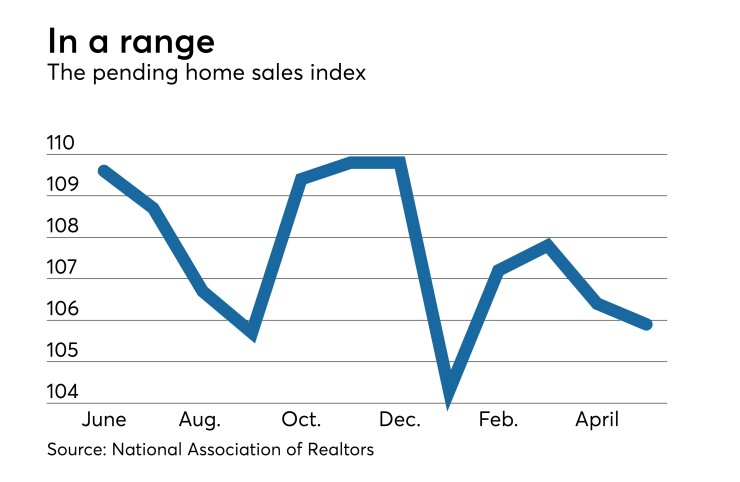

Pending home sales declined 0.5% to an index reading of 105.9 in May, after an unrevised 1.3% fall to 106.4 in April, according to a report released Wednesday by the National Association of Realtors.

An index of 100 is equal to the average level of contract activity during 2001.

Year-over-year the pending homes sales index decreased 2.2% from last May, when the index was 108.3.

IFR Markets predicted the index would be up 0.5%.

Regionally, pending sales were mostly higher. Northeast sales rose 2.0% to 92.4, grew 2.9% to 101.4 in the Midwest, while rising 0.6% in the West to 94.7, and dropping 3.5% in the South to 122.9.

“Pending home sales underperformed once again in May, declining for the second straight month and coming in at the second lowest level over the past year,” NAR Chief Economist Lawrence Yun said. “Realtors in most of the country continue to describe their markets as highly competitive and fast moving, but without enough new and existing inventory for sale, activity has essentially stalled.”

Supply has damped issuance, he said. If weak demand was the cause, price gains would slow, inventory would rise and time on the market would grow, he noted. But, home price increases are still faster than income growth and inventories dropped, while the typical listing was in contract in about three weeks, he said.

“With the cost of buying a home getting more expensive, it’s clear the summer months will be a true test for the housing market. One encouraging sign has been the increase in new home construction to a 10-year high,” added Yun. “Several would-be buyers this spring were kept out of the market because of supply and affordability constraints. The healthy economy and job market should keep many of them actively looking to buy, and any rise in inventory would certainly help them find a home.”