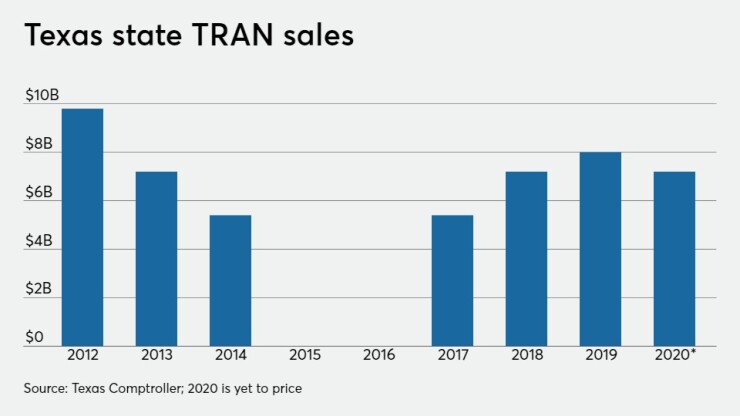

With a decade of dynamic growth on pause, Texas will take $7.2 billion of notes to market next week to smooth cash flow over the coming fiscal year.

The competitive tax and revenue anticipation note sale is scheduled for Aug. 19 with Stifel Nicolaus as financial advisor.

Texas begins its 2021 fiscal year Sept. 1 with major adjustments due to the lingering effects of the COVID-19 pandemic.

The human toll continues to rise, after a July that saw an average of 157 Texans killed daily by COVID-19, according to Department of State Health Services data.

Last year, the state saw strong demand for $8 billion of tax and revenue anticipation notes with interest rates 36 basis points below one-year Treasuries, according to state Comptroller Glenn Hegar.

The notes maturing this year received a net interest rate of 1.34% and were nearly three times oversubscribed. The rate fell 50 basis points below that of the Texas 2018 TRANs but 38 basis points above the 2017 deal's 0.96% rate.

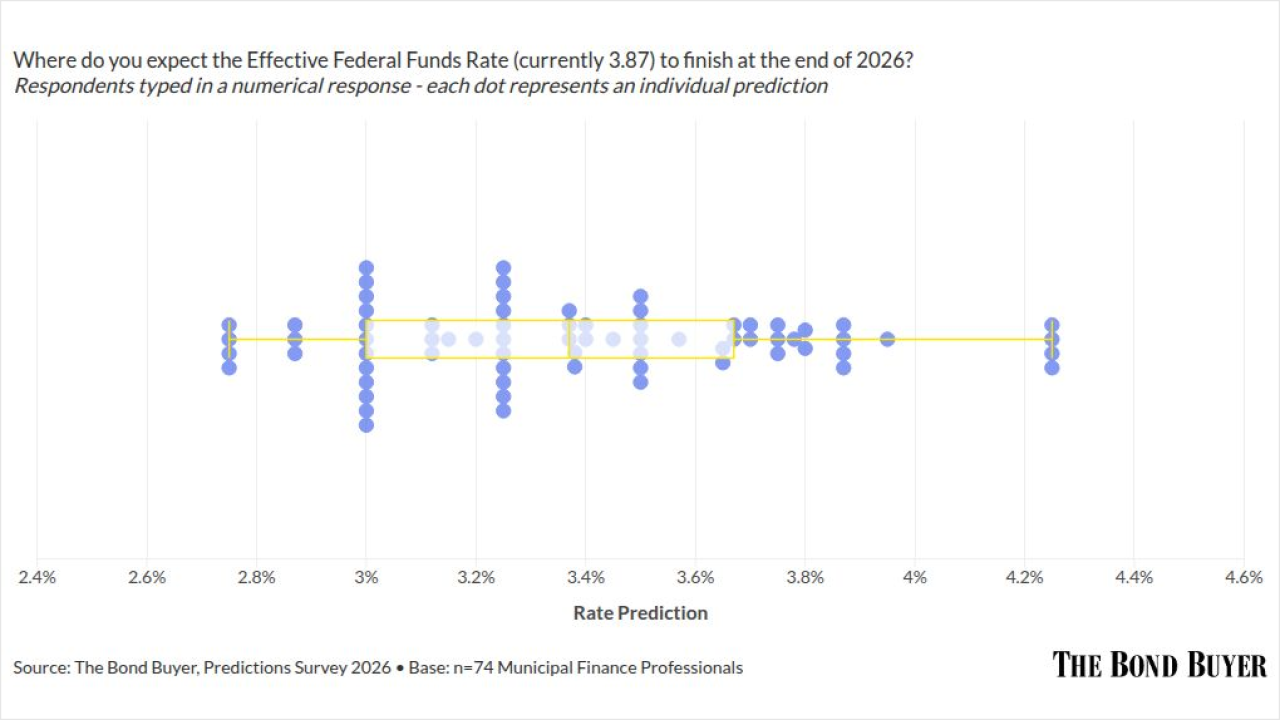

With top credit ratings from four agencies, Texas should do even better this year amid falling interest rates.

