Want unlimited access to top ideas and insights?

Another large wave of selling hit the market on Wednesday, with yields rising by more than a half percentage point on the long end, amid defensive bidding reminiscent of the mid-March sell-off.

March’s volatility has led to some of the widest price swings the market has seen since benchmark data was created and it continues as the second quarter begins.

Large block trades were showing massive swings in yield and AAA benchmark yields on various scales rose by 40 to 50 basis points from 10 years and out while the short end wasn’t spared either, seeing cuts of 16 to 35 inside 10 years.

That selling was being “propelled by various customer bid-wanted lists, which is seeing defensive bidding to say the least as memories of the mid-March sell-off are fresh on the minds of all involved,” said, Greg Saulnier, municipal analyst at Refinitiv.

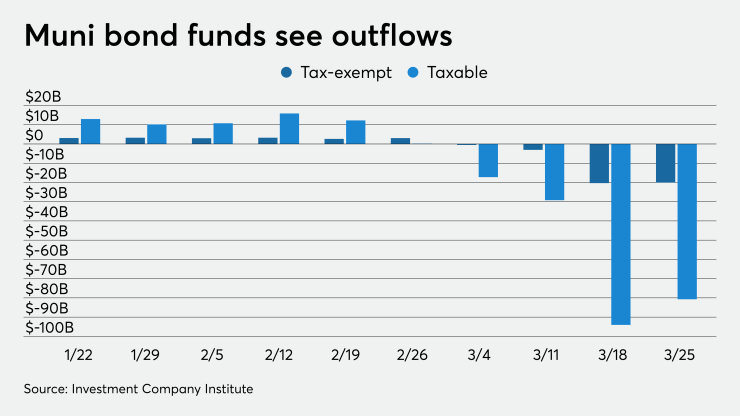

ICI reported more than $20 billion of outflows out of municipal bond mutual funds, bringing the total to over $44 billion of outflows since the week ended March 4.

The primary market once again mostly remained closed, though at least one larger deal priced, a $269 million of water and sewer revenue bonds for the Metropolitan Government of Nashville and Davidson County Tennessee. The Aa2/AA rated issuer saw its 10 year come at 2.02% and the long bond, 4s of 2045, price at 2.89%. California said it will not bring a planned $1.5 billion of taxable state public works advanced refunding because of the market turmoil.

Meanwhile, in Washington,

Coronavirus-led fears are leading investors, particularly retail, to cash once again and there is another fear in the municipal market of the unknowns of just how much and what maturities of municipal bonds the Fed will purchase once the program begins.

“COVID-19 worries continue to spook financial market participants to convert to cash and, as one participant remarked earlier this morning, the Fed may be reticent to buy munis out beyond 5 or 10 year maturities. If that thinking is permeating the muni market, that is undoubtedly contributing to the steepening bias we have seen the past few days,” Saulnier said.

Traders noted that bidding is showing how much particular credits are being affected, specifically with issuers in New York and healthcare and airport credits.

“There is definitely customer selling today to point to, but I think participants are also starting to sort through credit winners and losers from the combination of the pandemic and the shelter-in-place orders,” the trader said. “Healthcare, transportation and smaller/lower rated higher-ed names seem to be trading much weaker.”

The trader added that the market is falling into a cycle of fund redemptions moving yields higher, which in turn causes the primary market to largely go day-to-day, which in turn takes the pressure off until the next wave of selling.

“This is all compounded by most buy-side and sell-side participants working from home,” the trader said. “Strange times indeed.”

Large blocks of New York City TFAs, 5s of 2031, traded at 2.11% Wednesday. They traded at 1.98% Tuesday. The 11-year ICE yield was at 1.74% Wednesday and 1.38% Tuesday. TFAs, rated Aa1/AAA, traded in the beginning of the month at 0.69%.

New York City GOs, 3s of 2045, traded at 3.18% in blocks Wednesday, 3.01% Monday and 2.94% Friday. The original yield when it priced at the beginning of the month was 2.35%.

California GOs, 5.25s of 2030, traded at 1.75% Wednesday after trading at 1.25% Monday.

Out long, Michigan Finance Authority Bronson Health, 5s of 2054, traded at 5.06%. At the end of February, they were at 2%.

“There is a big disconnect between where people are willing to sell and where they put stuff out for the bid,” an Atlanta-based trader said.

Credit concerns begins

“I think if you were to poll the investor community, they would say that the rally we saw last week was driven by misplaced euphoria over the combination of Fed liquidity as well as the CARES act,” said Jeffrey Lipton, managing director, head of muni research and strategy at Oppenheimer. “Now, we are seeing headlines tied to specific credits and it is making the market grow uneasy.”

Lipton said that last week’s rally was “probably” oversold, which could have something to do with the selloff yesterday and the even bigger sell off today. He added that while the backstop from Fed “helps” it does not include high yield.

“The rally we saw last week was somewhat overdone, and I think it boils down to that now, we are in a period here where we will have these back and forth and wide swings, fits and starts as far as muni yields go,” he said. “As we have been seeing, things can change and turn on a dime.”

He noted that now, market expectations are mounting over the need for additional relief, specifically to state and local governments.

“There is a growing need for cash, we don’t know when it will but when the economy does reopen, we think the reopening is going to me incremental and to add to that, we are unsure what business and consumer sentiment will be.”

One of the biggest changes the market has made since the virus impact has walloped the market, is now market technicals are a less reliable barometer.

