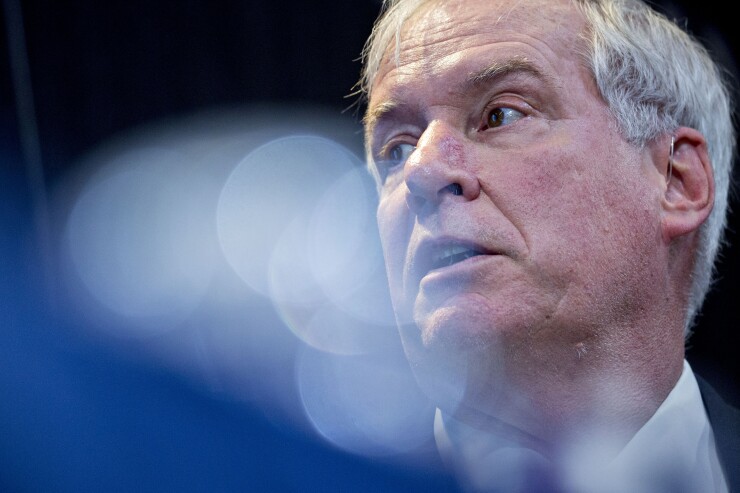

Trade issues with China should end with a deal, leaving the U.S. economy mostly unscathed, Federal Reserve Bank of Boston President Eric Rosengren said Tuesday. This is another reason why the Fed should hold rates where they are, he said.

While tariffs will cause an increase in prices of imports, uncertainty about when and if a deal will be reached should be “transitory, and thus have only a modest effect on the forecast for the U.S. economy overall,” he told the Economic Club of New York.

Although it is a downside risk to the Survey of Professional Forecasters’ projection of 2.6% GDP growth this year, and if it “is prolonged, financial markets could retrench further, and households and firms could curtail spending.” Rosengren said the growth figure is “a little above my own forecast.”

His baseline forecast calls for a deal at some point, without serious disruption to global trade or economies. He said most forecasts see the economy growing above potential this year and below potential in subsequent years while inflation increases.

Currently “the two elements of the Fed’s mandate are sending opposing signals for monetary policy, with low unemployment perhaps suggesting a bit tighter policy, and low inflation the opposite,” Rosengren said. “In this setting, I see no clarion call to alter current policy in the near term. I view current policy as slightly accommodative and likely to be consistent with inflation returning to the Fed’s 2% inflation target over time.”

Tariffs would work to increase inflation. “However, given that inflation has underrun the target over the last several years, it is wise to admit to some uncertainty about this part of the forecast. It is my view that the Fed can afford to wait to see if that forecast does indeed materialize. In addition, the presence of a prominent downside risk — more disruptive trade negotiations — seems to me to be another important reason for policymaker patience until this source of uncertainty is more resolved.”

Powell

In comments Monday evening, Federal Reserve Board Chair Jerome Powell spoke about rising corporate debt, some of it risky, which could leave “some businesses” hurting “if the economy deteriorates.” Ultimately, he believes the financial system is strong enough to handle potential losses.

Rosengren, responding to a question, said corporate leverage is “worrisome” because if the economy goes bad, it could mean a “more severe recession.”

Economic data

The National Association of Realtors said existing home sales fell 0.4% in April to a seasonally adjusted annual rate of 5.19 million units, from an unrevised 5.21 million pace in March. Economists polled by IFR Markets expected a 5.30 million rate.

Also, the Federal Reserve Bank of Philadelphia’s Nonmanufacturing Business Outlook Survey showed slower expansion in the sector, as the current general activity at the regional level slid to 17.3 in May from 21.0 in April, while at the firm level, it fell to 28.1 from 39.2. The indexes for future activity improved, suggesting growth is expected to continue for the next six months.