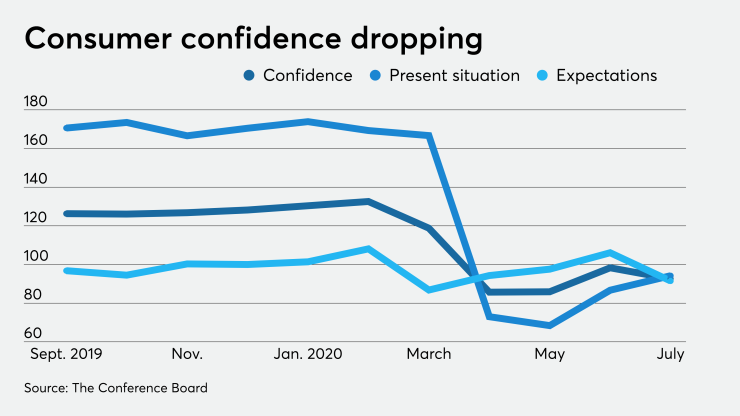

The handful of economic indicators released on Tuesday suggest the U.S. economy has slipped as the number of COVID-19 cases rises and reopening slows or reverses.

The Conference Board's consumer confidence index dropped to 92.6 in July from 98.3 in June. The present situation index rose to 94.2 from 86.7, while the expectations index fell to 91.5 from 106.1.

Economists polled by IFR Markets projected a 94.5 level for the main index.

“Large declines were experienced in Michigan, Florida, Texas and California, no doubt a result of the resurgence of COVID-19,” said Lynn Franco, senior director of economic indicators at The Conference Board. “Looking ahead, consumers have grown less optimistic about the short-term outlook for the economy and labor market and remain subdued about their financial prospects. Such uncertainty about the short-term future does not bode well for the recovery, nor for consumer spending.”

The drop in confidence is "a troubling sign," said Roiana Reid, U.S. economist at Berenberg Capital Markets. It reversed “almost half of its 12.6 point increase between April and June,” she noted. “The reversal in confidence three months into the recovery reflects the spikes in incidence of COVID-19 across many states since late June, which have led to a flattening of economic and labor market activity.”

Richmond Fed surveys

Manufacturing in the Federal Reserve Bank of Richmond district “showed signs of recovery” this month.

The manufacturing index rose to 10 in July from zero in June, the shipments index soared to positive 23 from negative 4, while the volume of new orders index gained to 9 from 7. The backlog of orders index grew to positive 5 from negative 14. The number of employees index narrowed to negative 3 from negative 6 and the wages index increased to positive 12 from negative 1.

Service sector activity in the district “remained tepid” in the month, according to the Richmond Fed.

The revenue index narrowed to negative 14 from negative 27, the demand index climbed to negative 5 from negative 14 and the local business conditions index jumped to positive 2 from negative 24.

The number of employees index widened to negative 10 from negative 7, while the wages index reversed to negative 2 from positive 2.

Dallas Fed services survey

Texas service sector activity “contracted in July after showing moderate growth in June,” according to the Federal Reserve Bank of Dallas.

The current general business conditions index dropped to negative 26.7 from positive 2.1, while at the company level, the index fell to negative 15.8 from positive 2.2.

The revenue index declined to negative 8.5 from positive 5.7. The employment index fell to negative 6.8 form negative 1.9.

Looking ahead six months, both the general business activity index and the company index dropped, to negative 9.2 and negative 3.1, respectively, after June’s readings of positive 6.8 and positive 6.2.

S&P/Case-Shiller

Home prices rose 4.5% year-over-year in May, slightly lower than the 4.6% gain in April, according to S&P CoreLogic Case-Shiller.

Year-over-year, the 10-city composite grew 3.1%, down from the 3.3% rise a month earlier, while the 20-city composite rose 3.7% increase, off from the 3.9% increase a month ago.

Economists estimated prices would gain 4.0% year-over-year.

The national index gained 0.7% in May, compared to April, while the 10-city composite rose 0.3% and the 20-city composite climbed 0.4%.

Economists predicted a 0.3% rise month-over-month.