Municipal bonds faced some pressure in secondary trading making for a weaker tone as investors ignored the risk-off trade and U.S. Treasuries rose while equities lost ground, but new issues provided a distraction to outside volatility and priced to strong demand.

Triple-A benchmark yields rose one basis point across the curve while municipal to UST ratios closed at 61% in 10 years and 66% in 30 years on Tuesday, according to Refinitiv MMD, while ICE Data Services had the 10-year at 60% and the 30 at 67%. The drop out longer shows municipal outperformance to UST there.

BofA Securities bought the day's two competitive loans from Florida and Oregon issuers while a San Antonio deal repriced to lower yields and Energy Northwest came with $700 million-plus revenue refunding exempt and taxables. The Dormitory Authority of the State of New York priced for retail various school district revenue credits, all with eight-year calls.

"Today was a mixed bag for munis, definitely some selling pressure out there, hence the one bp cuts to scales, but really it was an off day for markets overall," a New York trader said. "There is nothing fundamentally saying muni yields will or should rise."

In the primary, J.P. Morgan Securities LLC priced $610.9 million of revenue refunding bonds for Energy Northwest, Washington (Aa2/AA-/AA/). The first series, $69.9 million of Project 1 electric revenue refunding bonds, Series 2021-A, saw 5s of 2026 yield 0.53% and 4s of 2042 1.73% (callable 7/1/2031); the second, $524.3 million of Columbia Generating Station electric revenue and refunding bonds, Series 2021-A, saw 5s of 2022 at 0.10%, 5s of 2023 at 0.15%, 5s of 2040 at 1.51%, 5s of 2041 at 1.55% and 4s of 2042 at 1.73%; The last, $16.7 million of Project 3 electric revenue refunding bonds, saw 4s of 2042 at 1.73% (callable 7/1/2031).

J.P. Morgan Securities also priced $100 million of taxables for the issuer with bonds in 2025 at 0.897%, 2031 at 2.066%, and 2034 at 2.346%, all priced at par.

Raymond James & Associates Inc. priced for retail $335.9 million of school district revenue bond financing program refunding bonds Series 2021A, B & C for the Dormitory Authority of the State of New York, all tranches callable in 10/1/2029.

The first series, $276.8 million Series 2021A (A1//AA-/), serials 2023-2041, terms 2046, 2050 all insured by Assured Guaranty Municipal Corp., except for 4s of 2022 that yield 0.19%; the other maturities: 4s of 2023 at 0.21%, 5s of 2026 at 0.62%, 5s of 2031 at 1.29%, 4s of 2036 at 1.66%, 3s of 2041 at 2.11%, 3s of 2046 at 2.30%, 3s of 2050 at 2.34%.

The second, $47.2 million of Series 2021B (Aa3//AA-/), saw 4s of 2022 at 0.14%, 5s of 2026 at 0.62%, 5s of 2031 at 1.29%, 4s of 2036 at 2.30%, 3s of 2041 at 2.11%, 3s of 2046 at 2.30% and 3s of 2050 at 2.34%.

The last, $11.8 million of Series 2021C (A1//AA-), Assured Guaranty Municipal Corp. insured, saw 5s of 2022 at 0.24%, 5s of 2026 at 0.72%, and 4s of 2035 at 1.72%.

Morgan Stanley & Co. priced $272.3 million of unlimited tax school bonds for the San Antonio Independent School District, Texas (Aaa///) (Aa2 underlying) PSF insured. Bonds in 2022 with a 5% coupon yield 0.11%, 5s of 2027 at 0.68%, 5s of 2031 at 1.13%, 4s of 2036 at 1.36%, 3s of 2041 at 1.66%, 2.25s of 2046 at 2.24% and 2.375s of 2051 at 2.29%.

In the competitive market, Hillsborough County, Florida, (Aa1/AAA/AA+/)) sold $164 million of capital improvement non-ad valorem tax revenue bonds to BofA Securities. Bonds in 2022 with a 5% coupon yield 0.10%, 5s of 2026 at 0.56%, 5s of 2031 at 1.13%, 3s of 2036 at 1.56%, 2s of 2041 at 1.98%, 3s of 2046 at 2.00% and 2.25s of 2051 at 97.000.

