-

Analysts don't expect a rate cut at this meeting, but offer thoughts on the year ahead and the to-be-named Fed chair.

January 27 -

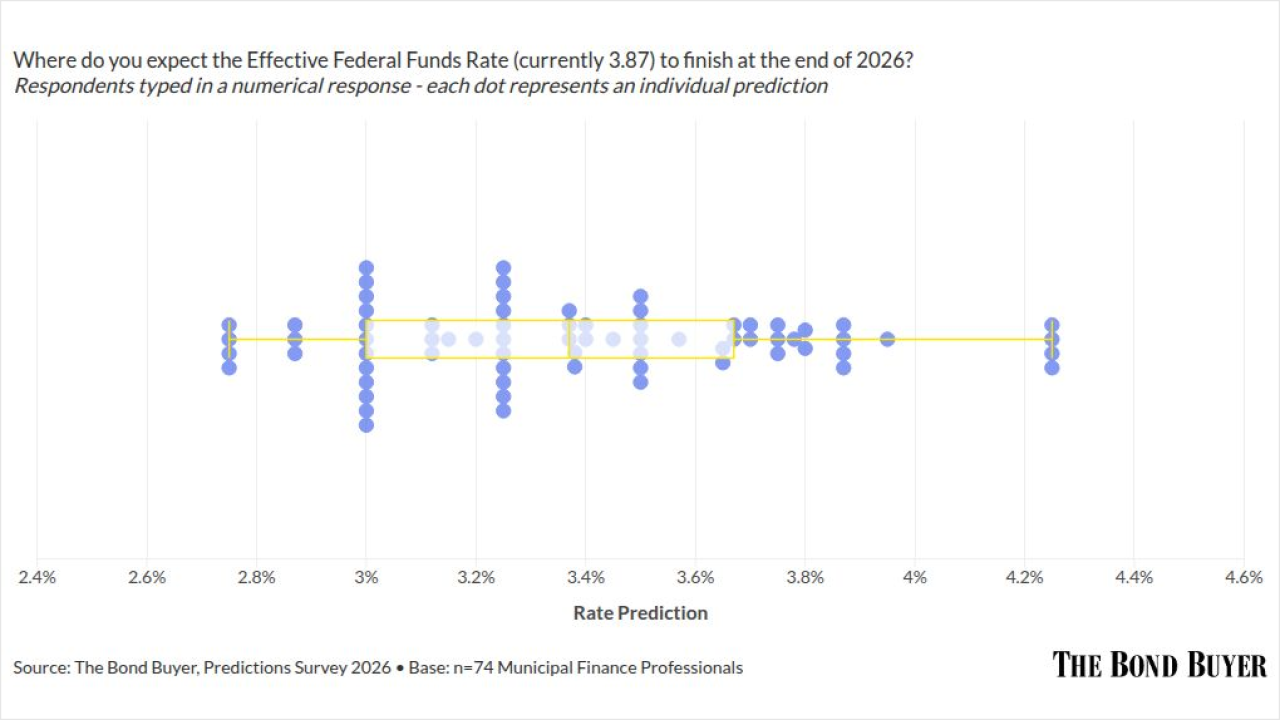

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

-

Much has changed since October and most economists are sure the FOMC will lower rates by 25 basis points this week, with dissenting votes expected.

December 8 -

Although the Federal Reserve is not expected to cut rates at this meeting, the market is closely watching for signs of a September easing and how the divide among officials plays out.

July 28 -

The FOMC's decision to "hold rates steady while signaling only two cuts this year was a subtle but powerful shift," said James Pruskowski, CIO at 16Rock Asset Management.

June 18 -

The panel is not expected to change rates, but the dot plot will be watched to see if the Fed's prior projection of two rate cuts this year holds.

June 16 -

The Federal Open Market Committee will meet on June 17-18. While no rate cuts are expected at this point, things can change quickly. Lauren Saidel-Baker, economist at ITR Economics, provides her take on the meeting the new Summary of Economic Projections and Fed Chair Jerome Powell's press conference.

-

"The threat of having both inflation and unemployment rising simultaneously continues to create a big headache for the Fed's interest policy," said Wells Fargo Investment Institute global fixed income strategist Luis Alvarado.

May 7 -

The specter and economic implications of tariffs coupled with still above-target inflation and a healthy labor market will sideline policymakers at this week's meeting, analysts said, but not everyone agrees when the next rate cut will be.

May 6 -

With no policy changes expected, analysts are eagerly awaiting the new Summary of Economic Projections for clues about future monetary policy.

March 18 -

The Federal Open Market Committee cut the fed funds target again in December but signaled fewer cuts in 2025. There was some dissent. The markets are watching to see if the Federal Reserve pauses its easing cycle in January. Brian Rehling, head of global fixed-income strategy at Wells Fargo Investment Institute, recaps and parses the previous day's FOMC meeting and Fed Chair Jerome Powell's press conference.

