Market participants cautiously optimistic about the chances of important infrastructure legislation becoming law in 2021, as a new president prioritizing infrastructure faces the hurdles of the coronavirus and possibly a divided Congress.

Sources expect President Joe Biden to push for an infrastructure bill early in the year, possibly as part of a broader economic stimulus bill., The pressure of a looming deadline near the end of 2021 for surface transportation funding will bring the hustle, stakeholders hope.

"When Congress comes back in January, and when the Biden-Harris administration takes office that there will be a push to do something on infrastructure early in the year, said Jim Tymon, executive director of the American Association of State Highway and Transportation Officials. "We’re optimistic that it’s one of the first legislative items that the administration is pushing for and we’re hopeful that congress jumps on board with that as well.”

The most likely option is the reauthorization of the Fixing America’s Surface Transportation Act combined with other infrastructure investment, Tymon said. The FAST Act was renewed for one year in September, but that could serve as a deadline in which to get infrastructure done.

Tymon is hopeful for a five to six-year authorization.

“Long term bills like that give state DOTs and transit agencies the predictability that they need to take on those major transportation infrastructure projects,” Tymon said. “Congress understands that and I think that will be their goal.”

The U.S. Chamber of Commerce is optimistic that “substantial infrastructure legislation will occur in 2021.”

“We think this will be at the top of the heap,” said Ed Mortimer, vice president of transportation and infrastructure at the Chamber. “How do you bring Republicans and Democrats together and we feel like a lot of the work we’ve done over the last couple of years has led us to this point where we really see the opportunity to get some bipartisan solutions that can get enacted into law, that’s the goal.”

The FAST Act reauthorization has always been the base of any discussion on infrastructure, Mortimer explained.

“So in our view, any infrastructure bill with the surface reauthorization will be the base of that,” Mortimer said.

“From our perspective, the timing of the Sept. 30 deadline is one that will force Congress to act,” Mortimer added. “Because the surface bill is the largest part of our infrastructure and that will be the base of any infrastructure debate as we go into 2021.”

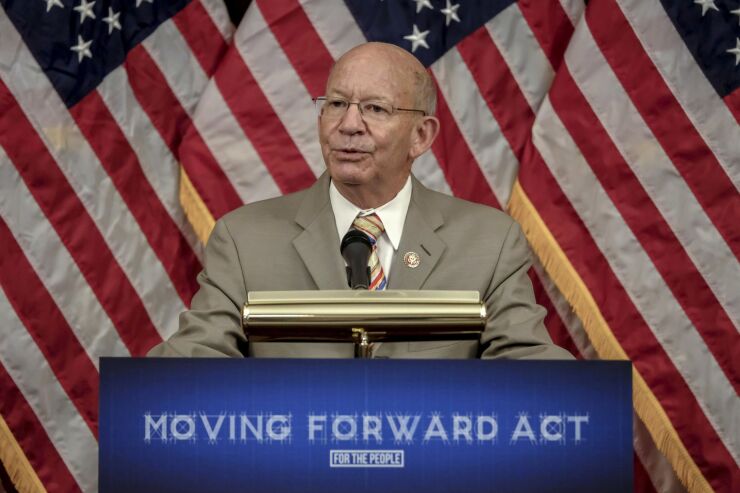

One bill that will make a comeback in 2021 will be House Democrats’ Moving Forward Act that included a plethora of municipal bond provisions.

The bill, passed by the House during the summer, is a large infrastructure proposal that includes permanently reinstating Build America Bonds and tax-exempt advance refunding. It would also increase the cap of private activity bonds on the federal side, which has practically reached its limit.

“From our initial conversations with folks, it’s going to be very similar,” Mortimer said. “We also know that the Biden team is very interested in the parameters of the Moving Forward Act.”

Mortimer expects muni bond provisions to be included in a future infrastructure bill and is confident that Rep. Richard Neal, D-Mass., chair of the House Ways and Means Committee, will include them.

“We’re confident that Chairman Neal will include those provisions and there will be interest in that in the Senate as well so hopefully we can get those in the final package as well,” Mortimer said.

In 2009, Congress passed the American Recovery and Reinvestment Act, which created Build America Bonds. Those bonds offered issuers a 35% subsidy on the interest owed to investors, but the authority to issue them ended in 2010.

ARRA also gave $48.1 billion for programs administered by the U.S. DOT, with more than half for highways, according to the Congressional Research Service. Sources say an economic stimulus package like ARRA is possible.

