-

The housing market continues to lead all sectors in recovery, althoough a manufacturing and two services surveys also showed signs of recovery.

September 22 -

Consumer confidence sputtered even as new home sales surged, highlighting an uneven economic recovery.

August 25 -

As the coronavirus infections rise in parts of the nation, the economy is suffering.

July 28 -

Data released on Tuesday suggest the economy remains weakened by the impact of the coronavirus.

June 23 -

The coronvirus pandemic led to economic declines and contacts are unsure how quick recovery will be.

May 27 -

The coronavirus pandemic could do lasting harm to U.S. productivity unless the nation adapts to the realities of living with COVID-19, says Federal Reserve Bank of Richmond President Thomas Barkin.

May 4 -

Pessimism about the economic situation in the United States continues to affect the way consumers view the economy and their financial position.

April 28 -

The Conference Board reported Tuesday that its consumer confidence index improved rose to 130.7 in February.

February 25 -

Consumers remain confident, as the consumer confidence index rose to 131.6 in January from an upwardly revised 128.2 in December, the Conference Board reported Tuesday.

January 28 -

While members of the Federal Open Market Committee believe monetary policy is in a good place, several factors have the power to change that.

January 3 -

Manufacturing activity contracted again in December, according to the Federal Reserve Bank of Richmond’s survey.

December 24 -

Federal Reserve Board Gov. Lael Brainard presented her alternative to quantitative asset purchases.

November 26 -

Federal Reserve Bank of Richmond President Tom Barkin notes the bond market is signaling pessimism and asks whether rates negate that message.

November 5 -

The U.S. economy is sending mixed signals about the pace of growth going forward, said Neel Kashkari, president of the Federal Reserve Bank of Minneapolis.

October 22 -

Three Federal Reserve Bank presidents said they would cautiously consider supporting a rate cut.

August 29 -

Despite trade issues, consumer confidence slipped only slightly in August, as “consumers have remained confident and willing to spend.”

August 27 -

Existing home sales and the Federal Reserve Bank of Richmond’s manufacturing index support a 25 basis point Fed rate cut next week.

July 23 -

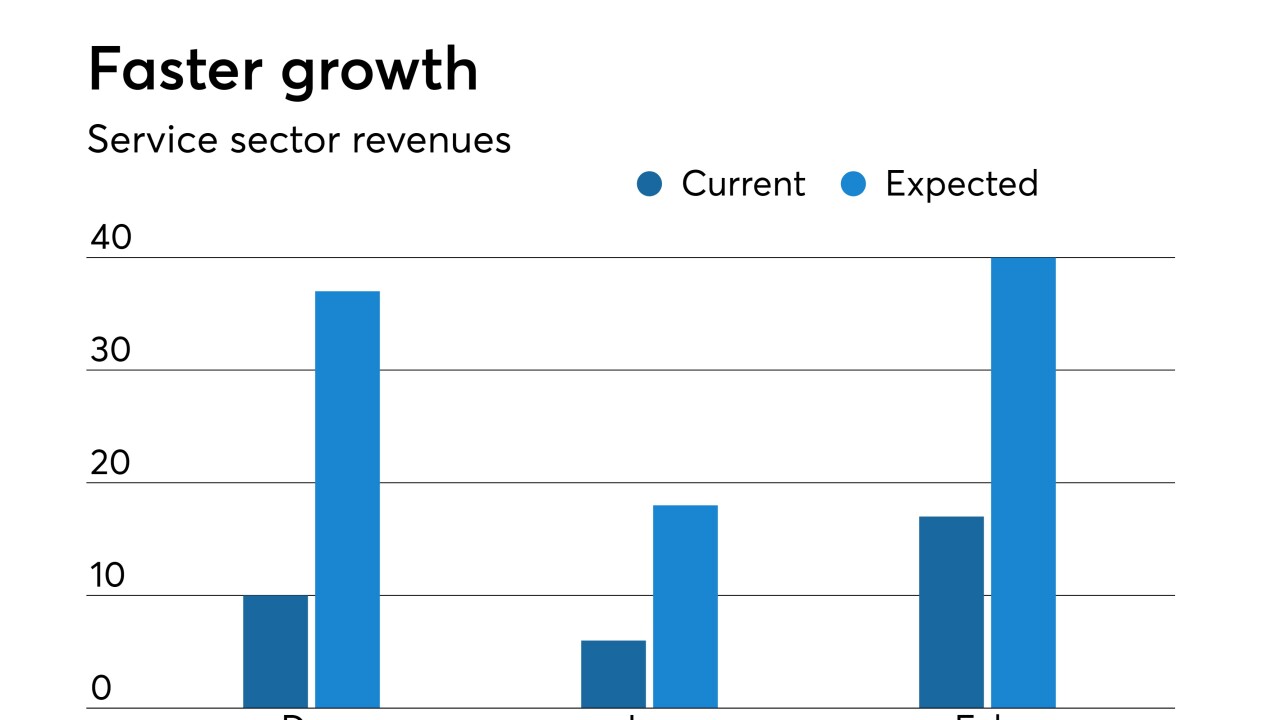

Manufacturing growth in the central Atlantic region was weaker than in March, while “service sector activity was robust in April.”

April 23 -

Manufacturing and services growth in the central Atlantic region in March was weaker than in February.

March 26 -

The service sector improved in February, according to the Federal Reserve Bank of Richmond service-sector activity survey, released Tuesday.

February 26