Municipal bonds were on the move Wednesday as two big issuers came to market with over $1 billion in transportation bonds.

Primary market

Citigroup priced the Massachusetts Department of Transportation’s $694.535 million of Metropolitan Highway System revenue bonds.

The deals consisted of $495.05 million (A2/A+/A+) of Series 2019A senior revenue refunding bonds and $199.485 million (Aa2/AA/AA+) of Series 2019C subordinated revenue refunding bonds that are Commonwealth Contract Assistance secured. The agency will use the proceeds from the larger sale to refund the outstanding senior series 2010B bonds that mature after Jan. 1, 2020 and to pay a portion of the costs of issuing the 2019 bonds. It projects $127.2 million of savings, or 21.4% of refunded senior par on a net present value basis.

MassDOT, which also operates the Massachusetts Bay Transportation Authority — Greater Boston’s mass transit system — enacted its five-year, $18.3 billion capital program in June. It includes investments in system reliability, asset modernization and capacity expansion. The metropolitan highway system’s portion of the plan amounts to $816.5 million.

A major initiative is the projected $1.1 billion Allston Multimodal Project, to reconfigure the Massachusetts Turnpike — Interstate 90 — where an overhead viaduct swerves through the city’s Allston neighborhood west of downtown along the Charles River, where Harvard and Boston University line each side.

It stands to be the biggest highway undertaking in Boston since the controversial Big Dig, whose costs soared to roughly $24.3 billion from the originally estimated $2.6 billion.

Omnicap Group LLC is the financial advisor for the sales and Locke Lord LLP is bond counsel.

Massachusetts’ system has $893 million and $833 million of senior and subordinated bonds, respectively. Its capital structure is relatively level through 2029 and begins to decline thereafter until full amortization in 2039, officials said on an investor presentation.

State lawmakers intend to debate Gov. Charlie Baker’s $18 billion transportation bond bill, which includes a nearly $5.7 billion upkeep for the MBTA and support a variety of anti-congestion measures including a $2,000-per-employee tax credit, capped at $50 million, to encourage telecommuting and remote working.

In the competitive arena, the Maryland Department of Transportation (Aa1/AAA/AA+) sold $490 million of Series 2019 consolidated transportation bonds. BofA Securities won the deal with a true interest cost of 2.0926%.

PFM Financial Advisors and People First Financial Advisors were the financial advisors. Kutak Rock was the bond counsel. Proceeds will be used to for capital funds for the consolidated transportation program.

Clark County, Nevada, (Aa1/AA+/NR) sold $200 million of bonds in two deals.

JPMorgan Securities won the $130.71 million of Series 2019C Las Vegas Convention and Visitors Authority convention center expansion limited tax GOs additionally secured with pledged revenues with a TIC of 2.4868%. Raymond James & Associates won the $69.29 million of taxable Series 2019D Las Vegas Convention and Visitors Authority convention center expansion limited tax GOs additionally secured with pledged revenues with a TIC of 3.2346%.

Hobbs, Ong & Associates, PFM Financial Advisors and JNA Consulting Group were the financial advisors. Sherman & Howard was the bond counsel. Proceeds will be used to finance some of the costs of work on the Las Vegas Convention Center.

Richmond, Va., (Aa2/AA+/AA+) sold $132.885 million of Series 2019A GO public improvement and refunding bonds. Morgan Stanley won the bonds with a TIC of 2.2199%.

Davenport & Co. was the financial advisor; Orrick Herrington and Lewis Munday Harrell were the bond counsel. Proceeds will be used to reimburse the city for school and general capital improvement projects and to refund certain outstanding debt.

Jefferies held a second day of retail orders on New York City’s (Aa1/AA/AA) $850 million of tax-exempt general obligation bonds. The deal will be priced for institutions on Thursday, the same day it competitively sells $130 million of taxable GOs.

The tax-exempts were priced to yield from 1.23% with 3% and 5% coupons in 2021 (one basis point over the comparable MMD) to 2.75% with a 3% coupon (80 basis points over the comparable MMD) and 2.45% with a 4% coupon (50 basis points over the comparable MMD) in a split 2044 maturity.

