-

Regional Plan Association has renewed its proposal to establish a 24-mile, above-ground rail line to serve Brooklyn, Queens and the Bronx.

November 11 -

New York City raised its target for contracts with Minority and Women-Owned Business Enterprises by $5 billion by fiscal year 2025.

November 7 -

New York City voters take the first step to include a formal rainy day fund in the budget process.

November 6 -

The city and its Transitional Finance Authority issued $6.18 billion of long-term bonds, according to the comprehensive annual financial report.

November 1 -

New York City voters will decide a proposal to change the City Charter and establish a formal rainy-day account in the budget.

October 31 -

Municipal Market Analytics warned that climate change may pose the biggest threat to municipal bond credits over the next decade.

October 30 -

Andrew Rein president of the watchdog Citizens Budget Commission, tells The Bond Buyer's Paul Burton why New York City voters on Nov. 5 should vote yes on ballot Question 4, which calls for a dedicated rainy-day fund. The state must also approve the change.

October 30 -

Wall Street had its most profitable first half in a decade; the second half remains uncertain.

October 25 -

Andy Byford, president of the Metropolitan Transportation Authority's transit division, wrote a letter of resignation before rescinding it.

October 21 -

The policy would require firms to consider women and people of color for every open board seat and for CEO appointments.

October 15 -

Massive borrowing for essential projects in the face of a projected deficit spike is a dilemma as its $51.5 billion capital program undergoes scrutiny.

October 10 -

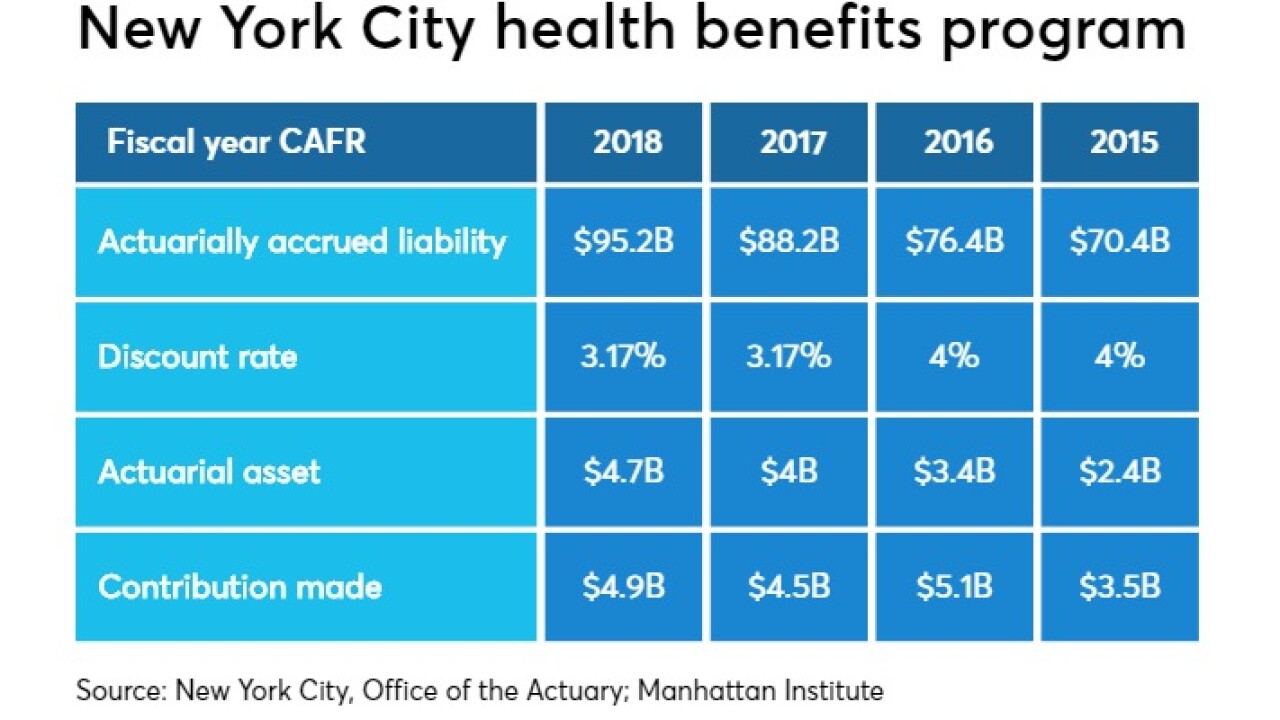

Variables related to other post-employment benefit liabilities jeopardize core services in the tri-state area, said the Manhattan Institute.

October 8 -

Through three quarters municipal bond issuers are coming to market more frequently than they did during the same period of 2018, as low rates and yields are too good to pass up and demand for muni bonds is closing in on an all-time high.

October 7 -

The Big Apple was a big presence in the market on Thursday as it sold almost $1 billion of taxable and tax-exempt general obligation bonds.

October 3 -

Municipal bonds were on the move Wednesday as two big issuers came to market with over $1 billion of transportation bonds.

October 2 -

Muni yields were mixed as weak economic data pressured Treasuries and stock prices.

October 1 -

William Glasgall, Senior Vice President and Director of State and Local Initiatives at the Volcker Alliance, sits down with Chip Barnett and Lynne Funk to talk about why states should bolster their rainy day funds.

October 1 -

Another big week is in store for investors with a $1B NYC deal waiting in the wings.

September 30 -

New issuance is up by about $21B over 2018, but still lags previous years.

September 30 -

Mismanagement of real-property related taxes may be shortchanging an MTA revenue stream, said city Comptroller Scott Stringer.

September 30