“Right now, credit quality is replacing market technicals as the more important investment decision factor,” Lipton said. “The first two months of the year, when we had all the technicals on our side, investors were paying up for certain structures, certain sectors that perhaps were not a perfect match up for their portfolios.”

He said that for example, the rally last week after a record of greater than $13 billion of Lipper outlflows.

“These headlines will continue to influence fund flows,” Lipton said. “This week I would expect to see another meaningful outflow, I am not sure it will be another record breaker but that is not out of the realm of possibility.”

Outflows will continue until the mindset of the retail investor changes and they feel comfortable with overall credit quality.

“The concern over credit will not abate anytime soon, it will only grow,” he said. “You would be hard-pressed to find a sector in public finance that isn’t directly or indirectly impacted by this economic shutdown.”

S&P Global Ratings send out a report around midday on Wednesday, saying that all of their public finance sectors now have a negative outlook.

“Given mobility restrictions and closure of large segments of the economy due to COVID-19 and the swift onset of recession, all of S&P Global Ratings' sector outlooks in U.S. public finance are now negative,” said the report. “Sector outlooks are an indication of credit trends in the year ahead and may be informed by existing outlook distributions or existing and emerging risks that could influence rating actions.”

The rating agency said that at the start of 2020 all sector outlooks were stable with the exception of higher education, ports, and mass transit.

“The shift in our outlooks to end the first quarter reflects the expectation of sharp decline in the economy through at least the second quarter and uncertainty about the rate of spread and peak of COVID-19 as well as the timing of economic recovery.”

Lipton said that the muni market is being set up for an unforeseen wave of rating actions, negative outlooks, negative watches and potentially downgrades.

He said that while institutional investors have begun the process of what to keep, what to pare back on, if they should be holding more cash and what they want to buy, for the retail investor, they will take a pause and a bit longer to go through that process.

“More relief is needed, I think that is agreed upon by everyone in the industry and that is why I believe there will be a phase four and it will come soon,” Lipton said. “If we can get into a period where the market stabilizes a bit and we can move away from erratic and volatile swings in yields, more people will be willing to jump in at certain entry points, recognizing the value proposition that our asset class has.”

Secondary market

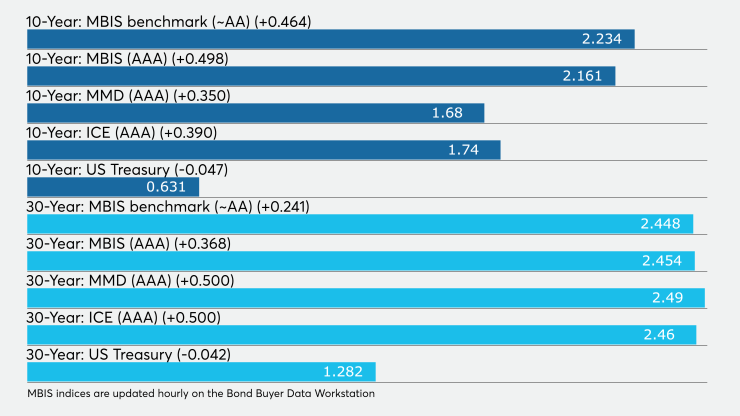

Munis were weaker on the MBIS benchmark scale Wednesday, with yields rising 46 basis points in the 10-year maturity and by 24 basis points in the 30-year maturities. High-grades were also weaker, with yields on MBIS' AAA scale increasing by 49 basis points in the 10-year and by 36 basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO rose 35 basis points to 1.68% while 30-year increased 50 basis points to 2.49%.

The MDD muni to taxable ratio was 183.8% on the 10-year and 150.6% on the 30-year.

On the ICE muni yield curve late in the day, the 10-year yield was up 39 basis points to 1.74% while the 30-year was up 50 basis points to 2.46%.

BVAL saw the 10-year rise 31 basis points to 1.76% and the 30-year rose 50 basis points to 2.58%.

Stocks fell as did Treasury yields.

The Dow Jones Industrial Average fell about 4.13%, the S&P 500 index dropped around 4.38% and the Nasdaq lost roughly 4.22%.

The three-month Treasury was yielding 0.094%, the Treasury two-year was yielding 0.222%, the five-year was yielding 0.369%, the 10-year was yielding 0.631% and the 30-year was yielding 1.282%.

ICI reports outflows of $20-plus billion yet again

Long-term municipal bond funds and exchange-traded funds saw a combined outflow of $20.081 billion in the week ended March 25, the Investment Company Institute reported on Wednesday.

It was the fourth week in a row of outflows, as the last inflows came during the week of Feb. 26 and this week marked the second week in a row, where outflows exceeded $20 billion. The previous week, ended March 11, saw $20.355 billion of outflows.

Long-term muni funds alone had an outflow of $19.272 billion after an outflow of $19.017 billion in the previous week; ETF muni funds alone saw an outflow of $809 million after an outflow of $1.338 million in the prior week.

Taxable bond funds saw combined outflows of $80.717 billion in the latest reporting week after revised outflows of $94.046 billion in the previous week.

ICI said the total combined estimated outflows from all long-term mutual funds and ETFs were $156.532 billion after outflows of $152.882 billion in the prior week.

The biggest loser for the third week in a row were bond funds, which saw an outflow of $100.798 billion this past week, after an outflow of $114.401 billion the week before.