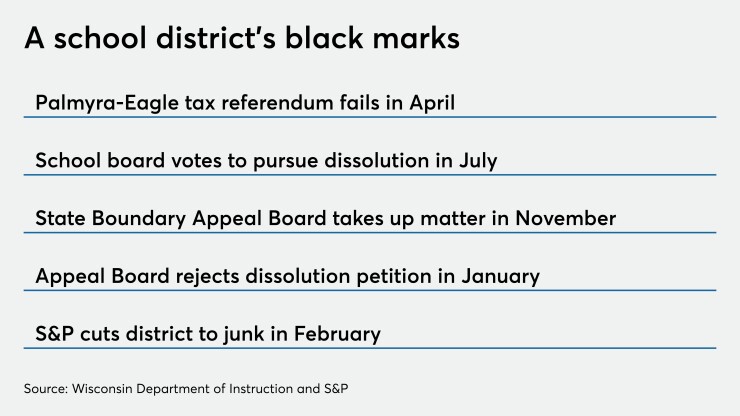

A Wisconsin school district lost its investment grade rating as concerns mount over its precarious fiscal condition in the aftermath of a failed bid to dissolve.

S&P Global Ratings this week cut the Palmyra-Eagle Area School District’s rating by two notches to BB-plus from BBB and placed the rating on CreditWatch with negative implications as the district’s ability to honor debt service weakens.

The district has about $13 million of bonds outstanding.

"The lowered rating is a result of the district not being granted dissolution authority and rapidly deteriorating financial health, with reserves that are expected to be negative by the end of fiscal 2021," said S&P analyst Andrew Truckenmiller.

The district has long warned it will exhaust operating cash by the end of fiscal 2021. It is eyeing measures that include layoffs and school closures but after years of cutting costs more reductions are difficult. Palmyra could appeal the decision or pursue a new referendum but voters have rejected recent requests, including one last April.

District administrator Steven Bloom said the board is currently considering the closure of an elementary school and sale of the building to make ends meet in the coming year and could act at a board meeting later this month.

The district also has “every intention to meet its obligations relative to debt service.” The district’s next payment is due in March for $1.2 million.

Leadership turmoil is also contributing to the board’s credit woes.

Three board members resigned after a state board voted to deny the district’s dissolution request last month. A fourth one later resigned. Three of the seven board seats are also up for election this spring and two members are not seeking reelection.

Bloom said three of the vacancies have been filled by appointment and the fourth will seated soon. Bloom acknowledged the district’s fiscal strains will persist absent new revenue.

“At this point what the board is looking to do is to create an operational budget” where expenses and operations are aligned, “then the challenge is sustainability,” he said.

“We believe there is unstable board governance given that there are currently vacant seats. As a result, we believe the district is unable to make timely decisions regarding its fiscal health unless it takes other measures such as appointing a temporary board,” S&P wrote. “In our view, its changing circumstances are more likely to lead to a weakened capacity to make debt service payments.”

S&P said another factor weighing on the district’s credit profile is “uncertainty regarding bankruptcy laws as it relates to Wisconsin school districts.” The district serves a population of 7,700 in southeastern Wisconsin, about 40 miles from Milwaukee.

S&P said it expects the rating will remain watch for at least six months as the picture may not become clearer until the new fiscal year as budgets are not required to be adopted until September. S&P rated the district AA-minus before the district began considering dissolution.

The district’s board last year took the rare step of petitioning the state to allow it to dissolve after voters rejected an April referendum to raise its operating rate levy. District officials had said the $11.5 million that would have been raised over four years was needed to stay afloat after steep enrollment declines cut its operating revenue.

After a series of public hearings and input from stakeholders, including districts that would be asked to acquire the district’s assets and liabilities, the School District Boundary Appeal Board set up under the Wisconsin Department of Public Instruction denied the request on Jan. 9.

The district has warned that general fund reserves are projected to decline to 7.2% in fiscal 2020 from 20.1% in fiscal 2019 and it faces a $2 million negative fund balance by the end of 2020-2021 school year.

The district does not have near-term capital borrowing needs but it does rely on cash-flow borrowing in anticipation of tax revenue, which could be impacted by the downgrade, Bloom said. The district works with a local bank that is a longtime “partner” and so the district’s hope is that the fiscal impact would be limited.

The district's enrollment dropped by 400 students over five years to about 800. District operating revenues are determined by a three-year rolling enrollment average, so the quick drop led to a growing structural budget imbalance. The district attributes the enrollment drop to the state’s open enrollment policies that allow students within the district boundaries to turn elsewhere.

The members of the state board who voted against the petition cited worries that it would open the door to other such requests and noted concerns among the districts that would absorb Palmyra that it could strain their finances. The last district in Wisconsin to be dissolved was Ondossagon in 1990.

Moody’s Investors Service, which rates neighboring districts but not Palmyra, said it did not believe the fiscal impact would have a material negative impact for the districts that would absorb Palmyra but it did call the vote a credit negative for district bondholders.

Moody’s said dissolution would have posed challenges for other districts but they could be managed. Palmyra's debt of $12.7 million and 770 students is small compared to the combined $265 million debt and 22,500 students of seven neighboring districts. Moody’s rates six of the seven and two are at Aa3 and four are at the Aa2 level.

Analysts also believe the vote highlights a statewide problem. “The SDBAB denial of dissolution highlights the lack of structured state oversight for school districts in Wisconsin on the path to financial distress, although few districts in the state face similarly dire circumstances as Palmyra,” Moody’s analysts Dan Kowalski and Katie Anthony wrote in a special commentary last month.

Moody’s agreed with the district that its enrollment struggles are rooted in losses due to open enrollment where students can transfer out of their resident districts and take state funding in the form of tuition transfers with them. Since the state program's inception in 1998, open enrollment and related financial transfers statewide have expanded dramatically and Palmyra-Eagle has the second worst open enrollment losses in the state, Moody’s said.