BofA priced the Alachua County Health Facilities Authority’s (A3/A/NR) $325.15 million of health facilities revenue bonds for the Shands Teaching Hospital and Clinics Inc. at the University of Florida.

JPMorgan Securities priced Harris County, Texas’ (Aaa/NR/AAA) $155.695 million of Series 2019A Flood Control District contract tax refunding bonds, unlimited tax road refunding bonds and permanent improvement refunding bonds

Barclays Capital priced the

RBC Capital Markets priced Denton County, Texas’ (Aaa/AAA/NR) $127.695 million of Series 2019A permanent improvement and refunding bonds.

Goldman Sachs received the written award on

Wednesday’s bond sales

Citi sees $440B muni issuance in 2020

“We expect about $440 billion in gross municipal issuance in 2020,” said Vikram Rai, head of Citi's Municipal Strategy group. “At present, we seem to be on track to meet our gross issuance forecast of $385 billion for 2019. Thus, gross issuance should be up by about 14% vs. 2019 (assuming that actual issuance is the same as our forecast)."

Citi said that even though it’s a preliminary estimate which is subject to change, they expect refundings to be a large portion of the gross issuance in 2020, with the net issuance number likely to be unimpressive — only around +$5billion to +$10 billion.

“And, we expect taxable municipals to account for a larger share of overall issuance in 2020,” he said.

Secondary market

Weak data again pressured markets Wednesday as private sector job growth moderated in September, according the ADP employment report.

On Tuesday, the ISM Manufacturing Index for September fell to its lowest level since 2009. And the reading on construction spending in August came in much lower than expected.

“Businesses are becoming more cautious in their hiring because of the U.S.-China trade dispute, fragile global economy and U.S. manufacturing slowdown,” the Bank of the West said in a research note. “Despite the below-consensus ADP jobs report today, we are forecasting a gain of 145,000 non-farm payrolls when the BLS report is released on Friday.”

Stocks fell on renewed recession concerns as Treasuries strengthen in a flight-to-quality bid.

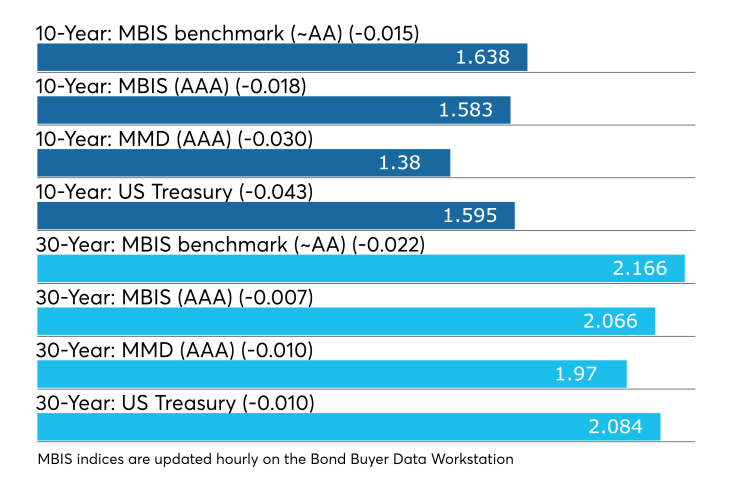

Munis were stronger on the MBIS benchmark scale, with yields falling by one basis point in the 10-year maturity and by two basis points in the 30-year maturity. High-grades were also better, with yields on MBIS AAA scale falling by one basis point in the 10-year maturity and by less than a basis point in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and 30-year GOs dropped three basis point to 1.38% and 1.97%, respectively.

“The ICE muni yield curve is down one to three basis points on appreciable volume as the Treasury curve steepens,” ICE Data Services said in a market comment. “Tobaccos are flat to one basis point lower. High-yield is one basis point lower and taxables are down as much as six basis points.”

