Whether Illinois’ investment grade ratings survive the economic damage caused by COVID-19 hinges on uncertain prospects for federal relief, rating agency patience, and Gov. J.B. Pritzker’s ability to avoid landmines as he rewrites the budget.

Illinois’ fiscal warnings are growing more stark: from a

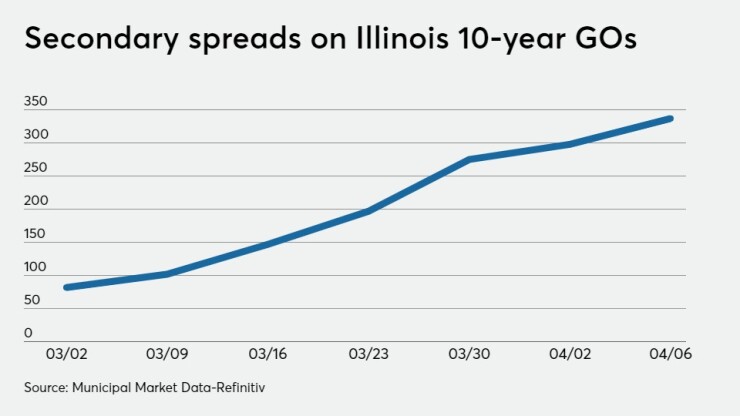

The state's ratings are low investment grade, but the bond market is pricing them as high yield. The spread penalty shot up to a 298 spread to the Municipal Market Data’s top benchmark last week and hit a new peak of 337 bps on Monday as the market digested the rating action. The 10-year previously hit a 335 bp peak in mid-2017, when the wounds were considered by analysts to be “self-inflicted” because the state couldn't pass a budget due to political gridlock.

“We are not in a budgetary crisis like we were in 2017. We are in a fiscal emergency,” said Michael Belsky, executive director of the Center for Municipal Finance at Harris School of Public Policy at the University of Chicago.

Municipal yields have shot up, but Illinois exceeds the market average as does Chicago, which has seen similar widening, said Daniel Berger, senior market strategist at MMD-Refinitiv. “That tells you that there is an elevated level of concern for Illinois credits and the markets anticipates some kind of rating action on Illinois credit,” Berger said.

The market benchmark 10-year rose by 70 bps through March to the start of April. Illinois yields rose more than 2.50%.

Pritzker acknowledged the need for federal help beyond the roughly $2.7 billion for the state and $2.2 billion for local governments from the $2 trillion federal CARES relief package approved late last month. Illinois which has a stay at home order in place through April as of Monday

The state will also qualify for other relief programs for healthcare and emergency services but the aid covers costs associated with dealing with the health crisis, not the loss of income, sales, and other tax revenue as the economy shuts down to slow the disease’s spread.

"We are looking very hard at what we need to do to get revenues and expenditures in line with one another. I think a lot of it is going to depend on the federal government…there is just no one that can step in to help our state finances the way the federal government can,” Pritzker said Monday. “We are going to need more, every state is going to need more. Every state’s revenues have cratered.”

U.S. House Speaker Nancy Pelosi said this week a fourth package for at least $1 trillion is in the works with additional state and local government help a priority.

While most states face lost revenues, many entered 2020 with healthy reserves built during the decade long economic expansion. Many “will get stimulus funds and their rainy day funds will offset the decline,” said Vikram Rai, head of Citi’s municipal strategy group. Illinois had just $59 million in its rainy day fund last month.

S&P's negative outlook reflects a view that the state faces a one-in-three chance of being downgraded over the next year, said lead Illinois analyst Geoffrey Buswick. That’s slightly different from the standard outlook view of two years and is far longer than a CreditWatch placement, which reflects a 50-50 risk over a 90-day view.

“The rating on Illinois reflects some of the credit attributes we have long cited as being most exposed to credit pressure derived from exogenous shocks, including lower reserve levels and elevated fixed costs,” S&P said.

Illinois is the only state with a negative S&P outlook.

The rating agency will be looking for a “balanced” fix. While no one action, like pension payment delays or deficit borrowing, may trigger a downgrade, a big pension obligation bond issue or other large one-shot budget patch might be viewed more negatively with a mix of fixes viewed more positively, Buswick said. “It’s not a case” where the rating agency views a downgrade as inevitable," he said. “I think the state has the ability to do it.”

Market

The state has big plans to borrow in the coming years to support the $45 billion infrastructure program so its yield penalties carry a price tag. In the near-term, bankers said the state has information on credit lines if needed and for floating rate ideas that would benefit from the Federal Reserve’s purchases of variable-rate paper that began last month.

