Issuer deal volume has risen 14.4% in the first half of 2021, bringing issuance totals higher than the prior year when COVID-19 skewed deal flow in the first half of 2020.

The top issuers have accounted for $219.57 billion in the first six months of 2021, compared to $191.87 billion at the same time last year.

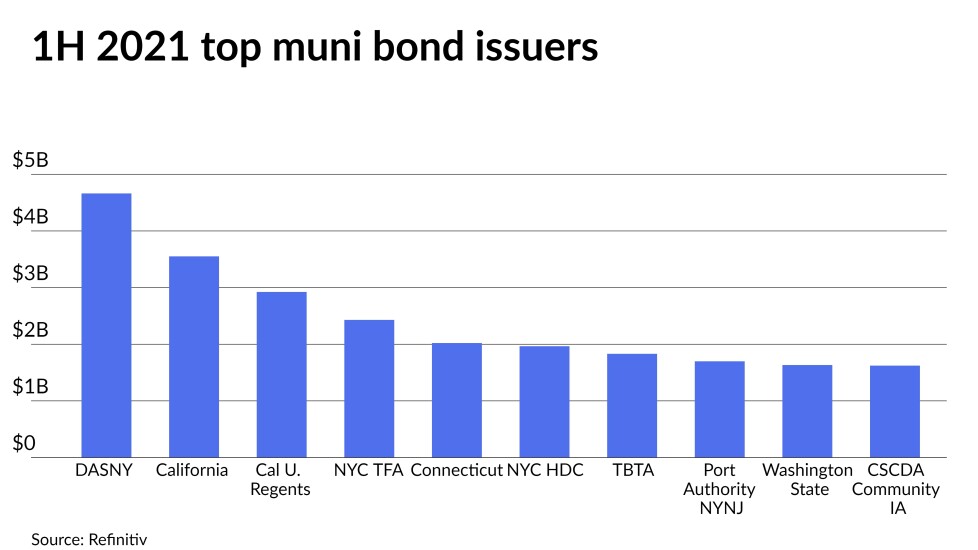

Issuers in the Empire State accounted for spots one, four, six, seven and eight and issuers from the Golden State landed in two of the top four spots.

There were seven new issuers that made it into the top 10 in the first half of 2021, two of which were not ranked at this time last year and four of which were outside the top 20.