The Municipal Market Data AAA scale set fresh all-time record lows on Friday, as buyers swarmed new issues amid persistent supply-demand imbalance, MMD noted.

The City and County of Denver earned yields of 0.075% on top-rated general obligation notes maturing in one year with 5% coupons, according to MMD.

About half of a projected $21.3 billion in annual school aid will be disbursed to local school districts between September and November, prompting the need for the notes.

Cash receipts in fiscal 2020, not including $12.5 billion of federal funds received in the state's Coronavirus Relief Fund to address pandemic-related expenditures, are expected to total $104.6 billion compared to $106.6 billion forecast in 2019.

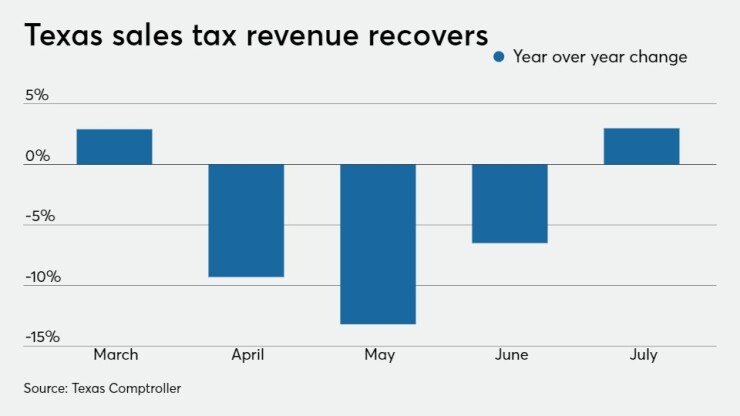

In July, Hegar reduced the certification revenue estimate by $11.6 billion or 9.5% from the October 2019 estimate. That converted the anticipated $2.9 billion surplus to a $4.6 billion deficit.

The revenue forecast incorporates an expected 5.4% reduction in net revenue from the prior biennium, including sales tax revenue that is now expected to be 0.2% below collections in the 2018-2019 biennium and 9.2% below the October 2019 forecast.

“This revised estimate carries an unprecedented amount of uncertainty,” Hegar wrote in a letter to state leaders. “We have had to make assumptions about the economic impact of COVID-19, the duration and effects of which remain largely unknown. Our forecast assumes restrictions will be lifted before the end of this calendar year, but that economic activity will not return to pre-pandemic levels by the end of this biennium. The state’s economic output, employment and revenues will not return to pre-pandemic levels until consumers and businesses are confident the spread of the virus has been controlled. Even then, it likely will take some time to recover from the economic damage done by the deep recession.

“Our outlook is clouded further by recent volatility in oil prices and production, which have been unpredictable even by the standards of the industry,” Hegar added. “Although prices have partially recovered from April lows, they remain well below where they were at the start of this year.”

With $9.5 billion in its rainy day fund, known officially as the Economic Stabilization Fund, Texas was well positioned for the global shock created by the pandemic, analysts say.

“Texas' economic resource base is large and diverse, although oil and gas remain significant and their volatility can impact the state's economy and revenue sources,” Fitch analyst Marcy Block said. “Fitch expects the effects of the coronavirus pandemic occurring alongside an unprecedented crude oil market downturn to significantly challenge the state's near-term economic and revenue growth prospects. Fitch continues to view the state's longer-term economic prospects as strong.”

When the 2021 legislative session convenes in January, Democrats may hold more power than they have in decades.

According to the non-partisan Texas Election Source, Democrats need a net of nine seats to retake a majority in the chamber.

“We project they will get six, up three from our April ratings, which would cut the Republicans’ advantage to 77-73 entering the 2021 legislative session,” TES said in early August.

A July poll by

"With crises swirling through American society and a country deeply divided, there's no other way to slice it," said Quinnipiac University polling analyst Tim Malloy. "It's a tossup in Texas."

Republicans have held control of statewide offices in Texas for 44 years.

A troubled U.S. Census could spell trouble for the state by undercounting Texas’ rapidly growing population of immigrants. President Trump’s effort to order that census takers ask about resident’s legal status was shot down, but the return of census forms from areas of the state with large Hispanic populations have been lackluster. Some Texans fear a loss of representation in Congress.

A flawed count threatens the state for the next decade because it serves as the funding basis for federal programs such as early childhood education to highway planning and construction. Data derived from the count controls planning across the state’s 254 counties.

Another immigration-optics issue, construction of a wall between Texas and Mexico, could turn on the outcome of the election. Trump has made the wall the heart of his re-election campaign while former Vice President Joe Biden said “not another foot of wall” would be built.