Portland, Oregon, (/AA//)) sold $163 million of senior lien water system revenue and refunding bonds to BofA Securities. Bonds in 2022 with a 5% coupon yield 0.10%, 5s of 2026 at 0.50%, 5s of 2031 at 1.07%, 3s of 2036 at 1.56%, 2s of 2041 at 2.01% and 2.125s of 2046 at 2.15%.

Banks as muni buyers

First quarter FDIC data show another big jump of about $10.75 billion-plus in U.S. banks’ net purchases of municipal securities.

"Although that’s the lowest net addition in the last five quarters, it still ranks as the eighth-biggest quarter in at least the last 72 (i.e., since 1Q03)," Matt Fabian, partner at Municipal Market Analytics wrote in the weekly Outlook.

By contrast, banks’ direct lending activity remains stalled with just a $30 million increase in assets versus the fourth quarter of 2020, he noted.

"This is likely more a function of the rapacious demand from capital markets investors (who compete with banks to provide loans to state and local governments) than of banks’ showing undue concern for the asset class," Fabian wrote. "To the extent the regular municipal market backs up in any way, direct loan origination would likely rise in response. Total bank ownership of muni risks is now $584 billion (an all-time high), comprising $387B of securities (also a record) and $197 billion of direct loans."

Secondary trading and scales

Trading showed high-grades seeing some softness. Montgomery County, Maryland, 5s of 2023 traded at 0.16%-0.15%. Utah 5s of 2023 at 0.14%, the same as Monday. Massachusetts water 4s and 5s of 2025 at 0.36%. New York City water 5s of 2026 at 0.45%-0.44%. Washington 5s of 2025 at 0.36%. Wake County 5s of 2026 at 0.49%. Georgia 5s of 2027 at 0.62%. North Carolina 5s of 2027 at 0.61%. Georgia 5s of 2028 at 0.73%.

California 5s of 2029 at 0.95%. Fairfax County, Virginia, 4s of 2029 at 0.89%. NYC water 5s of 2030 at 0.96%. Ohio 5s of 2030 at 0.97%. California 5s of 2030 at 1.06% and 5s of 2030 at 1.02%. Wisconsin 5s of 2031 at 1.08%.

Maryland DOT 5s of 2034 at 1.16%. Washington 5s of 2042 at 1.53%. NYC TFA 4s of 2036 at 1.57%-1.55%.

Los Angeles DWP 5s of 2050 at 1.58%. Triborough Bridge and Tunnel Authority 5s of 2051 at 1.80%.

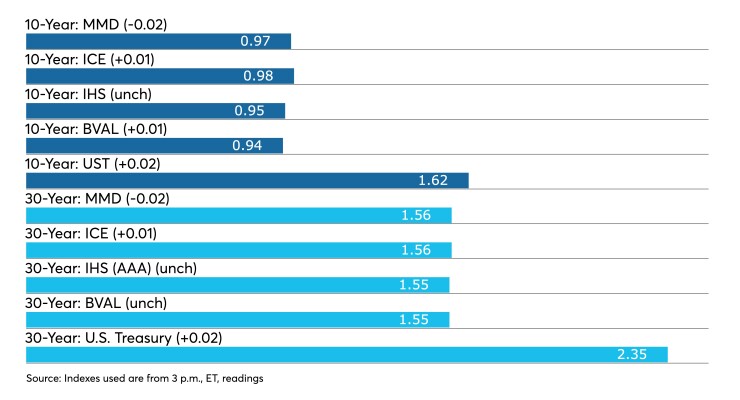

On Refinitiv MMD’s AAA benchmark scale, yields were steady at 0.09% in 2022 and 0.11% in 2023. The yield on the 10-year at 0.97% and the 30-year to 1.55%.

The ICE AAA municipal yield curve showed yields at 0.09% in 2022 and 0.13% in 2023, the 10-year at 0.97%, while the 30-year sat at 1.55%.

The IHS Markit municipal analytics AAA curve showed yields steady at 0.09% in 2022 and 0.12% in 2023, the 10-year at 0.96% and the 30-year at 1.56%.

The Bloomberg BVAL AAA curve showed yields steady at 0.05% in 2022 and 0.07% in 2023, with the 10-year at 0.93%, and the 30-year yield at 1.55%.

