-

Municipal bond issuance in the region was down 11.7% year-over-year in 2021, as new money, refunding, taxable and tax-exempt volume all slipped.

February 25 -

The Volcker Alliance looks at the state’s outstanding municipal bonds and $83 billion in other obligations and suggests improved transparency and oversight.

February 11 -

Municipal yield curves were little changed for the seventh straight session while Refinitiv Lipper reported the 40th week of inflows into municipal bond mutual funds, with high-yield seeing a large increase week over week.

December 9 -

Month over month, the municipal market is in a much better position, as heavy demand and flows continue to drive it.

November 18 -

The Dormitory Authority of the State of New York overtook California for the most issuance, while New York issuers made up half of the top 10.

July 8 -

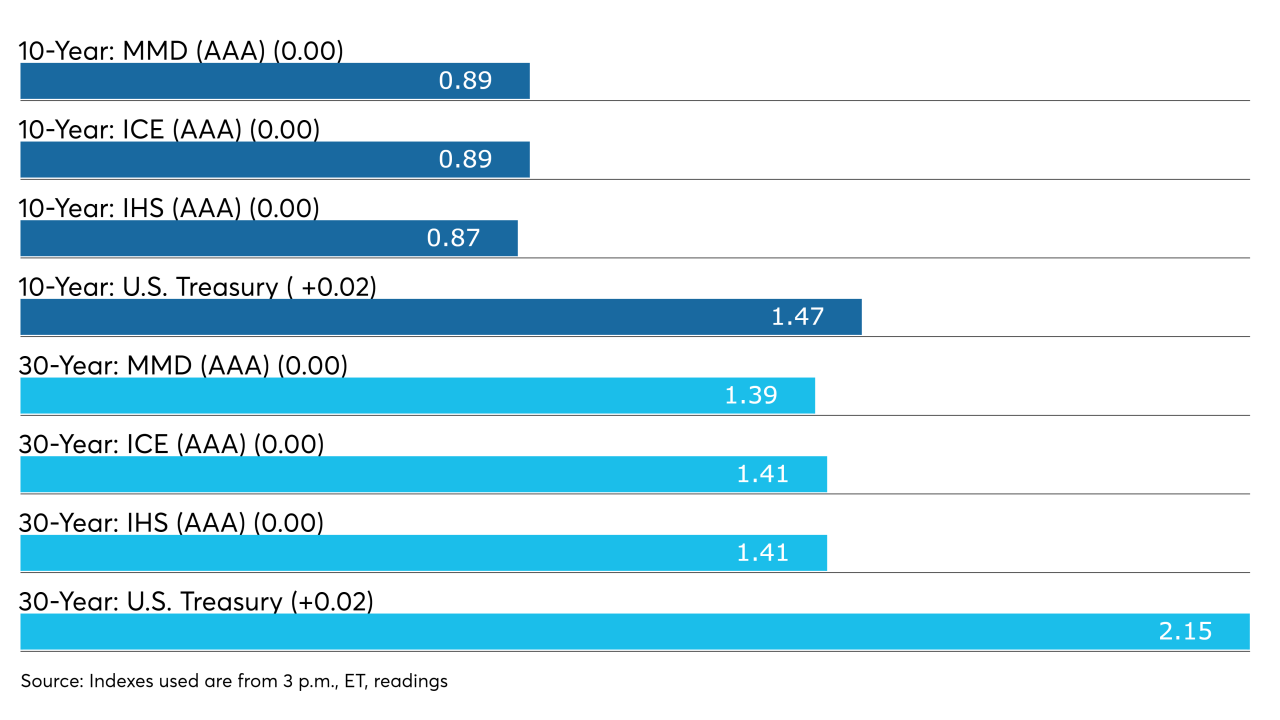

Yields on top-quality munis were flat on the AAA scales Friday; yields were seven to nine basis points lower on the week.

June 11 -

While the pressure was on municipal yields, which rose two to four basis points, the Investment Company Institute reported another week of inflows, with $928 million coming into municipal bond mutual funds and another $285 million into ETFs.

May 12 -

First quarter FDIC data show a $10.75 billion-plus jump in U.S. banks’ net purchases of municipal securities, the eighth biggest quarter since 2003, MMA says.

May 11 -

The municipal market was steady Monday as the investors gear up for three separate billion-dollar deals heading to market from California, New York, and Connecticut issuers.

April 19 -

Municipal bond issuers in the State of New York accounted for half of the top 10, while issuers from California held two of the top four spots.

April 9 -

A reversal of fund flows and the arrival of the economic aid for states and local governments helped boost the market's morale ahead of $10 billion in new-issues supply this week.

March 15 -

Municipals largely ignored the moves to higher yields in U.S. Treasuries as participants await the largest new-issue calendar of 2021 and big-name deals out of New York and Illinois.

March 12 -

Skeptics ask whether New York's governor is overplaying the Washington hand and how the state can improve its own lot.

January 20 -

The Puerto Rico Aqueduct and Sewer Authority said it might be refinancing its bond debt with a new bond issue by the end of the year.

October 8 -

Municipal bond issuers are coming market at a 26.2% faster pace than they were at this point last year.

October 8 -

The region's bond issuers sold $55.4 billion of municipal debt during the first half of 2020, a 21.1% increase from the same period in 2019.

August 21 -

Long-term munis strengthened as investors bank on recoveries and navigate an uncertain credit landscape.

July 14 -

State University of New York refinancing could offset lost revenues from expected declines in student housing revenue stemming from the COVID-19 pandemic.

July 13 -

Municipals finished little changed ahead of this week's almost $14 billion of new issues.

July 13 -

Despite the coronavirus wrecking havoc all over the world and with the brunt of the damage occurring in the second quarter of the year, municipal bond issuers have sold just over $23 billion more than they did at this time last year.

July 8