LOS ANGELES – Hawaii Gov. David Ige has signed a bill extending Honolulu's general excise tax and increasing the state’s hotel room tax to cover cost overruns on Honolulu's multi-billion-dollar elevated rail project.

The state legislature went into special session to decide whether to pay for the additional costs using a property tax or extend the general excise tax a second time.

They ultimately crafted legislation that will cover the $2.4 billion shortfall in funding by extending the GET three years to provide an additional $1.046 billion; raising the state's Transient Accommodation Tax by 1% for 13 years to provide $1.326 billion; and permanently increasing the amount counties other than Honolulu get from the hotel tax.

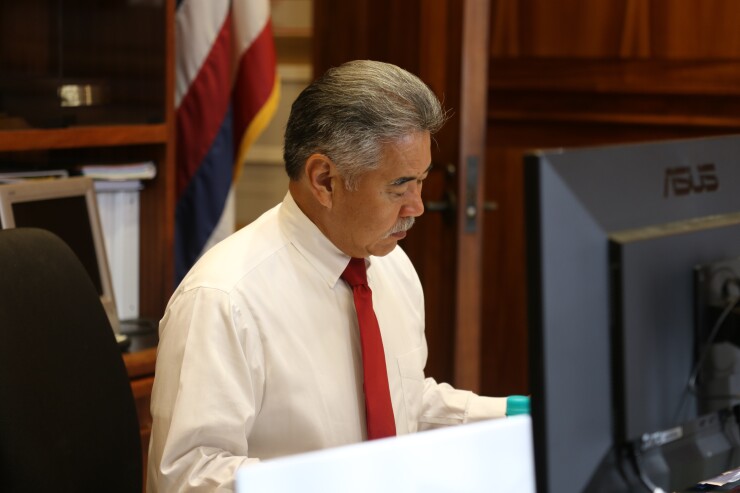

The governor, who signed Senate Bill 4 Tuesday, called the legislation “a strategic investment in Hawaii’s future.”

The bill also reduces the state Department of Taxation’s administrative fee on the GET surcharge from 10% to 1%, creates a mass transit special fund to review and disburse funds to the city for its costs on the rail project and requires a state-run audit of the rail project and annual financial reviews.

The bill signing allows the Honolulu City Council to approve Bill 45, which extends Oahu’s half-percent surcharge to the state general excise tax another three years, and is a key component of the updated financial plan the Federal Transit Administration requires by Sept. 15, said Honolulu Mayor Kirk Caldwell.

“The signing of the rail funding bill into law shows Gov. Ige’s commitment and leadership in completing the rail project as promised to the people of Oahu, and is proof of the hard work done by members of the state Senate and House during the special legislative session," Caldwell said.

Completion of the rail project “will add fuel to the economic engine that helps power the entire state of Hawaii by promoting smart development, generating much-needed affordable housing and creating multi-modal communities that all of us are striving for,” the mayor said.

The city is working with the Honolulu Authority for Rapid Transportation on an updated financial plan that takes the new funding mechanism into account, Caldwell said, so that it can answer any questions the FTA may have about completing the elevated rail line from East Kapolei to Ala Moana. The FTA is contributing $1.55 billion to the project through a grant agreement, but had threatened to cut off the last half of the funding if the city didn’t come up with a financial plan to complete the entire project. Caldwell had suggested shortening the line to cut costs.

“My administration continues to work closely with our federal, state and city partners on implementing all of the mandates of the rail funding bill, in particular more state oversight of rail construction and the timely transfer of tax revenues to the city,” Caldwell said.

The governor said he also has heard the concerns from leaders and residents of Hawaii’s other counties – and that they would like to see more support from the visitor industry and he plans to work with the county mayors, county councils and the Legislature on a fair distribution of the hotel taxes.