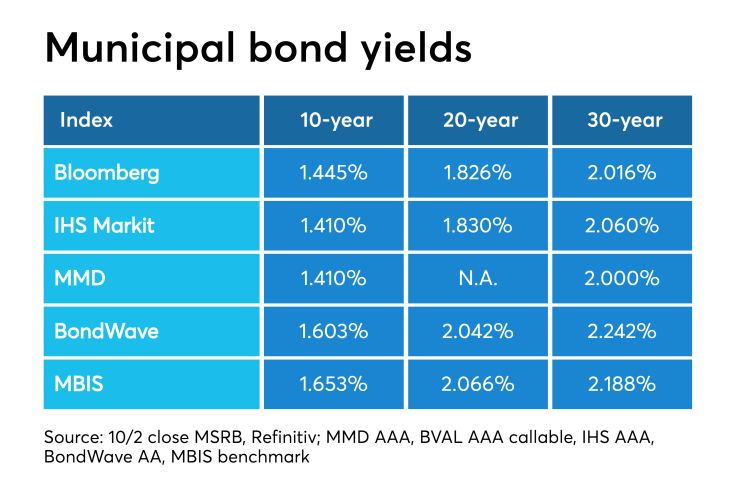

The 10-year muni-to-Treasury ratio was calculated at 86.8% while the 30-year muni-to-Treasury ratio stood at 94.7%, according to MMD.

The Treasury three-month was yielding 1.782%, the two-year was yielding 1.484%, the five-year was yielding 1.430%, the 10-year was yielding 1.595% and the 30-year was yielding 2.084%.

Previous session's activity

The MSRB reported 33,214 trades Tuesday on volume of $11.659 billion. The 30-day average trade summary showed on a par amount basis of $11.08 million that customers bought $5.96 million, customers sold $3.24 million and interdealer trades totaled $1.88 million.

California, Texas and New York were most traded, with the Golden State taking 14.604% of the market, the Lone Star State taking 11.025% and the Empire State taking 9.962%.

The most actively traded security was the New Jersey Transportation Trust Fund Series 2019BB 4s of 2044, which traded 18 times on volume of $45.42 million.

ICI: Muni funds see $382M inflow

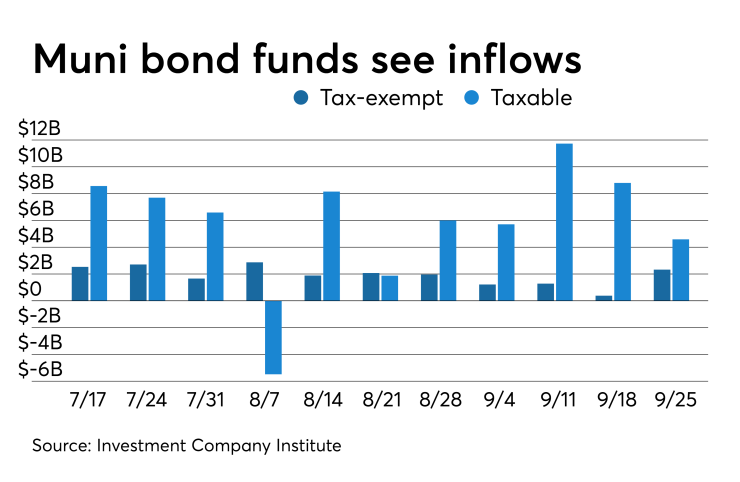

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $2.327 million in the week ended Sept. 25, the Investment Company Institute reported on Wednesday.

It was the 39th straight week of inflows into the tax-exempt mutual funds and followed a revised inflow of $387 million in the previous week.

Long-term muni funds alone saw an inflow of $1.674 billion after an inflow of $424 million in the previous week; ETF muni funds alone saw an inflow of $652 million after a revised outflow of $37 million in the prior week.

Taxable bond funds saw combined inflows of $4.587 billion in the latest reporting week after revised inflows of $8.906 billion in the previous week.

ICI said the total combined estimated outflows from all long-term mutual funds and ETFs were $8.428 billion after revised inflows of $18.747 billion in the prior week. Equity funds were the biggest losers of the week with $15.779 billion of outflows.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.