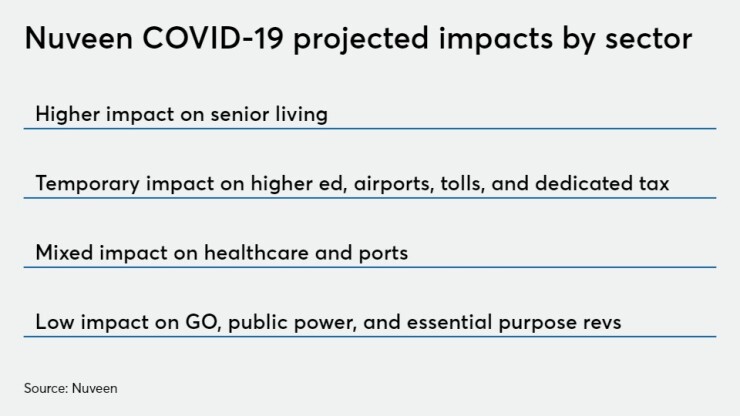

General obligation, essential public revenue bonds and even debt backed by tourism-related revenues may weather the COVID-19 outbreak with minimal to temporary impacts while senior living is more at risk, Nuveen says in a report that looks at risks in the municipal market, sector by sector.

The liquidity-driven sell-off this week made all the more glaring the dramatic turn being taken in a market that had been led by inflows, with the buy-side scooping up paper as fast as a deal’s scales were distributed. Credit and sector risk took a backseat to demand for higher-yielding bonds.

Those risks are now rising to the forefront as the COVID-19 outbreak extends its economic impact with the shuttering of stadium events, convention business, some schools and travel-related bans.

“The credit impact on individual borrowers will vary by sector, as well as the severity and duration of the outbreak in a particular location,” the Nuveen Municipal Credit Research team wrote in a March 11 report, “Coronavirus potential impact on municipal bond sectors.”

“Credit ratings are generally a good barometer of a borrower’s ability to withstand unexpected financial stress. Most municipal issuers provide essential services and generally have a long history of functioning through varying economic cycles, credit cycles and temporary disruptions,” the report said.

Veteran municipal strategist George Friedlander weighed in suggesting “it is time for the muni market to start more effectively differentiate between credits as values swing sharply.”

While the market has dramatically weakened in recent days, there’s been little widening of credit spreads from quality single-A credits on up, Friedlander said. “To the extent that this is the case, investors should be focusing on the highest quality credits they can find.”

Friedlander takes that position because the implications of the coronavirus would be heightened in a weaker economic environment, where access to testing will lag, and more layoffs could occur. Pension problems could also grow in severity as the stock market plunges.

“The potential damage ought to be reflected in wider spreads. So, for now, investors should join the flight to quality in munis too, with some potential real values likely to show up in high-grade muni space,” Friedlander said in a commentary.

While most sectors reviewed by Nuveen fell under the low–to-mixed-to temporary impact, continuing care and senior living was the sole recipient of a “higher impact” label as it has the potential to lead to credit deterioration and defaults.

“The senior living sector will likely be more directly affected than hospitals or most other municipal market sectors,” Nuveen wrote. “While the impact will likely vary across the country, potential systemic risks exist.”

The elderly are more susceptible to COVID-19 complications so prospective residents may delay a move to a retirement community. The risk is most acute for those facilities still trying to attract residents.

“Facilities currently in the fill-up stage may see far greater cash deficits before they reach stabilization. Reduced liquidity could compromise new projects,” Nuveen said. “In certain Continuing Care Retirement Communities, we might even see a spike in immediate refund liabilities, which could push bonds for lower-rated facilities into distress or default.”

There’s a long-term pay off as “low rates benefit the senior living sector by providing greater flexibility for refinancing and increasing valuations,” Nuveen said.

The broader not-for-profit healthcare sector could see a “mixed impact.”

“Increased volume may help revenues initially, but a longer disruption may strain capacity at some providers and perhaps result in localized shortages in medical supplies,” Nuveen said.

Smaller, standalone hospitals are more at risk than larger systems and “any impact on hospital financials will likely be temporary and should not materially impact overall credit quality or default risk.”

Port-backed bonds gets a “mixed impact” classification. The American Association of Port Authorities expects first quarter year-over-year U.S. cargo volumes to be down at least 20% due to supply-chain disruption. “We expect port volumes to be impacted, although ports with minimum annual guarantees and fixed lease agreements are largely protected from extreme revenue volatility,” Nuveen predicts. “U.S. ports may be affected by supply disruption, as well as a reduction in cruise travel.”

The higher education impact should be “temporary.” Universities have canceled classes and move to virtual learning as a precautionary measure and that should insulate schools tuition losses, Nuveen said.

Endowment earnings may be impacted due to market volatility as well as international student recruitment for the next admissions cycle but that’s dependent on how the outbreak’s impact unfolds in the coming months.

“For large institutions, diverse revenue sources” that include state appropriations for public schools “and significant balance sheet resources protect against temporary revenue stress. Smaller, more vulnerable institutions already more susceptible to external shocks will experience greater disruption. Any impact on universities’ financials will likely be temporary and should not materially impact overall credit quality or default risk,” Nuveen said.

Dedicated tax bonds and toll road credits might see a “temporary impact.” The former are “generally well-positioned to recover as recessions or economic slowdown are often factored into long term projections.

Toll roads, generally, could see declines but they might be offset somewhat by heavier vehicle travel as air travel temporarily falls.

“We are closely watching toll roads that rely heavily on commuter traffic, given the likelihood of interim office closures. Impact to toll roads catering to commercial traffic will likely be similar to a typical recession,” Nuveeen wrote. “Overall, mature tollroads should not see significant impact to credit quality given their relatively strong debt service coverage ratios and history or surviving prior downturns.”

Airports too should see just a temporary impact with significant revenue bases and balance sheets to manage. Revenue may take a hit as travel is cancelled but the sector’s ability to weather both was underscored by the September 11th terrorist attacks and the 2008-2009 financial crisis, Nuveen said.

BofA Global Research in a report Friday said it doesn’t expect to see widespread defaults across the municipal market from the coronavirus in the transportation and travel-related sector but it does “see potential pockets of stress.”

“Strong liquidity and reserves, the ability to borrow for cash-flow purposes, strong and proactive management teams and financial and fiscal practices are crucial,” BofA said. “We reiterate our focus on quality: we prefer issuers with stronger debt and financial metrics and also debt higher in the capital structure. In times such as these, be selective.”

Nuveen sees a low impact on GO credit quality as the debt is “viewed as relatively stable, with many tools available to adjust to economic disruptions” given their backing by ad valorem taxes which are “historically a reliable source of revenue,” Nuveen said.

While there are exceptions “many issuers have built up reserves since the prior recession, providing some cushion for potential revenue and expenditure fluctuations,” Nuveen said. “Although the sector is not expected to see widespread disruption, some areas of vulnerability may include areas that depend on tourism or oil/gas, or those with increased public health care costs or declining pension assets.”

Revenue bonds issued for essential services also should fare well falling in Nuveen’s “low impact” category with many ties to user fees that are not expected to be disrupted.

Public power also falls into Nuveen’s “low impact” category as they represent one of the more stable sectors due to the essential services provided and many enjoy autonomy in rate setting with bond coverage ratios protected by bond covenants.