Municipal trading was quiet Friday and triple-A yield curves were little changed with strong technicals intact as the market has mostly outperformed a roving U.S. Treasury market.

"As Treasury yields have been moving up and down, muni yields have been quite sticky. Historically, tax-exempts outperform when USTs are selling off, but they underperform when Treasuries rally like they did this week," strategists at Barclays wrote in a Friday report. "In the current environment of supportive market technicals, when rates stabilize, demand for tax-exempts returns, pushing muni yields lower."

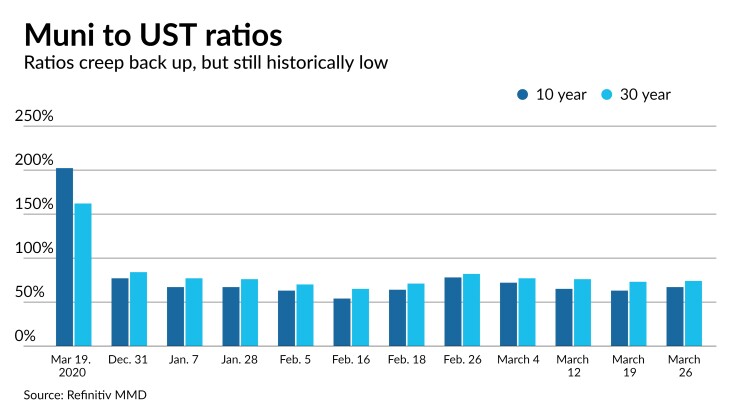

Municipal to UST ratios were at 67% in 10 years and 74% in 30 on Friday, according to Refinitiv MMD, while ICE Data Services showed ratios at 66% in 10 years and 75% in 30.

The report, authored by Mikhail Foux, Clare Pickering and Mayur Patel, cited supportive technicals for the asset class, including fund inflows, low dealer inventories and manageable supply, and pointed to the larger portion of taxables as a share of the total.

Funds are getting ready to deploy their cash when an attractive opportunity presents itself, according to Barclays.

"Hence, any municipal selloffs would likely be limited, in our view," they said. "We remain somewhat cautious as rate volatility might continue, but are not overly concerned about the asset class at the moment."

The primary drove a lot of the movements in trading in the secondary this week, a boon for issuers tapping the market.

The New York City Transitional Finance Authority’s $1.2 billion sale of future tax secured subordinate bonds achieved over $255 million in total debt service savings, with around $23 million and $232 million of debt service savings in fiscal 2021 and 2022, respectively, the TFA said on Thursday.

The deal saw refunding savings on a present value basis of nearly $247 million, or 17.1% of the refunded par amount.

The issue was made up of $1 billion of tax-exempt fixed-rate bonds priced by Ramirez & Co. and $228 million of taxable fixed-rates sold competitively.

During the exempt retail order period, TFA said it received $593 million of orders, of which $564 million was usable. The institutional order period saw about $2.1 billion of priority orders, representing 4.7 times the bonds offered for sale.

The TFA also competitively sold $228 million of taxables in two offerings. JPMorgan Securities won the $159 million of bonds due 2022 through 2026. The sale attracted 11 bidders. BNY Mellon Capital Markets won the $69 million of bonds due 2032 through 2036. The sale attracted 13 bidders.

The total potential volume for next week, shortened by the Good Friday holiday, is estimated at $3.3 billion, down from total sales of $8.5 billion this week. There are $2.391 billion of municipal bond sales scheduled for negotiated sale next week versus a revised $6.812 billion that were sold this week. Bonds scheduled for competitive sale next week total $936.7 million compared with $1.730 billion this week.

The supply/demand imbalance is certainly keeping rates lower and part of the reason for muni outperformance, analysts and traders said.

Data says inflation not an issue, yet

Inflation is “not yet rearing its ugly head,” analysts said, based on income and spending data released Friday.

Both personal income and expenditures dropped in February, while personal consumption expenditures also came in weaker than expected, meaning inflation remains in check for now.

Personal income plummeted 7.1% in February after a 10.1% jump a month earlier, the Commerce Department reported. Personal spending fell 1.0% in the month after a 3.4% rise in January.

Economists predicted income would drop 7.3% and spending would fall 0.7%.

But numbers can be deceiving since the stimulus checks issued to many Americans in early January “heavily distorted” that month’s income gains, according to Scott Ruesterholz, portfolio manager at Insight Investment.

“Employee compensation actually rose modestly in the month, pointing to continued labor market improvement,” he said. “Personal income will likely rise substantially again in March as $1,400 checks are paid, and then normalize from there.”

The decline in personal spending follows the path set by February retail sales, which also fell, Ruesterholz said, and comes on the heels of a strong January when consumers spent some of the stimulus money.

“Going forward, accelerating labor market improvement as the economy reopens will be critical to generate sustained spending and income growth,” he said.

The PCE price index climbed 0.2% in February following a 0.3% gain the month prior, while core PCE, which excludes food and energy grew 0.1% in the latest month after a 0.2% increase in January.

PCE price index year-over-year is up 1.6% this month, after a 1.4% gain last month, while core PCE climbed 1.4% in February, compared to 1.5% the previous month.

Economists estimated that core PCE year-over-year would climb 1.5%, while month-over-month, would tick up 0.1%.

