New York’s Metropolitan Transportation Authority approaches next week’s planned $2.5 billion of issuance with a momentum boost: a state review panel’s approval of its five year, $51.5 billion

The Capital Program Review Board allowed the MTA’s plan to take effect by default on Wednesday. Failure to act within 90 days of MTA board approval, which came in September, is a de-facto signoff.

Gov. Andrew Cuomo did not convene the panel.

“The plan is both historic and transformational for the largest transportation system in North America, and we’re ready to get to work to deliver for New Yorkers,” MTA Chairman Patrick Foye said.

Clearance could also resonate well in the capital markets, which have called out the MTA over revenue uncertainty. The previous program, for 2015 to 2019, materialized after a prickly political give and take, several amendments and an intricate compromise among state, city and MTA officials.

The MTA, one of the biggest municipal issuers with $44 billion in debt, operates New York City’s subway-and-bus system and Long Island and Metro-North commuter railroads, and several intraborough bridges and tunnels. It serves about 9 million daily customers.

It expects to sell roughly $1.5 billion of bond anticipation notes due in 2022 and 2023, and $940 million of climate bond certified green bonds next week, kicking off a busy month for the authority.

“We’ll have our work cut out for us in January,” finance manager Patrick McCoy said at the Dec. 18 board meeting.

Through the new capital funding, the authority expects to modernize New York City's subway and bus system, one of the nation's oldest. The plan anticipates revenue from a congestion pricing mechanism for Manhattan, scheduled to take effect in 2021.

State law requires the four-member review board, which consists of top state and city representatives, to sign off on the plan.

Cuomo, who chaired the panel, wanted New York Mayor Bill de Blasio to appear in person, but the mayor insisted that wanted budget aide Sherif Soliman, senior advisor to the first deputy mayor.

MTA officials have said the five-year plan generates $75 billion of estimated statewide economic activity. They also cited the awarding of $1 billion of capital projects to state-certified minority- and women-owned business enterprises since 2015.

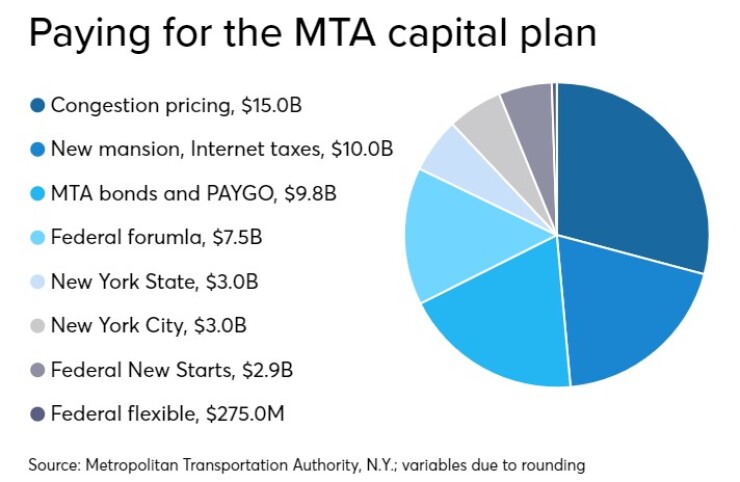

The new plan, 70% higher than the previous one, assumes $10 billion from the federal government and $3 billion each from New York State and New York City. A separate $3.3 billion for MTA Bridges and Tunnels is self-funded through toll revenue.

Other variables range from cost estimates on projects still in the planning stage to how the MTA executes a so-called transformation plan, based on a report by consulting firm AlixPartners and which the board approved in July.

Montreal businessman Anthony McCord took over as

Transit advocates worry about many unanswered questions surrounding the plan.

“Clearly, there are a number of unknowns in the program as put forth,” Lisa Daglian, executive director of the watchdog Permanent Citizens Advisory Committee to the MTA, told members of the New York City Council’s transportation committee.

“What we don’t know are things like: what projects will get built first and how will they be staged, where does congestion pricing fit into the decision-making mix, what’s the expected timeframe for delivery, [and] what’s going to be bundled and how will that work.”

The MTA has used five-year capital plans since 1981, when the state authorized it to issue bonds to fund the system. Its first plan, for 1982 to 1986, totaled $7.2 billion.