-

A week ahead of inauguration day, Scott Colbert, executive vice president, director of fixed income and chief economist at Commerce Trust, takes a look at how the Federal Reserve and the economy will fare in President-elect Donald Trump's second run in the White House.

-

Technicals could "break down" if there is a potential decline in risk assets or rising unemployment, particularly in white-collar jobs, said Jeff Timlin, a managing partner at Sage Advisory.

December 4 -

For municipals, Wednesday "marks a crucial step forward, perfectly aligned with the current risk landscape," said James Pruskowski, chief investment officer for 16Rock Asset Management.

September 18 -

Given the Fed's reluctance to "surprise markets or take actions that could be perceived as overtly political," Interactive Brokers Chief Strategist Steve Sosnick said, "we find it hard to believe that anything other than 25 bp is the likely outcome for the upcoming FOMC meeting."

September 16 -

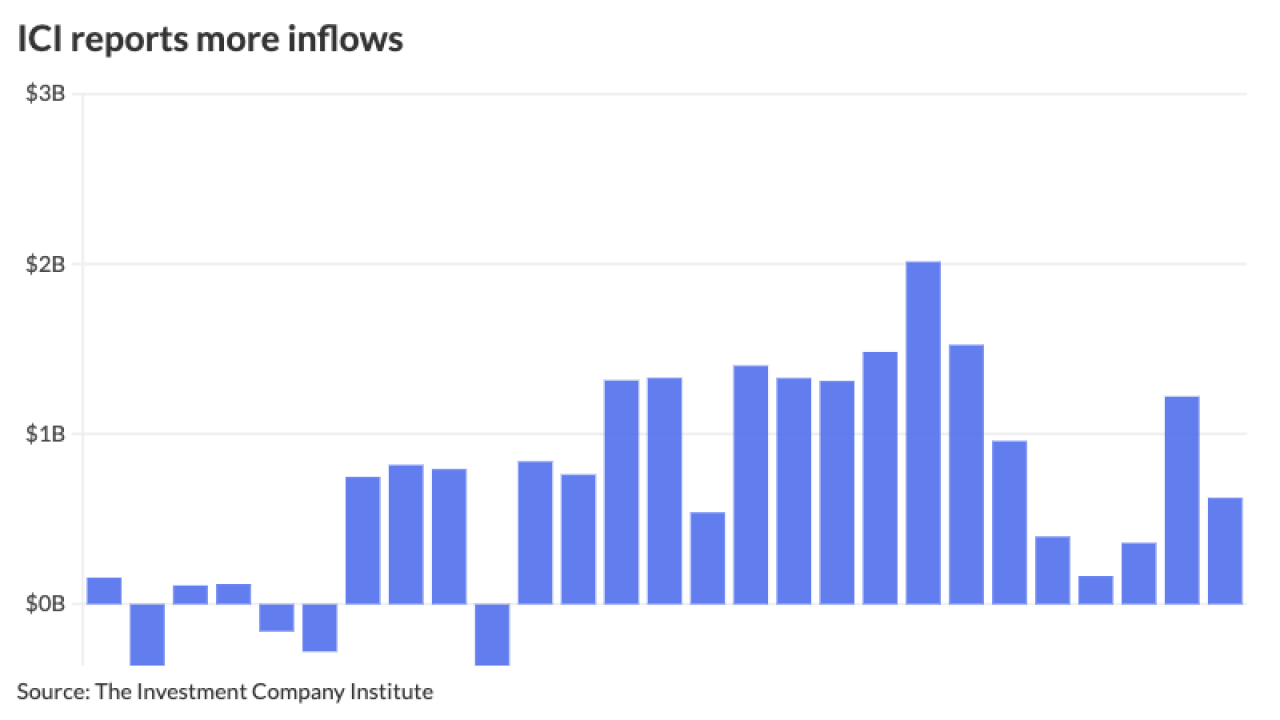

The calendar next week largely continues "the elevated pace of primary market volume seen since May, against a backdrop of broadly supportive fund flows (LSEG inflows for eight consecutive weeks), somewhat better dealer positions (although still heavy), mid-August reinvestment to spend, but lighter late summer attendance," said J.P. Morgan strategists led by Peter DeGroot.

August 23 -

It was a good day for munis with larger deals clearing the primary and secondary trading showing a more constructive tone with triple-A yields falling a few basis points amid a stronger session for all markets.

March 6 -

"Although inflation has moved down from its peak — a welcome development — it remains too high," Powell said in the text of a speech Friday at the U.S. central bank's annual conference in Jackson Hole, Wyoming.

August 25 -

After holding at its last meeting, the Federal Open Market Committee may decide to raise rates again in July.

-

Powell is set to appear on Capitol Hill this week for his semi-annual monetary policy testimony, the first time the Fed chief will answer questions from Congress in public since early March.

June 21