-

Rich ratios focus buyers' eyes on a primary market that simply doesn't have enough supply to keep up with demand.

February 2 -

It is most certainly an issuers' market as rates are low, credit spreads continue to tighten, money pours into municipal bond mutual funds at record levels and a net negative supply of more than $11 billion.

January 29 -

Returns of all the investment grade options "pale in comparison to those for municipal high-yield," which should bolster Texas gas and Chicago public schools deals.

January 25 -

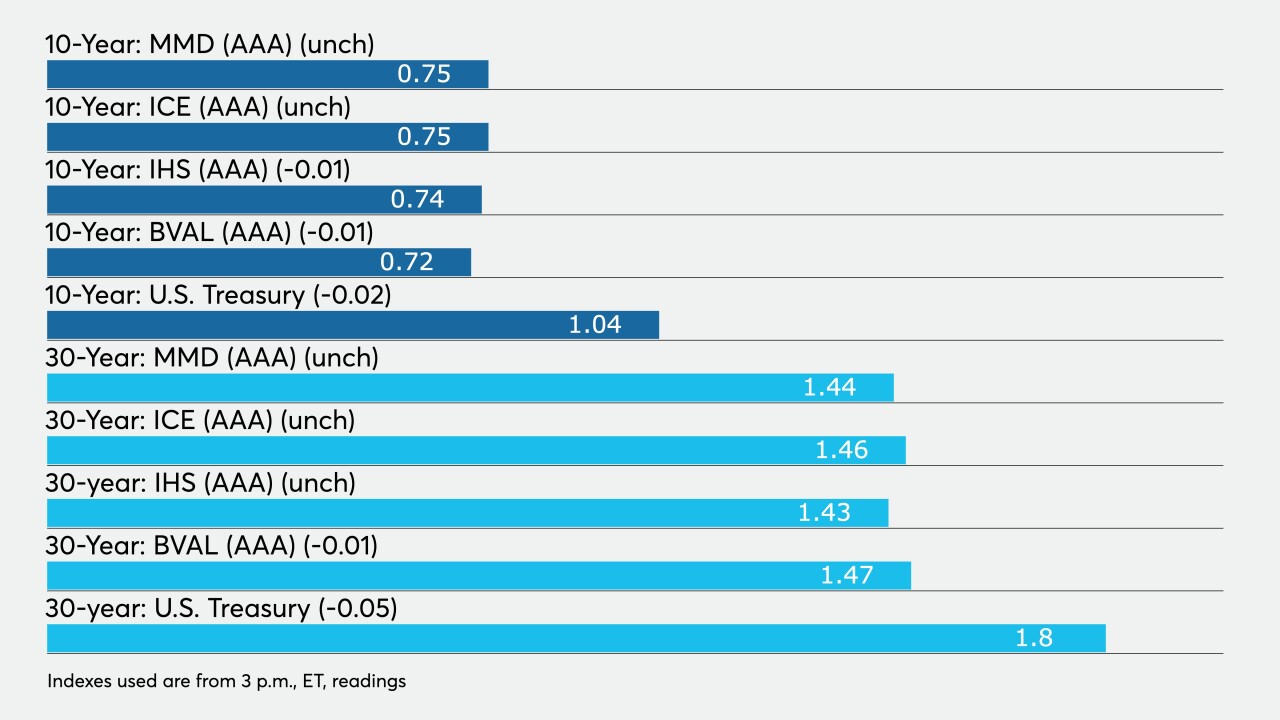

Taxables march on while ICI reports billions of inflows and secondary trading shows long-end strength.

October 28 -

Municipal bonds were steady to stronger on Tuesday. Taxable issuance continues its record growth, putting overall issuance on pace to be the largest year on record.

October 27 -

Municipals were in a holding pattern ahead of this week's $15.8 billion new-issue slate as issuers pour debt into the market and investors remain cautious ahead of election results.

October 26 -

Municipals held firm Friday as the market gets set for another week of hefty supply. Citi anticipates $550 billion in 2021, led by surge in taxable issuance.

October 23 -

Municipals finished little changed Wednesday as a hefty slate of new deals came to market.

October 14 -

Municipals were mostly unchanged with a firm tone on Tuesday, according to market participants, ahead of the week's large new-issue calendar that's heavy on taxables.

October 13 -

Municipal bond issuers are coming market at a 26.2% faster pace than they were at this point last year.

October 8