Puerto Rico’s debt cannot be canceled by order of the president, restructuring experts and a key congressman said, after President Trump sent the territory's bonds tumbling with a comment that the debt would have to be wiped out after Hurricane Maria.

Puerto Rico bonds fell to record lows Wednesday after Trump said in a Fox News interview Tuesday night: “They had $72 billion in debt before the hurricane hit…. We have to look at their whole debt structure. You know they owe a lot of money to your friends on Wall Street. We’re gonna have to wipe that out. That’s gonna have to be – you know, you can say goodbye to that.”

In a telephone press conference on Wednesday, Rep. Rob Bishop, R-Utah, who chairs the House committee that oversees Puerto Rico, said the current debt restructuring would proceed under the Oversight Board appointed last year.

“Part of the reason to have a board was to have a logical approach [to the debt restructuring]. We need to have this process played out" he said. “There’s not going to be one quick panacea to a situation that has developed over a long time,” said Bishop, chair of the House Committee on Natural Resources. “I don’t think it’s time to jump around … when we already have a structure to work with.”

Bishop said that Hurricane Maria's devastation would require the board to revise its 10-year fiscal plan. The goal to have a balanced budget will have to be pushed back from the current target of fiscal year 2019. However, Bishop also repeated that the board must retain its independence from Congress.

Bishop said the members of Congress would consider extending something like the Puerto Rico Oversight, Management, and Economic Stability Act to the U.S. Virgin Islands. This would open the door to a debt restructuring for the more than $2 billion in public sector Virgin Islands debt.

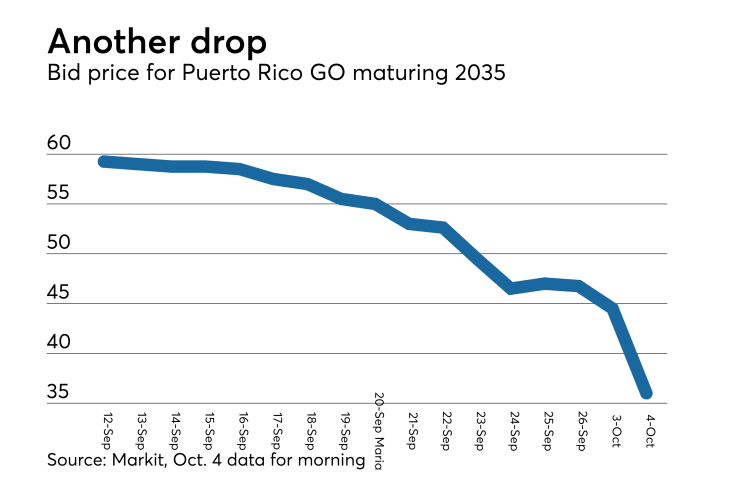

As recently as Sept. 12 Puerto Rico’s 2014 general obligation bond maturing in 2035 had been trading at 59.25 cents on the dollar, according to Markit. Due to Maria’s tremendous impact on the island the price had sunk to 44.5 cents by Tuesday. On Wednesday morning, after the president’s remarks the bond had plunged to 36 cents, according to Markit.

Municipal bankruptcy expert James Spiotto said it would be Congress rather than the president that would pass any bankruptcy legislation. He added that it had already done that with the PROMESA.

“You can’t just use an edict to wipe out debt,” said Spiotto, managing director at Chapman Strategic Advisors. “If Congress were to wipe out debt, there would be constitutional challenges.”

“Past efforts to repudiate debt debts have had very serious consequences in terms of future access to capital markets and cost of borrowing,” he said.

If the federal government were to provide something like the Marshall Plan to Puerto Rico, Spiotto said, the economy could strengthen and the island would be in a position to pay off some its debts. In the Marshall Plan the United States provided mainly grant money to West European nations from 1948 to 1952. Many of the nations’ economies had been struggling in the years following World War II.

A bond trader agreed that a Marshall Plan was a good idea.

“The muni market is very much concerned about the sanctity of the debt contract, especially as it has been under attack in places in Detroit,” the trader said. “Furthermore, there is an implied attack on the security of U.S. Treasury debt here – which is a really big deal.”

The trader said, “I think [the debt] should trade higher after the impact of the president’s statement concerning wiping out the debt fades, but I don’t think it will move back to the 50 price we saw last month.”

U.S. Rep. Nydia Velázquez, D-N.Y., said debt relief is needed.

“It seems one of the few positives out of the president’s trip to Puerto Rico is an acknowledgment of how the island’s debt will constrain its physical and economic recovery," she said. "While I agree with the sentiment that something will need to be done to address the island’s financial challenges, the president failed to lay out any specifics as to how he would ‘wipe out’ Puerto Rico’s debt.

“I’ve advocated for additional funding to address Puerto Rico’s looming Medicaid cliff, a long term fix for the island’s Medicaid shortage, a line of credit from the Treasury Department to assist with short term liquidity issues, and a robust funding package to pay for disaster recovery,” Velázquez continued.

Mick Mulvaney, director of the White House budget office, walked back the president's comments. “I think what you heard the president say is that Puerto Rico is going to have to figure out a way to solve its debt problem,” he said, according to Bloomberg News.

In Wednesday’s press conference Bishop said that a funding package to aid Puerto Rico was being developed in Congress. In addition, he said members of his committee and other representatives would meet later Wednesday to discuss temporary measures to reduce government rules slowing Puerto Rico’s recovery. The group will look at ways to make Puerto Rico’s and the U.S. Virgin Island’s electrical systems more resistant to storms.

He said the group would be looking at how to improve things in both territories in the short-, medium-, and long-term.

Aaron Weitzman contributed to this story