While the report will be discounted as it comes “between massive stimulus bills,” Edward Moya, senior market analyst at OANDA, said the PCE deflator, the “Fed’s favorite inflation indicator,” was still important. “Treasury yields declined after a slightly softer-than-expected PCE deflator reading suggested inflation is not yet starting to rear its ugly head.”

Ruesterholz agreed, saying the report confirms price pressures remain “well under control.”

“Over the next few months, base effects will push inflation higher, though improvement in shelter and medical inflation will likely prove necessary to sustain an inflation overshoot,” he said.

The University of Michigan’s final consumer sentiment index for March climbed to 84.9 from 76.8 in February.

Economists polled by IFR markets anticipated an 83.5 read.

The current conditions index increased to 93.0 from 86.2 the prior month, while expectations climbed to 79.7 from 70.7.

Year-over-year, sentiment is down 4.7%, conditions 10.3% lower and expectations are flat.

“The rise in consumer sentiment to the highest level since the pandemic began coincides with faster vaccination, reopening announcements, and stimulus checks,” Ruesterholz said. “Continued recovery in the jobs market should continue to lift consumers’ spirits and willingness to spend down the $1.8 trillion in excess savings they have accumulated since COVID began.”

Friday’s data supports the view the economy is recovering. “It also gives us confidence that this recovery will accelerate meaningfully over the next quarter,” he said, “as the economy reopens and consumers spend more forcefully after a year of pent-up demand for travel and recreation activity.”

Secondary market

High-grade municipals were unchanged across the curve on Refinitiv MMD's scale. Short yields were at 0.09% in 2022 and 0.12% in 2023. The 10-year steady at 1.11% and the 30-year at 1.76%.

The ICE AAA municipal yield curve showed short maturities at 0.10% in 2022 and 0.15% in 2023. The 10-year at 1.08% and the 30-year yield steady at 1.75%.

The IHS Markit municipal analytics AAA curve showed yields at 0.08% in 2022 and 0.13% in 2023, the 10-year at 1.04%, and the 30-year at 1.71%.

The Bloomberg BVAL AAA curve showed yields at 0.08% in 2022 and 0.12% in 2023, while the 10-year at 1.06%, and the 30-year yield at 1.75%.

The 10-year Treasury was at 1.67% and the 30-year Treasury was yielding 2.37% near the close, while the Dow gained 198 points, the S&P 500 rose 0.70% and the Nasdaq lost 0.16%.

Primary market

The Golden State Tobacco Securitization Corporation is set to price $995.6 million of taxable enhanced tobacco settlement asset-backed bonds, Series 2021A, serials: 2021-2022, 2029-2035; term: 2038. Jefferies LLC will run the books.

The Washington State Convention Center is set to price $345 million of nonrated green junior lodging tax notes on Tuesday. J.P. Morgan Securities LLC is lead underwriter.

The Cleveland-Cuyahoga County Port Authority is set to price $279.9 million of taxable VA Cleveland Health Care Center Project federal lease revenue bonds on Tuesday, serials 2021, term, 2031. Huntington Securities, Inc. is head underwriter.

The Pennsylvania Turnpike Commission (A1/A+/A+/AA-) is set to price $250 million of turnpike revenue bonds on Tuesday, serials 2022-2041; terms 2046, 2051. PNC Capital Markets LLC is bookrunner.

The Successor Agency to the La Quinta Redevelopment Agency is set to price $158.9 million of tax allocation taxable refunding bonds, serials 2021-2034. HilltopSecurities is head underwriter.

The Board of Trustees of the University of Arkansas (Aa2///) is set to price $138.9 million of UAMS Campus various facilities taxable and tax-exempt revenue bonds on Wednesday. $96.61 million exempt, $42.38 taxable. BofA Securities is bookrunner.

The Ontario International Airport Authority, California, (/AA/A-/) is set to price $115 million of airport revenue bonds, Non-AMT, AMT and taxable on Wednesday. Insured By: Assured Guaranty Municipal Corp. Morgan Stanley & Co. LLC is lead underwriter.

The Kentucky Asset/Liability Commission (A1///) is set to price on Wednesday $114.6 million of general fund refunding project notes, 2021 Series A. Morgan Stanley & Co. LLC is head underwriter.

The CSCDA Community Improvement Authority, nonrated, is set to price $112.5 million of essential housing revenue bonds (Moda at Monrovia Station social bonds). Citigroup Global Markets Inc. will run the books.

The Advocate Health and Hospitals Corporation (Aa3/AA/AA/) is set to price on Wednesday $100 million of taxable corporate CUSIP bonds (Advocate Aurora Health Credit Group) Reopening of 2049 CUSIP 007589AC8. Citigroup Global Markets Inc. is lead underwriter.

The issuer is also set to price $100 million of taxable corporate CUSIP bonds (Advocate Aurora Health Credit Group) Reopening of 2028 CUSIP 007589AA2. Citi will run the books.

The Texas Department of Housing and Community Affairs (Aaa/AA+//) is set to price $100 million of residential mortgage revenue bonds, serials 2022-2033; term: 2036, 2041, 2051 and 2052. Jefferies LLC is lead underwriter.

In the competitive markets, Palm Springs USD, California is set to sell $118 million of general obligation bonds at noon eastern on Tuesday.

Oklahoma City is set to sell $116 million of tax-exempt GOs at 9:30 a.m. eastern and $30 million of taxable GOs at 10 on Tuesday.