-

Daily bid-wanteds totals per Bloomberg have fallen to an average par value below $450 million from $640 million per day during the first quarter and $549 million in the second.

August 31 -

Returns of negative 0.40% would be the third-worst August performance of the past 10 years, according to Bloomberg data.

August 30 -

Experts agreed that Federal Reserve Board Chair Jerome Powell acknowledged the Fed could start tapering this year and that it would have no implications for liftoff, but not everyone was satisfied with what they heard.

August 27 -

With all eyes on Friday’s employment report, since several additional strong months of gains are needed for the Federal Reserve to be comfortable announcing a tapering of its asset purchases, Wednesday’s news could signal trouble.

August 4 -

Muni participants await a new month with growing issuance, but perhaps not quite enough as issuers are hesitant to add more debt before final word from Washington on infrastructure.

July 30 -

The Dormitory Authority of the State of New York overtook California for the most issuance, while New York issuers made up half of the top 10.

July 8 -

Municipal bond issuers in the State of New York accounted for half of the top 10, while issuers from California held two of the top four spots.

April 9 -

Both personal income and expenditures dropped in February, while personal consumption expenditures also came in weaker than expected, meaning inflation remains in check for now.

March 26 -

ICI reported another week of inflows at $2.23 billion. U.S. Treasuries strengthened further as COVID-19 concerns linger with shutdowns in Germany and spreads elsewhere. Equities were mixed.

March 24 -

Monday’s economic data suggested weakness, with existing home sales declining for the first time in four months and the Federal Reserve Bank of Chicago’s National Activity Index slipping into negative territory, but economists are not concerned.

March 22 -

A reversal of fund flows and the arrival of the economic aid for states and local governments helped boost the market's morale ahead of $10 billion in new-issues supply this week.

March 15 -

ICI reports a third week of $3-plus billion of inflows. Couponing is becoming as much a factor in inquiry as credit and issuers move to lower coupons in both competitive and negotiated deals.

February 3 -

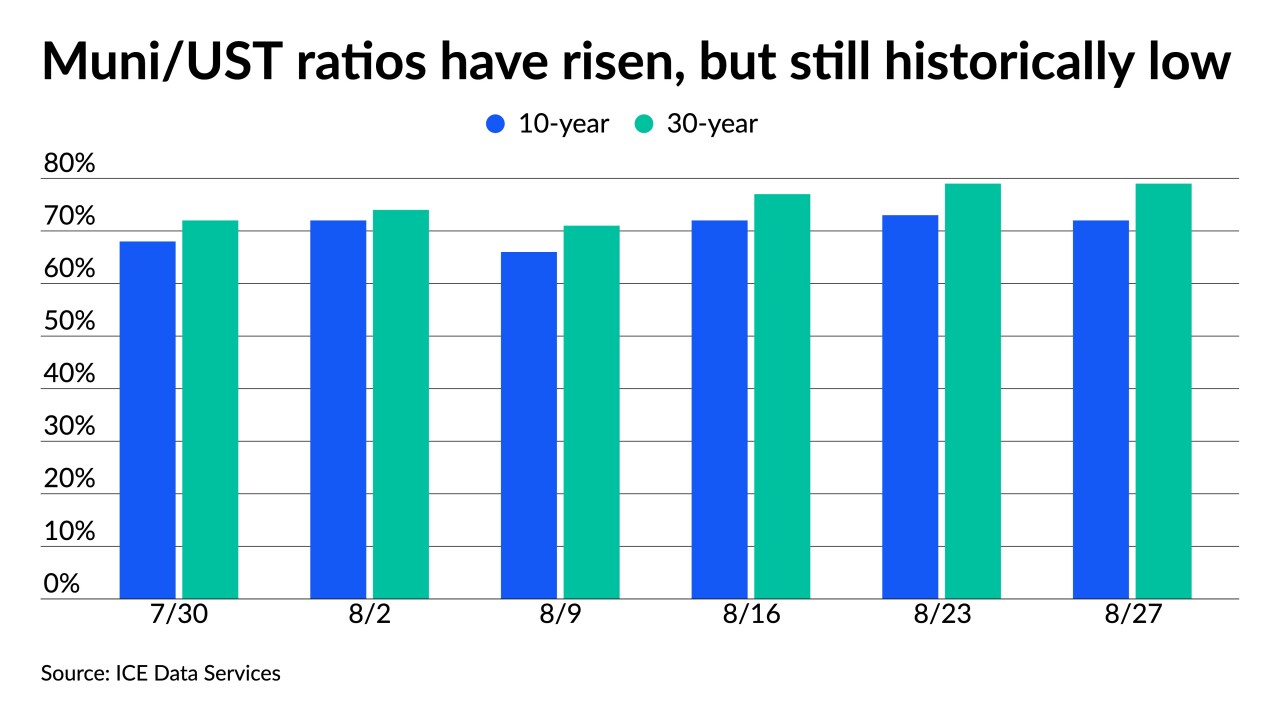

Rich ratios focus buyers' eyes on a primary market that simply doesn't have enough supply to keep up with demand.

February 2 -

It is most certainly an issuers' market as rates are low, credit spreads continue to tighten, money pours into municipal bond mutual funds at record levels and a net negative supply of more than $11 billion.

January 29 -

Returns of all the investment grade options "pale in comparison to those for municipal high-yield," which should bolster Texas gas and Chicago public schools deals.

January 25 -

Taxables march on while ICI reports billions of inflows and secondary trading shows long-end strength.

October 28 -

Municipal bonds were steady to stronger on Tuesday. Taxable issuance continues its record growth, putting overall issuance on pace to be the largest year on record.

October 27 -

Municipals were in a holding pattern ahead of this week's $15.8 billion new-issue slate as issuers pour debt into the market and investors remain cautious ahead of election results.

October 26 -

Municipals held firm Friday as the market gets set for another week of hefty supply. Citi anticipates $550 billion in 2021, led by surge in taxable issuance.

October 23 -

Municipals finished little changed Wednesday as a hefty slate of new deals came to market.

October 14