The municipal bond market started off the week adopting a cautious tone, with one eye on heavy new issuance and the other on events unfolding in the Middle East.

Primary market

The New York Metropolitan Transportation Authority (MIG1/SP1/F1+/K1+) sold $1.5 billion of transportation revenue bond anticipation notes on Monday in two offerings.

Four groups won the $800 million of 5% Series 2020A Subseries 2020A-1 BANs, including BofA Securities ($300 million with an effective rate of 1.319120%), JPMorgan Securities ($300 million with an effective rate of 1.316290%), Citigroup ($100 million with an effective rate of 1.317860%) and Goldman Sachs ($100 million with an effective rate of 1.316610%).

Four groups won the $700 million of 4% Series 2020A Subseries 2020A-2S BANs, including BofA ($200 million with an effective rate of 1.286050%), JPMorgan ($200 million with an effective rate of 1.284140%), Citi ($200 million with an effective rate of 1.285090%) and Morgan Stanley ($100 million with an effective rate of 1.284140%).

Public Resources Advisory Group and Rockfleet Financial are the financial advisors. Nixon Peabody and D. Seaton & Associates are the bond counsel.

On Thursday, the

On Tuesday, the New York City Transitional Finance Authority heads to market with a competitive sale of about $109 million of Fiscal 2020 NYC recovery bonds. Frasca & Associates and Public Resources Advisory Group are the financial advisors. Norton Rose and Bryant Rabbino are the bond counsel.

Also on Tuesday,

On Thursday, the New Jersey Economic Development Authority’s (Baa1/BBB+/A-/NR) $500 million of Series 2020A NJ Transit transportation project bonds are set to be priced by Barclays Capital.

A game changer in the Mideast

Late last week, a U.S. airstrike in Iraq killed Qassem Soleimani, leader of Iran’s Islamic Revolutionary Guard Corps. Pro-Iranian Iraqi paramilitary commander, Abu Mahdi al-Mohandes, was also killed when their convoy was hit outside Baghdad International Airport.

Soleimani was the most influential Iranian military commander of the last 20 years and responsible for many of the explosive devices that killed at least 600 Americans during the Iraq war. He had also built a strong Shia militia force under his control in Iraq and Syria.

According to Academy Securities’ Geopolitical Intelligence Group, the U.S. attack could be the most destabilizing event in the region since the U.S. invaded Iraq.

The strike hit the heart and brain of the IRGC-Quds, but left behind a large special force and popular mobilization forces that can lash out at U.S. interests, said Lt. Gen. Vincent Stewart, an Academy Securities’ advisory board member. Shia forces will try to undermine the Iraqi government by targeting U.S. forces and Iraq’s leaders won’t be able to control the chaos.

The attack has changed the narrative in Iraq from a weak government where there were protests at the U.S. Embassy to “down with America” chants and a violation of sovereignty.

“The events of the last few days have had a significant impact on the international landscape. These events affect the markets and the macro environment, ultimately impacting our municipal clients,” said Rick Kolman, head of the municipal securities group at Academy. “The Academy Securities’ Geopolitical Intelligence Group is comprised of 13 retired generals and admirals whose expertise on Iran, Iraq, and the entire Middle East is unmatched. Our goal is to keep our clients abreast of the situation and help them understand the implications of this developing situation — including the potential for increased cyber attacks.”

The question now is will Iran escalate and if so, when and how?

“I anticipate an asymmetric response to include cyber,” said Stewart, a retired Marine Corps general. “Will they attempt to drag Israel into this? The Israel Defense Force is quietly celebrating both Soleimani and Mohandes deaths, but must be concerned about spillover effects. The Yemen theater is also in play. The Saudis are quietly celebrating as well but they must also be concerned about being caught up in this proxy war.”

Despite the significance of the attack, there remains no action on Iran’s missile capability which can reach all of U.S. bases in the region and into Europe.

“In the past, they have demonstrated their cyber capability against oil and financial assets. They view the U.S. financial system as a critical U.S. vulnerability,” said Stewart, formerly Deputy Commander of U.S. Cyber Command. “We will see how much ‘will’ the Supreme Leader has to push for cyber activity in the oil or financial sectors. This is a game changer.”

Academy’s analysts said that from Iran’s perspective, the U.S. has engaged in economic warfare and the economic sanctions are having a significant effect.

“U.S. maximum pressure is working. The only option left for Iran is to strike (militarily/terrorism) because their influence otherwise is negated. The U.S. must figure out what the ‘release valve’ is or something worse could occur (nukes),” said Gen. James "Spider" Marks, Academy’s head of geopolitical strategy and senior advisory board member.

An effective strategy must be formulated at the top level of U.S. policymaking.

