WASHINGTON — The top executives of the Financial Industry Regulatory Board, the Municipal Securities Rulemaking Board, and some industry groups received total compensation topping $1 million in recent years, according to The Bond Buyer’s latest

These figures far exceed the highest compensation levels at state and local government groups, which all came in under $500,000, as well as Securities and Exchange Commission Chairman Jay Clayton’s salary of $174,500.

The survey is based on the groups’ latest Form 990s, the forms that nonprofit organizations file annually to the Internal Revenue Service.

The forms include the groups’ revenues, expenses, net assets or program balances, members’ dues, and expenditures on things like lobbying and legal services, as well the compensation of executives and other key staff officials.

The survey doesn’t exactly provide an apples-to-apples comparison because the forms vary according to each organization’s fiscal year and some of the groups are more up to date on their filings than others. In addition, while the tax information on the forms is for the fiscal years for which the forms were filed, the compensation figures are usually from W-2 or 1099 tax forms for calendar years.

Bond Dealers of America had the most recent Form 990, for its fiscal year ending Feb. 28 of this year. SIFMA, the MSRB and the National League of Cities forms were the next most recent, with SIFMA’s for the fiscal year ending on Oct. 31, 2017 and MSRB and NLC forms for fiscal years ending Sept. 30, 2017.

The National Governors Association Center for Best Practices had the most out-of-date form, for its fiscal year ending June 30, 2016.

In fact, nine of the 23 groups’ Form 990s were filed during or for calendar year 2016. Some of the older forms do not reflect recent changes in the groups’ leadership.

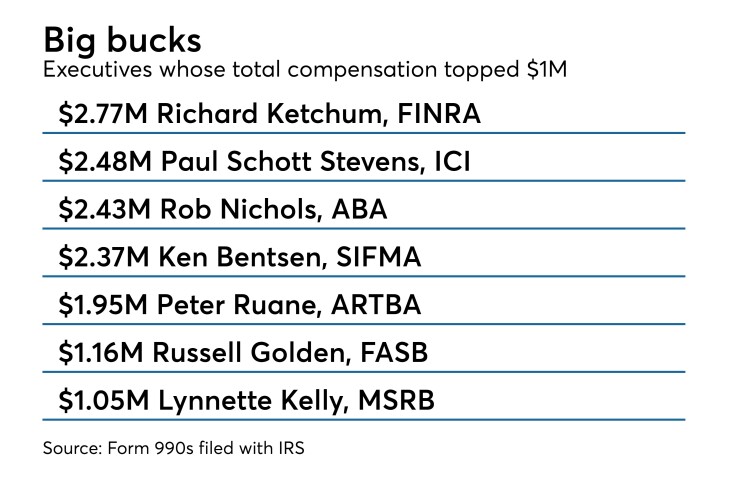

For example, the highest level of compensation, as in previous years, was received by Richard Ketchum, who was chair and chief executive officer of the FINRA until Aug. 14, 2016. His total compensation was $2.77 million, with most of that — $1.5 million — in bonuses and incentives. His base compensation was $770,809 and his deferred compensation and benefits were $495,000.

FINRA’s latest Form 990 was for 2016. Ketchum was replaced by Robert Cook in August of that year. Cook’s total compensation for the year was $442,312, including a base salary of $328,109.

FINRA, along with the SEC, enforces the rules that the MSRB writes. MSRB had no enforcement capability beyond providing data for audit trails and consultation to the commission and FINRA.

The next highest compensation levels were for the presidents and chief executive officers of the Investment Company Institute, the American Bankers Association and SIFMA. ICI’s Paul Schott Stevens total compensation was $2.48 million, ABA’s Rob Nichols was $2.43 million and SIFMA’s Ken Bentsen Jr. was $2.37 million.

The top executives who made a total of more than $1 million in compensation included American Road and Transportation Builders Association President and CEO Peter Ruane at $1.95 million, Financial Accounting Standards Board Chairman Russell Golden at $1.16 million, and MSRB’s Lynnette Kelly at $1.05 million.

