Pessimism about the economic situation in the United States continues to affect the way consumers view the economy and their financial position.

And the latest surveys of the manufacturing and service sectors from the Federal Reserve Bank of Dallas and the Federal Reserve Bank of Richmond show the effects of COVID-19 is having on those regional economies.

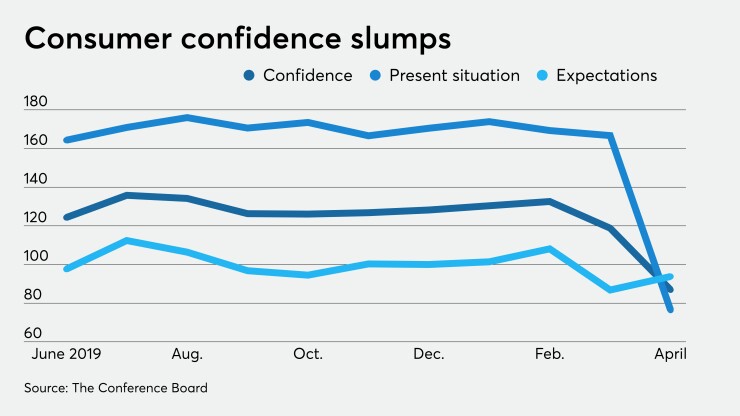

The consumer confidence index fell to 86.9 in April from 118.8 in March, The Conference Board reported on Tuesday. Economists surveyed by IFR Markets had expected the index to fall to 88.0 this month.

The present situation index plunged to 76.4 in April from 166.7, its largest drop on record. This index is based on consumers’ current assessment of business and labor market conditions.

However, the expectations index, which is based on consumers’ short-term outlook, rose to 93.8 in April from 86.8 last month.

“Consumer confidence weakened significantly in April, driven by a severe deterioration in current conditions,” said Lynn Franco, senior director of economic indicators at The Conference Board. “The 90-point drop in the present situation index, the largest on record, reflects the sharp contraction in economic activity and surge in unemployment claims brought about by the COVID-19 crisis.”

Those expecting more jobs in the months ahead rose to 41.0% from 16.9% while those anticipating fewer jobs increased to 29.8% from 17.6%.

In the short-term, the percentage of consumers expecting an increase in their income fell to 16.7% from 20.0% while those expecting a decrease rose to 18.5% from 10.1%.

“Consumers’ short-term expectations for the economy and labor market improved, likely prompted by the possibility that stay-at-home restrictions will loosen soon, along with a re-opening of the economy,” Franco said. “However, consumers were less optimistic about their financial prospects and this could have repercussions for spending as the recovery takes hold. The uncertainty of the economic effects of COVID-19 will likely cause expectations to fluctuate in the months ahead.”

The indexes use 1985 as a baseline. The survey was conducted by Nielsen, with a cutoff date of April 17.

In Texas, the Dallas Fed said the service sector continued to see a dramatic contraction in April amid the coronavirus pandemic and mitigation measures.

The revenue index, a key measure of state service sector conditions, moved up to negative 65.4 in April, off the all-time low of negative 67.0 in March, the Dallas Fed said.

Steep declines were seen in employment and there were further shortenings of employees' workweek, according to business executives responding to the survey.

The employment index fell to negative 35.2 from negative 23.8, the lowest reading on record. The hours worked index dropped more than five points to negative 48.2, with over half of the survey respondents seeing cuts in employee hours.

In Virginia, the Richmond Fed said service providers reported a significant softening of activity in April.

The revenues index dropped to negative 87 this month, the lowest reading recorded and largest one-month drop on record, from positive 1 in March.

The Richmond Fed said the indexes for demand, local business conditions and capital spending all fell, with the demand and local business conditions indexes reaching record lows. Firms expected conditions to remain soft in the near future.

Survey results showed drops in employment, wages and the average workweek in April, as all three indexes fell to the lowest readings in the history of the survey.

Looking at Virginia’s manufacturing sector, the Richmond Fed said activity there also declined sharply in April.

The composite index plummeted to negative 53 from positive 2 in March. The April number was the index's lowest reading and largest one-month drop on record. All three index components — shipments, new orders, and employment — fell and the indexes for shipments and new orders reached record lows.

Firms reported weakened local business conditions and expected conditions to remain soft in the next six months.

Survey results also reflected a deterioration in employment conditions in April. More contacts reported drops in employment and average work week, although the wage index remained flat. Manufacturers said they expected these conditions to persist.

In pre-COVID-19 data, home prices in major cities rose a seasonally adjusted 0.45% in February, according to the S&P Case-Shiller 20-city home price index.

“This was above the consensus forecast of 0.35% and up from the upwardly revised 0.35% gain in January,” said Scott Anderson, chief U.S. economist at Bank of the West. “Prices increased in all 20 cities in February led by Minneapolis (+1.27%), Tampa (+0.97%) and Cleveland (+0.88%).”

Before the pandemic, the housing market appeared to be on solid footing.

“The Case-Shiller Indexes for February showed strong enthusiasm in the housing market prior to the COVID-19 pandemic. Home buyers, particularly millennials, were encouraged by falling mortgage rates and a strong employment market,” said Selma Hepp, CoreLogic’s deputy chief economist. “But, developing insights into COVID-19 impacts on the U.S. economy put some uncertainty around housing markets.”

The market is expected to weaken considerably as updated data comes in.

“Home sales are expected to weaken over the near term on lower demand stemming from surging unemployment. We expect national home prices will also start to decline by the end of the year. The 20-city Case-Shiller home price index is forecast to drop 4.0% by the end of 2020,” Anderson said.