The Big Apple was a big presence in the municipal bond market on Thursday as it sold nearly $1 billion of taxable and tax-exempt bonds.

Primary market

Jefferies priced and repriced New York City’s (Aa1/AA/AA) $850 million of tax-exempt general obligations for institutions after a two-day retail order period. The tax-exempts were repriced to yield from 1.19% with 3% and 5% coupons in 2021 to 2.70% with a 3% coupon and 2.39% with a 4% coupon in a split 2044 maturity.

There was strong investor demand for the bonds throughout the pricing process.

"During a two-day retail order period for the tax-exempt bonds, the city received $234 million of orders from individual investors, of which approximately $176 million was usable. During the institutional order period, the city received approximately $3.4 billion of priority orders, representing 5.0 times the bonds offered for sale to institutional investors," the city said in a press release.

"Given strong investor demand during the institutional order period, yields were reduced for all maturities. Yields were reduced by two basis points for maturities in 2021 through 2030, by five to eight basis points for maturities in 2031 through 2040 and by two to six basis points for maturities in 2041 through 2044," the city said.

The city also sold $130 million of taxable Fiscal 2020 Series B, Subseries B-2 GOs. JPMorgan Securities won the bonds with a true interest cost of 2.1398%.

The financial advisors were Public Resources Advisory Group and Acacia Financial Group. The bond counsel were Norton Rose and Bryant Rabbino. Proceeds will be used for capital projects.

The Spartanburg County School District No. 7, S.C., (A1&Aa3/AA&AA-/NR) sold $130 million of Series 2019D GOs. The bonds are insured by the South Carolina School District Credit Enhancement program.

Jefferies won the bonds with a TIC of 3.2425%. Compass Municipal Advisors was the financial advisor; Burr Forman McNair was the bond counsel. Proceeds will be used to retire at maturity the Series 2018 GO bond anticipation notes and for voter-approved projects.

Goldman Sachs priced

JPMorgan Securities priced the Spring Branch Independent School District, Harris County, Texas (PSF:Aaa/AAA/NR) $226.24 million of Series 2019 unlimited tax schoolhouse bonds. JPMorgan priced the Dallas County Hospital District, Texas; (Aa2/AA-/NR) $190.205 million of Series 2019 limited tax refunding bonds. JPMorgan also priced the Nebraska Investment Finance Authority’s (NR/AA+/NR) $171.815 million of single-family housing revenue bonds

Wells Fargo Securities priced the Southern California Public Power Authority’s (NR/AA-/AA) $111.94 million of Refunding Revenue Bonds, Series 2019-1 for the Milford Wind Corridor Phase I Project.

RBC Capital Markets received the written award on the New Mexico Mortgage Finance Authority’s (Aaa/NR/NR) $120 million of tax-exempt Series 2019F single-family mortgage program Class I bonds not subject to the alternative minimum tax.

BofA Securities priced the Community Development Administration, Maryland Department of Housing and Community Development’s (Aa2/NR/AA) $350 million deal consisting of $322.51 million of Series 2019 non-AMT residential revenue bonds and $27.49 million of taxable Series 2019D residential revenue bonds.

“Supply has been picking up as this year progresses. We estimate that final 2019 new issue supply will approach $390 billion, which is a 15% increase over a very slow 2018 pace,” Janney said in a Thursday market comment. “The Bloomberg 30-day visible supply of $17.5 billion includes $2.7 billion New York State Thruway Authority (A1/A/NR), but does not consider the $1.1 billion California GO (Aa3/AA-/AA) sale listed on the state Treasurer’s website. Both issues are scheduled to price the week of Oct. 14.”

Wednesday’s bond sales

Secondary market

More weak data on Thursday pressured stocks and caused Treasury yields to keep on dropping. The September ISM Non-Manufacturing Index fell to its lowest reading since August 2016.