“Strangling Iran is not a strategy. An effective strategy creates conditions where Iran is not a threat regionally or globally. Ends, ways, and means must be delineated,” said Marks, a retired Army general. “Regime change in Iran not likely. Ali Khamenei will be gone in a couple years. His son is the successor and he’s in his 40s. With his succession we could have a century long vitriolic and isolationist relationship with Iran going forward. There is too much at risk that must be fixed.”

Three elements were cited to change Iran’s position as a regional power and ultimately achieving regime change: No development of nuclear capability; rolling back the IRGC and Quds forces; and rolling back their missile capability.

Secondary market

Munis were mixed on the MBIS benchmark scale, with yields falling two basis points in the 10-year maturity and rising less than a basis point in the 30-year maturity. High-grades were stronger, with yields on MBIS AAA scale falling by two basis points in the 10-year maturity and by less than a basis point in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO dropped one basis point to 1.36% while the 30-year declined two basis points to 1.98%.

“The ICE muni yield curve is unchanged to one basis point lower as the market takes a wait and see attitude toward U.S.-Iran tensions following Friday’s flight-to-quality,” ICE Data Services said in a Monday market comment. “Tobaccos are unchanged to one basis point lower and high-yield is unchanged. Taxables are two basis points higher and Puerto Rico is mixed.”

The 10-year muni-to-Treasury ratio was calculated at 75.1% while the 30-year muni-to-Treasury ratio stood at 86.8%, according to MMD.

Stocks were little changed as Treasuries weakened. The Treasury three-month was yielding 1.538%, the two-year was yielding 1.549%, the five-year was yielding 1.611%, the 10-year was yielding 1.802% and the 30-year was yielding 2.271%.

Previous session's activity

The MSRB reported 29,048 trades Friday on volume of $7.996 billion. The 30-day average trade summary showed on a par amount basis of $10.8 million that customers bought $5.77 million, customers sold $3.24 million and interdealer trades totaled $1.79 million.

New York, California and Texas were most traded, with the Empire State taking 15.987% of the market, the Golden State taking 14.683% and the Lone Star State taking 7.341%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp. [COFINA] restructured revenue zeros of 2046, which traded 10 times on volume of $25.2 million.

Last week’s actively traded issues

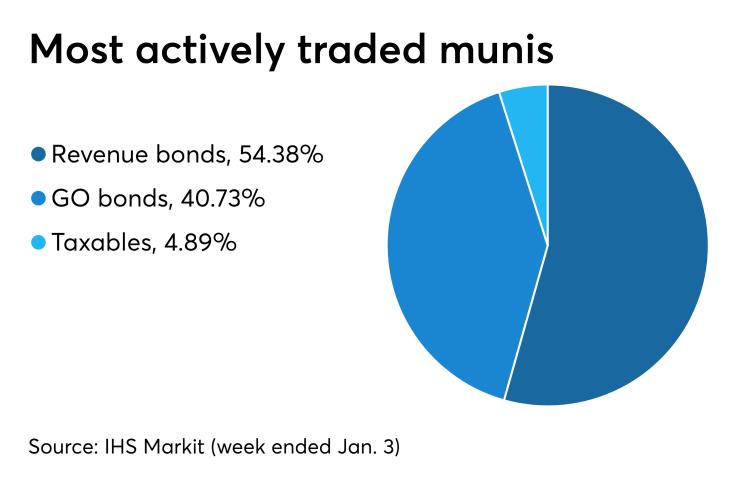

According to

Some of the most actively traded munis by type in the week were from New York, Washington, D.C. and California issuers.

In the GO bond sector, the New York City zeros of 2024 traded 10 times. In the revenue bond sector, the Metropolitan Washington Airports Authority 3s of 2050 traded 22 times. In the taxable bond sector, the Los Angeles Community College District 1.65s of 2020 traded 13 times.

Last week's actively quoted issues

Puerto Rico, D.C. and Colorado bonds were among the most actively quoted in the week ended Jan. 3, according to IHS Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 5s of 2058 were quoted by 29 unique dealers. On the ask side, the Metropolitan Washington Airports Authority revenue 3s of 2050 were quoted by 117 dealers. Among two-sided quotes, the Colorado Health Facilities Authority revenue 3.25s of 2049 were quoted by 11 dealers.

Treasury auctions bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed, as the $42 billion of three-months incurred a 1.520% high rate, unchanged from 1.520% the prior week, and the $36 billion of six-months incurred a 1.520% high rate, down from 1.560% the week before.

Coupon equivalents were 1.551% and 1.557%, respectively. The price for the 91s was 99.615778 and that for the 182s was 99.231556.

The median bid on the 91s was 1.495%. The low bid was 1.450%. Tenders at the high rate were allotted 37.85%. The bid-to-cover ratio was 2.94. The median bid for the 182s was 1.500%. The low bid was 1.470%. Tenders at the high rate were allotted 78.88%. The bid-to-cover ratio was 3.09.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.