lawmakers are working quickly to put together an infrastructure bill, with hopes of including key municipal bond provisions.

April 19 -

Among over 1,200 dealers registered with the MSRB, 21 firms are bank dealers who would be impacted by the change.

March 5 -

Reinstating certain municipal bond provisions would make way for more infrastructure investment.

March 3 -

The use of alternative trading systems is growing, accounting for 21% of all trades in 2020.

March 2 -

Bills to expand the use of tax-advantaged bonds that are being reintroduced in the new Congress have favorable odds for being signed into law this year.

February 26 -

Dealer groups say changes to FINRA rules should be cohesive with municipal rules.

February 17 -

Much of the material being retired dates back more than 35 years.

February 12 -

From ESG to infrastructure, regulation to legislation, SIFMA's President and CEO Ken Bentsen and Managing Director and Associate General Counsel Leslie Norwood discuss what SIFMA members are prioritizing on Wall Street and in Washington when it comes to munis. Lynne Funk and Kyle Glazier host. (34 minutes)

February 11 -

The dealer group is concerned the SEC may provide another exemption for municipal advisors to work on private placement deals.

February 2 -

The reduction would be the largest the MSRB has done, substantially more than a previous one which caused a loss of $5.2 million.

January 29 -

Since a temporary exemption allowing muni advisors to facilitate certain private placement deals expired, a federal court cannot strike it down, the SEC argued.

January 26 -

The group specifically revised six of its model disclosure documents for risk disclosure including floating rate notes, fixed-rate bonds, interest rate swaps, forward delivery bonds, tender offer bonds and variable rate demand obligations.

January 14 -

Dealers said the pandemic has highlighted the challenges of outdated rules and the need to modernize them.

January 12 -

The MSRB is planning to overhaul existing rules in 2021, while stakeholders will lobby the SEC for and against reviving a registration exemption for muni advisors.

December 30 -

Sources see ways to get more investment in infrastructure with municipal bond provisions, but bipartisanship will be essential.

December 24