The state also stands to benefit from a state funding facility that Treasury officials said is in the works to provide low-cost borrowing support. And the Fed has further plans to step in as a buyer of last resort but

The state may struggle for a while with steep penalties, because there are “not enough buyers, so the distinction between good credits and bad credits” is more pronounced, Rai said. “Illinois is a high beta credit” so in a struggling market its spread swing is more exaggerated. If the Federal Reserve steps in to buy more municipals “Illinois will perform better than the market.”

Municipal Market Analytics views Illinois as “increasingly likely to become the first state to carry a non-investment rating” but that doesn’t mean investors should cut and run. Some may not be able to hold non-IG paper but Illinois is not at risk of default in the near-term.

State statutes offer GOs strong protections.

“Illinois is one of the few states with laws that protect and pre-fund its GO debt service payments a year in advance. Thus investors worried more about default than ratings should find strong value in dramatically wider state spreads,” MMA partner Matt Fabian wrote in the firm’s weekly outlook published this week. “Even if the state is downgraded to junk its credit spread will reasonably tighten once the municipal high yield market stabilizes.”

MMD set the state’s 10-year yield at 4.46% Monday, 298 basis points over the AAA rate of 1.48% and nearly 200 bps over the BBB benchmark of 2.49%. That’s double the 140 bp spread the state’s 10-year landed at in its last primary market sale in November and nearly double where it began 2020. Maturities further out were at a 301 bp spread. The state’s 10-year hit a peak of 335 bps in June 2017 as it headed into what threatened to be a third fiscal year without a budget, threatening its investment grade ratings.

It’s been rough going looking at individual trades on Illinois names, said IHS Markit strategist Edward Lee. A 2032 bond with a 5% coupon traded at a spread of 332 bps on Friday, a 2032 bond with a 4% coupon traded at ranges from 265 bps to 348 bps last week. Illinois sales tax-backed bonds have been trading in a range of 275 bps to 322 bps.

After the gridlock broke in 2017 rating pressures eased and the state ended 2017 at a 177 bp spread. Spreads further narrowed as the state benefitted from budget harmony between Democratic leaders and a market flush with cash and investors willing to overlook the state’s weak ratings and $137 billion pension burden. The 10-year in a fall sale landed at a 140 bp spread.

Spreads began rising in mid-March as turmoil took root amid the growing coronavirus crisis and warnings of global recession. The spread shot up to 197 bps after investors pulled $12 billion from the market in one week to preserve liquidity and it has steadily risen in 10 to 30 bp jumps over the last two weeks.

Federal Help

Illinois doesn’t yet have any cost or tax loss estimates and is still waiting for federal guidance as to what the federal package can be used to cover, said budget spokeswoman Carol Knowles.

Civic groups that follow state finances and have long pushed the state to shore up its finances say federal help is a big part of the road to recovery along with budget adjustments.

“There’s clearly going to have to be a much larger federal response if we expect the governments charged with supporting the economy to do what’s necessary to carry out the functions of government,” said Laurence Msall, president of the Chicago Civic Federation. “It’s hard to fathom how we get through this without significantly more help from the government.”

A deep look at spending and expenses and borrowing is needed once the public health crisis ebbs and the fiscal toll is known; rating agencies should have patience, Belsky said. Federal help is needed to fill in gaps and cuts, but on the revenue side it’s difficult to raise taxes “at a time like this,” Belsky said.

Borrowing could play a role and the state may want to revisit bond statutes, easing up on level repayment requirements that keep it from restructuring debt for near-term relief so can manage pension and general fund costs. “They are not the best financial practices but it buys the state time,” Belsky said.

The state's unpaid bill backlog, which hit a peak of more than $16 billion in 2017, is at $7.8 billion.

“Due to the severity of this impact, and the significant additional challenges it poses to the state’s finances, further payment delays are to be expected in the coming weeks and months,” State Comptroller Susana Mendoza warns on the office's website.

The state closed out March with income and sales tax growth over last year but “uncertainty looms large” for the remaining months, the Commission on Government Forecasting and Accountability said in its March report.

While some April income tax payments will be delayed because the filing deadline has been moved to July, the state also will begin to feel real hits from job and income losses and business profits due to the economic shutdown. Casino revenue will also grind to a temporary halt.

“Once the tide turns, and economic engines can again be fired up, it is hoped that the previous trajectory can be reestablished. Unfortunately, at this time, it’s unclear when that may be, to what extent permanent damage has been done, and what form a recovery from this pandemic will look like,” COGFA wrote.