Three Federal Reserve Bank presidents said they would cautiously consider supporting a rate cut, while the latest read of gross domestic product for the second quarter showed the economy growing at a 2.0% rate.

Federal Reserve Bank of Richmond President Thomas Barkin told reporters after a speech that he hasn’t decided whether a rate cut is needed, while Federal Reserve Bank of San Francisco President Mary Daly said she would “watch and see.”

Federal Reserve Bank of Dallas President Robert Kaplan suggested a rate cut might be needed if the Fed is forward-looking.

None of the three are voting members of the Federal Open Market Committee this year.

Barkin said a rate cut may be needed if inflation is low or the expansion is in jeopardy. “I am not persuaded on the inflation part,” he said, according to reports. The growth picture is not as clear, he said, as consumers continue to spend while business investment and manufacturing struggle.

Barkin told reporters he won’t decide until the meeting.

Daly cited headwinds and told reporters, “It’s better to avoid the ditch than dig yourself out of the ditch,” according to reports.

Kaplan said he is concerned manufacturing weakness will eventually work its way into the labor market, which will cut consumer spending. “If we wait for that to happen, we’ve waited too long,” he said in an interview with American Public Media’s Marketplace. “So I’m on heightened alert to see whether this weakness continues and intensifies.”

GDP

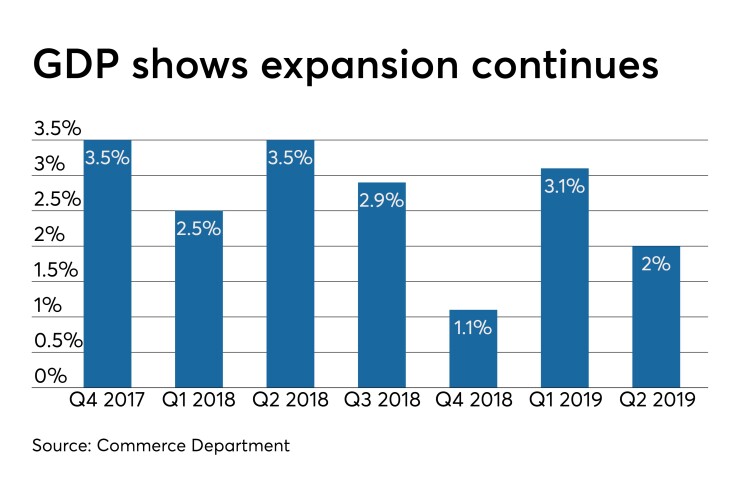

In the second read, growth in gross domestic product was revised to 2.0% from the 2.1% reported in the first read, the Commerce Department reported. First-quarter growth was 3.1%.

Growth in consumer spending was offset “by negative contributions from private inventory investment, exports, residential fixed investment, and nonresidential fixed investment,” Commerce said.

Economists polled by IFR Markets expected 2.0% growth.

The trade war with China has spurred businesses to delay investments, while consumers, buoyed by record employment levels, have kept the expansion going. Personal consumption expenditures, which is the largest part of economic activity, grew 4.7% in the quarter, the fastest pace since the last quarter of 2014. In the prior estimate, this growth was at a 4.3% annual rate.

Initial jobless claims

Initial jobless claims rose to 215,000 on a seasonally adjusted basis in the week ended Aug. 24, from 211,000 the prior week, the Labor Department said Thursday.

Continuing claims rose to 1.698 million in the week ended Aug. 17 from 1.676 million the week before.

Pending home sales

Pending home sales dropped 2.5% in July, after rising in May and June, the National Association of Realtors reported Thursday.

Year-over-year sales declined 0.3%.

“Super-low mortgage rates” have been offset by “economic uncertainty” and lack of supply in a moderate price range, according to Lawrence Yun, NAR chief economist.

Sales fell in all four regions, led by a 3.4% decline in the West. Sales fell 1.6% in the Northeast, 2.5% in the Midwest and 2.4% in the South.