The economic news was mostly positive Friday, with consumers spending on clothes, cars and eating out, while manufacturing continues to suffer.

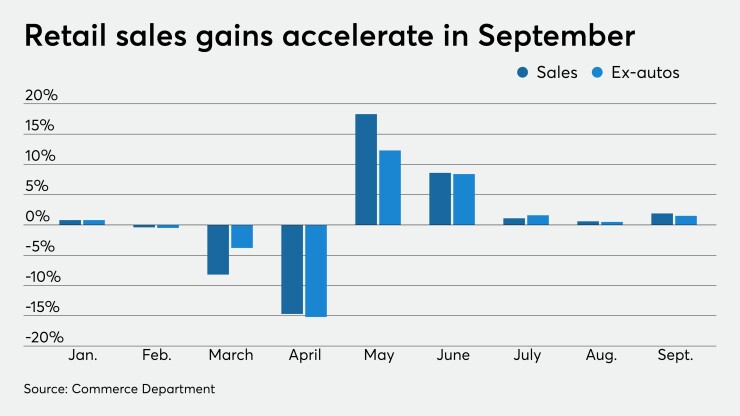

Retail sales soared 1.9% in September, after an unrevised 0.6% climb in August, the Commerce Department reported Friday.

Excluding autos, retail sales rose 1.5% in the month after a 0.5% gain a month earlier.

Economists polled by IFR Markets expected sales to rise 0.6% and saw a 0.4% gain excluding autos.

“Retail sales have exceeded pre-pandemic level since June, so the acceleration in its growth in September, which placed it 4.2% above February’s level, is remarkable,” said Roiana Reid, U.S. economist at Berenberg Capital Markets.

While increases were broad-based, with 12 of the 13 primary retail sectors gaining in the month, clothing and accessory stores and motor vehicles and parts sales were the prime movers, with restaurants also a big riser.

The control group, which excludes gas stations, food, building materials and auto sales, rose 1.4% in the month and are up 39.9% on an annualized basis in the third quarter, after dropping 9.1% the previous quarter, Reid said. This group factors directly into gross domestic product.

Also aiding sales, she said, were “the government’s generous income support programs,” and the bounce in labor. “Through September, the U.S. has recouped 11.4 million (or 52%) of the 22.2 million jobs lost in March and April,” Reid said.

“September was a month when people could kick up their heels a bit as COVID cases waned and the saving triggered by earlier stimulus was tapped,” according to Diane Swonk, chief economist at Grant Thornton. “The recovery remains K-shaped as the haves make big-ticket purchases and the have-nots strain to pay for basic necessities.”

The University of Michigan’s consumer sentiment index rose to 81.2 in its preliminary October read, up from the final September 80.4, and beating estimates of 81.0.

The current conditions index slipped to 84.9 from 87.8, while the expectations index gained to 78.7 from 75.6. The one-year inflation index ticked up to 2.7% from 2.6% in the last month’s report, while the five-year declined to 2.4%, its lowest reading since March.

Industrial production fell 0.6% in September, after rising an unrevised 0.4% in August, the Federal Reserve reported Friday. Capacity utilization slipped to 71.5% in September from an upwardly revised 72.0% in August, first reported as 71.4%.

Economists expected a 0.6% gain in production and a 71.9% capacity use rate.

The New York region service sector saw a slight decline in activity, according to the Federal Reserve Bank of New York’s Business Leaders survey. The current business activity index narrowed to negative 4.9 in October from negative 5.4 in September, while the business climate index crept to negative 65.9 from negative 66.5, suggesting respondents see the commercial environment as worse than usual.

The expectations for business activity declined to 1.3 in October from 6.8 in September, while the business climate index fell to negative 16.0 from negative 5.4, implying respondents don’t see things improving in the next six months.

Business inventories grew 0.3% in August, after rising 0.1% a month earlier, but are down 5.5% year-over-year, the Commerce Department said. Economists expected a 0.4% increase in the month.

Business sales rose 0.6% in August, after a 3.4% jump in July, but are off 0.4% year-over-year.