CHICAGO – St. Louis Metro transit enters the market next week with a $375 million issue under a long-planned restructuring and refunding that will introduce a new double-A-rated lien supported by revenues from a 2010 voter-approved sales tax.

Metro intends to hold a retail order period June 26 with the institutional pricing set Thursday June 27.

RBC Capital Markets is senior manager with Jefferies & Co. Inc. and Morgan Stanley serving as co-seniors. Columbia Capital Management LLC is advisor and Gilmore & Bell PC is bond counsel.

The sale of Combined Lien Mass Transit Sales Tax Appropriation refunding bonds addresses several challenges straining Metro’s balance sheet while putting it on a more stable fiscal course with its operating fund and preparing it for potential future expansion efforts, officials said.

The deal achieves traditional present value savings of at least 5%, establishes a debt portfolio that begins to amortize principal on a 2005 expansion issue, and eliminates market and bank support risks tied to two outstanding floating-rate series.

“The refunding resolves market risks with the variable-issue issues and for the first time Metro will put its 2005 expansion bonds on a path toward principal repayment,” said Columbia Capital’s Jeff White.

The deal refunds a $75 million bullet maturity due this year and another $70 million of outstanding variable-rate securities supported by a letter of credit that expires this year, said the agency’s director of treasury services, Mark Carroll.

The bonds are fixed-rate with a final maturity of up to 39 years. The finance team is tinkering with the structure and may use super sinkers, early calls, and fixed-rate put bonds that would give Metro flexibility in paying down some debt more quickly. The early retirement would be made possible under a pending agreement with St. Louis County that would forward some additional sales tax revenues to Metro for that purpose.

With the infusion of new revenues from the 2010 ballot measure providing sturdy debt service coverage of at least four times under a combined lien, Metro secured a Aa3 rating from Moody’s Investors Service. Standard & Poor’s will also rate the new lien but it has not yet published its report.

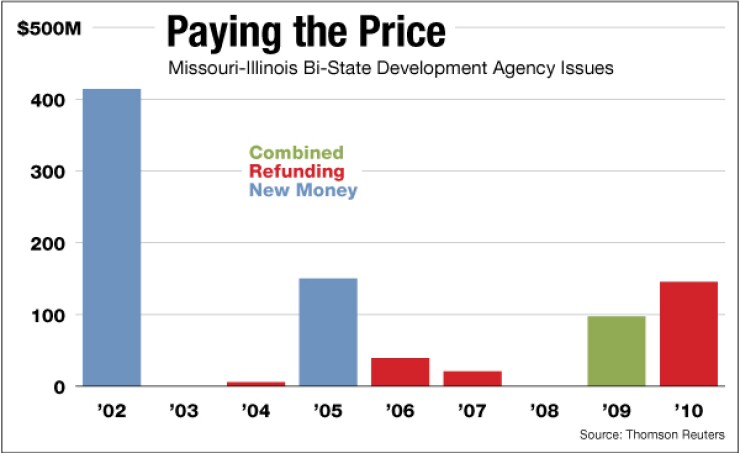

With the issue, the agency, formally known as the Bi-State Development Agency of the Missouri-Illinois Metropolitan District, will close off its senior lien sales tax appropriation revenue bond credit.

That move won a Moody’s upgrade to A1 from A2 on the $97 million of debt from a 2009 issue that will remain outstanding under the lien. Carroll said it was not economically feasible to refund that portion of debt.

The longer maturity structure on the upcoming issue may not be ideal from a credit perspective, but it offers the agency flexibility on the operating side and the agency is hoping to pay down debt more quickly.

“The idea is that Metro can take advantage of interest rates that are at near historic lows to structure an amortization that it can afford,” White said. The longer maturity was made possible by amendments to the compact between Illinois and Missouri that established the agency.

The new credit is secured by a senior lien claim on the city’s Proposition M2 one-quarter cent and the county’s Proposition A one-half cent sales taxes along with a subordinate lien claim on the original Proposition M city & county one-fourth cent sales tax.

St. Louis County voters approved the Proposition A half-cent increase in 2010. Officials had warned that due to growing budget costs, faltering sales tax collections, and dwindling federal funds, without the increase dramatic cuts would be needed on top of cuts made in March 2009.

Voter approval of Proposition A triggered enactment of the Proposition M2 city sales tax. City voters had previously approved the tax, but it could not be imposed until county voters approved an increase.

The Aa3 rating on the newly established credit “reflects sound projected debt service coverage by the combined revenue streams; adequate legal provisions….a sizeable and diverse tax base; cash funded debt service reserve equal to maximum annual debt service; and a satisfactory 1.8 times additional bonds test,” Moody’s said.

The rating benefits from a broader revenue stream and a structure that calls for revenues to go directly to the trustee once appropriated. The upgrade and double-A level rating mark a turnaround for the agency previously hit with downgrades and warnings of further deterioration as it worked on a long-term solution to its operational and debt structure challenges. Those efforts were bolstered by the 2010 tax approval.

The rating weighs appropriation risk although analysts note that risk is minimal given the narrow permitted legal uses of the pledged revenue, which restricts the use of sales tax revenues to only non-highway transportation purposes.

Other challenges for the credit include the long amortization schedule of nearly 40 years, which Moody’s called unusual for the mass transit sector, as well as low growth rates of pledged sales taxes over the last decade.

City and county Prop M revenues grew 5.6% in fiscal 2012 but the five-year compounded growth rate is negative 1.4%. The additional revenues from Prop M2 and Prop A are expected to generate about $90 million more annually.

The upgrade of the 2009 bonds “reflects the closure of the lien, stronger projected debt service coverage based on Prop M revenues, and elimination of a challenging debt structure that included a bullet maturity due in the current fiscal year and exposure to variable rate demand bonds,” Moody’s wrote, noting that debt service on those bonds remains backloaded. The outlook is stable.

Pledged revenues provide 2.45 times coverage.

Metro began construction of its light-rail transit system, MetroLink, in 1990 and has funded a series of expansions, including the Cross County MetroLink Extension. Metro issued $150 million of variable-rate bonds in 2005 to cover cost overruns on the 8.2-mile Cross County light-rail expansion project. It had hoped to pay down the debt with an anticipated settlement from a lawsuit against the project’s developers, but it lost the court battle.

The county’s Proposition A sales tax also is intended to fund future expansion projects, but the agency’s near-term capital program of $580 million is currently focused on repair and rehabilitation. About $331 million is supported by federal funds.

“We have various studies going on,” for future needs including bus rapid transit, said Metro’s chief financial officer Kathy Klevorn. “But we currently do not have any expansion projects on the drawing board.”

Under the agreement with the county that is up for a final vote Tuesday night by the county board, the county would loan the agency funds currently being set aside from Proposition A for future capital expansion projects to help the agency pay down its debt levels.

About $30 million is being set aside annually and earning little interest while the county has no big expansion plans in the works. The county would provide $75 million upfront and as much as $400 million over the life of the agreement although it could seek repayment beginning in 2018.

The Bi-State Development Agency was created in 1949 by a compact between Illinois and Missouri. It owns and operates the St. Louis metropolitan area’s public transit system which includes 87 light rail vehicles running on a 46-mile network, about 374 buses and 117 vans that serve St. Louis and St. Louis County and other nearby counties with overall ridership last year of 46 million. It has a $250 million annual operating budget.