Kelly, who was listed on the form as executive director but more recently has been titled MSRB president and CEO, had a base salary of $710,294. Added to that was $141,480 in bonuses and incentives as well as $197,047 in deferred compensation and other benefits. This was for calendar year 2016.

Perks

In addition, top FINRA and MSRB executives, as well as their board members, receive some perks, similar to the executives of industry groups. They are permitted to fly first class air travel for certain flights, those of more than three hours during one-way trips, in the case of MRSB.

Ketchum had a car and driver for business purposes in New York City and Washington, DC. He also was provided up to $20,000 per year for personal financial and tax counseling.

Twenty-two of MSRB’s board members received total compensation of $818,650.

The board has 21 members but individuals may go on or off the board in any given year, most often because of job changes.

MSRB officials said board members typically have received $45,000 annually, with committee chairs receiving another $5,000, the board’s vice chair an additional $10,000 and the board’s chair an additional $30,000.

The highest level of compensation was $65,000 for Colleen Woodell, MSRB chair for fiscal 2017, which began on Oct. 1, 2017. Woodell is retired and former chief credit officer of global corporate and government ratings at S&P Global Ratings.

The lowest level was $11,250 for Edward Sisk, managing director and head of public finance at Bank of America Merrill Lynch who joined the board in fiscal 2017 for a term that will expire on Sept. 30, 2020.

The MSRB also paid $195,183 to five individuals who were board members in fiscal 2016, including Nat Singer, who was chair before Woodell, Brian Wynne, Robert Cochran, James McKinney, and Marcy Edwards. MSRB officials said this information was on the 990 form because board compensation was for the 2016 calendar year.

FINRA paid total compensation of $1.81 million to 27 board members, not including its CEO. The self-regulator has a 24-member board that includes its CEO.

In contrast, the highest total compensation level for an executive of a state or local government group was $491,532 for Matthew Chase, executive director of the National Association of Counties. According to the Form 990 for calendar year 2017,

Chase’s base pay was $382,676 and he received $45,000 in bonuses and incentives as well as $63,856 in deferred compensation and other benefits.

The next highest was $480,281 for Clarence Anthony, executive director, secretary and treasurer of NLC, according to the group’s Form 990 for the fiscal year ending Sept. 30, 2017. Anthony’s base compensation was $408,425. In addition, he received $28,102 in bonuses or incentives and $43,754 in deferred compensation and other benefits.

He was followed by Jeff Esser, former executive director of the Government Finance Officers Association, who received $424,281 in total compensation, according to GFOA’s Form 990 for the fiscal year ending March 31, 2017.

The NCSL [National Conference of State Legislatures] Foundation for State Legislatures, included in the survey for the first time this year, gets a $1.31million grant from the NCSL and its Executive Director William Pound serves as a volunteer, according to the Form 990 that group filed for the fiscal year ending June 30, 1917.

Contracts

At least three of the 23 groups had management or consulting contracts with firms. The National Association for Local Housing Finance Agencies paid SmithBucklin Corp. $401,095 for management, according to NALHFA’s Form 990 for the 2016 calendar year.

The Council of Infrastructure of Financing Authorities paid Madison Associates, a consulting firm, $373,100 for 2016, according to CIFA’s 990 form for that year. The Association of Financial Guaranty Insurers paid Mackin & Casey $252,434 as executive director.

As for personnel changes since the 990 forms were filed, Bill Daly, the National Association of Bond Lawyers’ director of governmental affairs was replaced by Jessica Giroux at the beginning of this year.

Jeff Esser was replaced by Chris Morrill as executive director of GFOA on May 1, 2017. Tom Crippen was succeeded by Scott Pattison as executive director and CEO of the National Governors Association in December 2015.

Shaun Snyder became executive director of the National Association of State Treasurers in October 2017, replacing John Provenzano. Barbara Thompson was replaced by Stockton Williams as executive director of the National Council of State Housing Agencies in March 2018.