“The Biden team has expressed an interest in doing an economic stimulus package,” Mortimer said. “We don’t know the details, some of the initial conversations would be to put more investments in current programs because that’s the fastest way to get new investment out there and build some projects. At the same time, it gives the new Congress and the new administration some time to put out their longer-term vision for infrastructure.”

Muni bond provisions can fit into any of three bills, said Kenneth Bentsen, Jr., CEO and president at the Securities Industry and Financial Markets Association. Those could be a new surface transportation bill, a broader infrastructure bill, or an even larger stimulus bill.

“We’ll take a ticket to ride on any train,” Bentsen said. “All three of those are possible options included with the Sept. 30 deadline.”

Biden and Congress will also be looking at broadband, possibly forming an energy-related package and broadly focusing on water policy, said Adie Tomer, a fellow at the Brookings Institution.

Biden’s Build Back Better Plan calls for a $1.3 trillion infrastructure investment with a focus on net-zero greenhouse gas emissions, resiliency, electric vehicles, increase transit and broadband across the states.

“There is a huge amount of work to do, a lot of shared interest on both sides of the aisle, both chambers of Congress and the incoming administration,” Tomer said. “There is general alignment there.”

Some are not optimistic that an infrastructure bill will pass, noting the pandemic will remain the top priority.

Marc Scribner, senior transportation policy analyst at the right-leaning Reason Foundation, sees a status quo surface transportation reauthorization bill that would take the country through the next two to three years.

“Both sides are still in their partisan corners and I think until we see something from the new administration on what they want, not just sort of campaign aspirational language, but actual policy proposals and with a price tag, we’re not really going to go anywhere,” Scribner said.

More aid to transit might also be tricky since people may not want to ride public transit due to the pandemic and people increasingly working from home.

“I don’t know if there would be resolution on those items and if there isn’t, I’d suspect that you’re going to see a political compromise that looks like the status quo rather than anything transformative,” said Scribner.

The future of an infrastructure bill hinges on politics, others noted.

Marion Gee, president of the Government Finance Officers Association, wants to see a comprehensive infrastructure bill that includes roads, utilities and electric grid investment. Gee is also finance director at the Metropolitan St. Louis Sewer Water District.

Gee is hoping that early next year Congress will introduce an infrastructure bill.

“It depends on the politics, we’ve had four years now where we had a president that supported it, a Congress that supported it, but we just were not able to get anything done through the Senate,” Gee said.

Gee predicts Congress will extend the FAST Act and include infrastructure investment in an economic stimulus bill.

Gee is still hoping for an infrastructure bill, adding that now is the time with record low-interest rates to bring back muni provisions like tax-exempt advance refundings.

“Any types of tools available to us, that we can get additional support or a restoration of things that we lost,” Gee said. “I can’t think of a better time to do that than right now.”

Ports are all faring differently during the pandemic. Moody’s Investor Service revised its outlook for ports it rates to stable from negative in December, citing that cargo volumes are expected to grow over the next year.

“Strengthening economic activity and normalizing supply chain conditions in the US and globally will boost cargo volumes in the year ahead," said Moody's analyst Moses Kopmar in a report. "There are significant risks to the still nascent economic recovery, however, including the uncertain evolution of COVID-19 and the fragile financial health of the consumer and industrial sectors."

At the end of December, within a COVID relief bill, lawmakers

However for channel deepening, the cost-share is 75% federal and 25% non-federal, said Jim Walker, director of navigation policy and legislation of the American Association of Port Authorities. Bonding can be used for that 25%. The Army Corps gets the federal part of the money and accepts the nonfederal cost-share.

“In most instances, states have kept up and paid that share, in other cases they may have to issue bonds to generate that cost-share,” Walker said.

There was no direct aid for ports in the latest COVID-relief bill, but a provision in the National Defense Authorization Act would provide emergency grants to U.S. ports for the first time. The NDAA has not yet been signed by President Trump, but the bill has veto-proof majority from lawmakers.

“The Maritime Transportation Systems Emergency Relief Program was included in the NDAA,” said Evan Chapman, AAPA director of government relations. “So we’re hopeful that once this program is established, Congress will recognize the need to provide relief to our nation’s ports and consider doing so in any additional relief package.”

Chapman also emphasized that Biden seems to be an advocate for ports since he spoke at a AAPA event a few years ago.

The U.S. DOT will also have a new secretary if Pete Buttigieg is confirmed by the Senate.

“A deal is not just possible, it’s necessary,” Buttigieg told CNN in late December. “American’s shouldn’t settle for less that our peers around the developing world when it comes to the infrastructure resources.”