The three-month Treasury note was yielding 0.02%, the 10-year Treasury was yielding 1.60% and the 30-year Treasury was yielding 2.32% near the close. Equities were mixed with the Dow gaining 95 points, the S&P 500 falling 0.69% and the Nasdaq losing 2.20% near the close.

Need to avoid overstimulating economy

Instead of short-term stimulus, the economy would be better served with long-term infrastructure spending, according to one analyst.

“Monetary policy is one of the primary dampeners for the economy, and if we overstimulate, the Federal Reserve will have to increase interest rates to offset the excess stimulus,” said Colin Moore, global chief investment officer at Columbia Threadneedle. “Long-term infrastructure spending should be employed instead of short-term stimulus, not in addition to it.”

Like a swing set, “the economy has a natural range of activity and growth rate,” that needs to be balanced, he added. The goal of government efforts should be increasing economic output, which would create stability, Moore said, otherwise it will stimulate inflation.

The high rate of personal savings accumulated through the pandemic “has led to excess demand,” Moore said. “The resulting short-term imbalances should abate provided we don’t keep pushing additional stimulus.”

Infrastructure spending “could be an important contributor to sustaining employment growth as the economy rebounds,” said Steve Skancke, chief economic advisor at Keel Point, and “critical infrastructure is long-overdue.”

It would also boost economic growth over the long-term, rather than offering a “short-term surge” that came from COVID stimulus packages, he said.

President Biden’s $2.3 trillion infrastructure plan, “includes many items that traditionally are not considered infrastructure requiring,” Skancke said. And while the need for infrastructure improvements is agreed upon by all, he said, the question is “what is the most helpful infrastructure” and “what do we give up to” pay for it?

If corporate tax increases are used to pay for it, Skancke said, “company shareholders, retirement plans, small businesses and ultimately the labor force will be paying for the infrastructure spending.”

In economic data released Tuesday, small business optimism improved in April, but many respondents noted worker shortages, according to the National Federation of Independent Business.

The optimism index increased to 99.8 from 98.2 in March, while the uncertainty index dipped to 80 from 81 the previous month.

And while businesses reported hiring at a high level, a record 44% of respondents (up from 42% last month), said they had positions open but couldn’t find the right workers.

“Small business owners are seeing a growth in sales but are stunted by not having enough workers,” said Bill Dunkelberg, chief economist at NFIB. “Finding qualified employees remains the biggest challenge for small businesses and is slowing economic growth. Owners are raising compensation, offering bonuses and benefits to attract the right employees."

Bostic: Accommodative policy still needed

Fiscal policy is “right where it needs to be,” Federal Reserve Bank of Atlanta President Raphael Bostic said Tuesday.

While the nation is “firmly” on the road to recovery, there’s still “a long way to go,” he said, noting the disappointing employment report last week shows the unevenness of the recovery. “I feel it is appropriate for our policy to stay in accommodative mode, while we are still this far away in terms of job growth.”

“For now, Fed policy is going to hold steady,” agreed Federal Reserve Bank of Philadelphia President Patrick Harker in a separate speech Tuesday. “We’ll keep the federal funds rate very low and continue making more than $100 billion in monthly Treasury bond and mortgage-backed securities purchases,” he added.

Despite recent improvement, Harker said, the “recovery is still a work in progress, and there’s no reason to withdraw support yet.”

The stimulus and easy policy causes “some upside risk to increased inflation,” he said, but the Fed will watch it. Harker expects 2.3% inflation and 2% core inflation this year.

Also speaking Tuesday, Fed Gov. Lael Brainard sees a bright outlook, clouded by uncertainty. “Risks remain from vaccine hesitancy, deadlier variants, and a resurgence of cases in some foreign countries,” she said. Last week’s employment report “is a reminder that the path of reopening and recovery — like the shutdown — is likely to be uneven and difficult to predict, so basing monetary policy on outcomes rather than the outlook will serve us well.”

While predicting inflation is difficult, Brainard said, “there are a variety of reasons to expect an increase in inflation associated with reopening that is largely transitory.” The recent jump in energy prices “will fade over time, although recent pipeline disruptions add some uncertainty.”