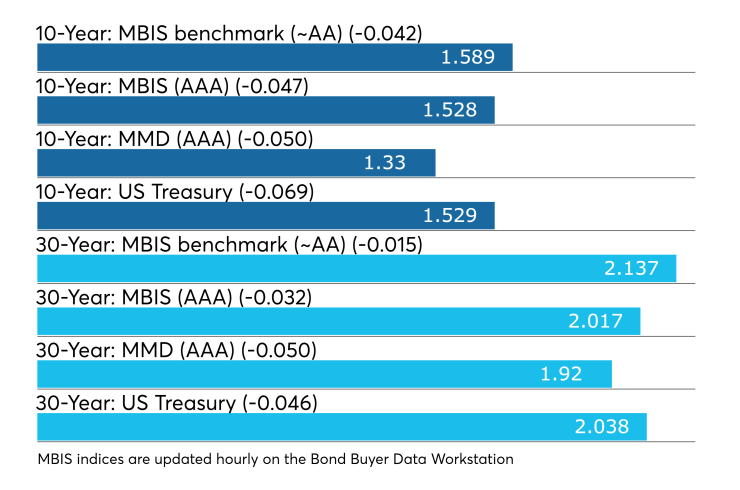

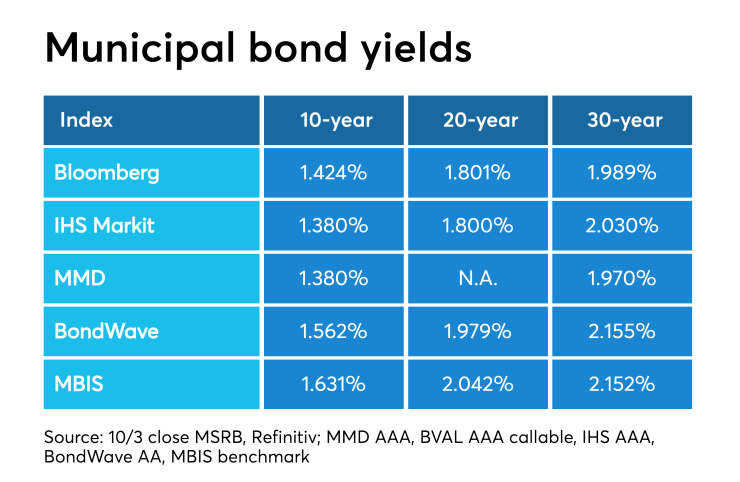

Munis were stronger on the MBIS benchmark scale, with yields falling by four basis points in the 10-year maturity and by one basis point in the 30-year maturity. High-grades were also better, with yields on MBIS AAA scale falling by four basis points in the 10-year maturity and by three basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and 30-year GOs dropped five basis point to 1.33% and 1.92%, respectively.

"The ICE muni yield curve inversion extends out to the seven-year maturities. The curve itself is three to four basis points lower," ICE Data Services said in a market comment. "The 10-year Muni/Treasury ratio is at 0.86, close to the high of 2019 of 0.87, set on Jan. 2. High-yield is two basis points lower along with the tobacco sector. Taxables are five to 10 basis points lower."

The 10-year muni-to-Treasury ratio was calculated at 86.8% while the 30-year muni-to-Treasury ratio stood at 94.2%, according to MMD.

The Treasury three-month was yielding 1.711%, the two-year was yielding 1.380%, the five-year was yielding 1.342%, the 10-year was yielding 1.529% and the 30-year was yielding 2.038%.

Previous session's activity

The MSRB reported 36,277 trades Wednesday on volume of $12.910 billion. The 30-day average trade summary showed on a par amount basis of $11.20 million that customers bought $6.07 million, customers sold $3.24 million and interdealer trades totaled $1.89 million.

California, Texas and New York were most traded, with the Golden State taking 12.705% of the market, the Lone Star State taking 11.485% and the Empire State taking 9.926%.

The most actively traded security was the Palm Beach County Health Facilities Authority, Fla., Series 2019 4s of 2049, which traded 24 times on volume of $32.60 million.

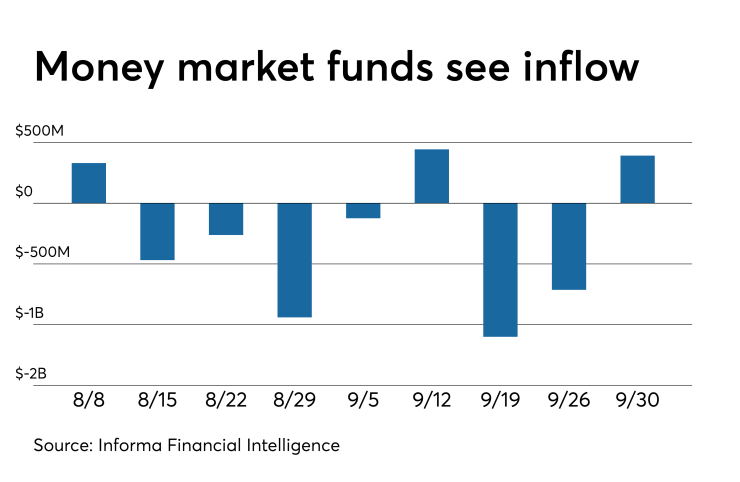

Muni money market funds see inflow

Tax-exempt municipal money market fund assets rose $391.8 million, raising its total net assets to $133.65 billion in the week ended Sept. 30, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 191 tax-free and municipal money-market funds increased to 1.12% from 1.02% from the previous week.

Taxable money-fund assets increased $22.82 billion in the week ended Oct. 1, bringing total net assets to $3.277 trillion. The average, seven-day simple yield for the 807 taxable reporting funds fell to 1.62% from 1.69% in the prior week.

Overall, the combined total net assets of the 998 reporting money funds increased $23.21 billion to $3.411 trillion in the week ended Oct. 1.

Treasury auctions announced

The Treasury Department announced these auctions:

- $16 billion 29-year 10-month 2 1/4% bonds selling on Oct. 10;

- $24 billion 9-year 10-month 1 5/8% notes selling on Oct. 9;

- $38 billion three-year notes selling on Oct. 8;

- $28 billion 364-day bills selling on Oct. 8;

- $42 billion 182-day bills selling on Oct. 7; and

- $45 billion 91-day bills selling on Oct. 7.

Treasury auctions bills

The Treasury Department Thursday auctioned $45 billion of four-week bills at a 1.750% high yield, a price of 99.863889. The coupon equivalent was 1.782%. The bid-to-cover ratio was 2.90.

Tenders at the high rate were allotted 18.49%. The median rate was 1.700%. The low rate was 1.650%.

Treasury also auctioned $40 billion of eight-week bills at a 1.710% high yield, a price of 99.734000. The coupon equivalent was 1.743%. The bid-to-cover ratio was 2.86.

Tenders at the high rate were allotted 98.20%. The median rate was 1.670%. The low rate was 1.620%.

Bond Buyer yield indexes decline further

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, dipped to to 3.58% for the week ended Oct.3 from 3.59% in the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields fell four basis points to 2.62% from 2.66% from the week before. The 11-bond GO Index of higher-grade 11-year GOs also dropped four basis points, to 2.16% from 2.20% the prior week. The Bond Buyer's Revenue Bond Index declined four basis points to 3.10% from 3.14% last week.

The yield on the U.S. Treasury's 10-year note dropped to 1.54% from 1.71% the week before, while the yield on the 30-year Treasury decreased to 2.04% from 2.15%.

Gary E. Siegel ad Aaron Weitzman contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.