The impact of bottlenecks on inflation “is much more difficult to predict,” the governor said. “There are compelling reasons to expect the well-entrenched inflation dynamics that prevailed for a quarter-century to reassert themselves next year as imbalances associated with reopening are resolved, work and consumption patterns settle into a post-pandemic ‘new normal,’ and some of the current tailwinds shift to headwinds.”

Bostic noted baseline effects and the supply-chain issues that suggest inflation pressures will be temporary. “If it seems like we are heading toward overheating, I would make the case to adjust policy,” he said, “but all that is way out ahead in the future. Right now, policy is exactly where it needs to be.”

Brainard and Bostic are voters this year, while Harker is not.

Primary to come

On Wednesday, New Mexico (Aa2/AA//) is set to sell $171.7 million of capital projects general obligation bonds at 10:30 a.m. eastern.

The Main Street Natural Gas, Inc. (Aa2//AA/) is on the day-to-day calendar with $747.1 million of gas supply revenue bonds, serials 2022-2028, a term in 2051, puts due 12/1/2028. RBC Capital Markets Inc. is lead underwriter.

Rady Children’s Hospital in San Diego (Aa3//AA/) is set to price $300 million of taxable corporate CUSIP Series 2021A bonds. J.P. Morgan Securities LLC is head underwriter.

Fairfax County, Virginia, (Aaa/AAA/AAA/) is set to price on Wednesday $232 million of sewer revenue bonds, Series 2021A and sewer revenue refunding bonds. Morgan Stanley & Co. LLC is head underwriter.

Johnson County, Kansas, (Aaa///) is set to price $157.7 million of Shawnee Mission Unified School District Number 512 general obligation refunding and improvement bonds. Stifel, Nicolaus & Company, Inc. is lead underwriter.

The Central Valley Water Reclamation Facility (/AA/AA/) is expected to price $150.4 million of sewer revenue green bonds on Wednesday. Stifel, Nicolaus is bookrunner.

The North Dakota Housing Finance Agency (Aa1///) is set to price on Wednesday $120 million of housing finance program home mortgage finance program bonds, serials 2022-2033, terms 2036, 2041, 2044, 2052. RBC Capital Markets is bookrunner.

Grand Forks, North Dakota, is set to price $118 million of Solid Waste Disposal Facility Revenue Bonds (Red River Biorefinery, LLC Project), Series 2021A (Green Bonds), Series 2021B refunding green bonds (Turbo Bonds). Jefferies LLC is head underwriter.

The Erie County, New York, Industrial Development Agency (Aa3/AA//) is set to price on Wednesday $110.1 million of school facility refunding revenue bonds (City School District of the City of Buffalo Project), Series 2021A school facility refunding revenue bonds and Series 2021B school facility refunding revenue bonds. Citigroup Global Markets Inc. will run the books.

The Fremont Union High School District, Santa Clara County, California, (Aaa/AAA//) is set to price on Wednesday $110 million of general obligation green bonds. Morgan Stanley & Co. LLC is head underwriter.

Fremont UHSD is also set to price on Wednesday $101.5 million of taxable general obligation refunding bonds. Morgan Stanley is set to run the books.

The Higher Education Student Assistance Authority, New Jersey, is set to price on Wednesday $108.56 million of student loan revenue and refunding bonds consisting of $11.48 million Series A-SEN (/AA//), serials 2023-2029; $84.08 million Series B-SEN, serials 2023-2029, term 2040 (/AA//) and $13 million Series C-SUB (/BBB//) serial 2051. RBC Capital Markets will run the books.

The Huntington Beach Union High School District, Orange County, California, (/AA-//) is set to price on Wednesday $104 million of taxable general obligation refunding bonds. Wells Fargo Securities is lead underwriter.

The Rhode Island Health and Educational Building Corp. (Aa3///) is set to price $100.7 million of public school revenue bond financing program revenue bonds, Series 2021 D (City of Providence Issue), serials 2024-2041. Raymond James & Associates, Inc. is head underwriter.

Grossmont-Cuyamaca Community College District, San Diego County, California, (Aa2/AA//) is set to price on Wednesday $100 million of general obligation bonds, Election of 2012, Series 2021, serials 2030-2041, terms 2046, 2050. Stifel, Nicolaus & Company, Inc. is bookrunner.