Top-rated municipal bonds were stronger at mid-session, according to traders, as the competitive arena heated up with the Dormitory Authority of the State of New York’s offering four bond sales totaling almost $1.5 billion while the state of New Mexico brought two sales totaling over $380 million.

Secondary market

The yield on the 10-year benchmark muni general obligation fell one to three basis points from 1.99% on Monday, while the 30-year GO yield dropped three to five basis points from 2.79%, according to a read of Municipal Market Data's triple-A scale.

Treasuries were stronger on Tuesday. The yield on the two-year Treasury dipped to 1.35% from 1.36% on Monday, the 10-year Treasury yield dropped to 2.26% from 2.32% and the yield on the 30-year Treasury bond decreased to 2.85% from 2.91%.

On Monday, the 10-year muni to Treasury ratio was calculated at 86.4%, compared with 86.2% on Friday, while the 30-year muni to Treasury ratio stood at 96.5% versus 95.9%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 36,208 trades on Monday on volume of $7.18 billion.

Primary market

DASNY sold $1.4 billion of state sales tax revenue bonds in four competitive sales.

Bank of America Merrill Lynch won the $517.02 million of Series 2017A Group C bonds with a true interest cost of 3.76%. The issue was priced to yield from 2.81% with a 5% coupon in 2040 to 3.19% with a 4% coupon in 2047.

Jefferies won the $469.02 million of Series 2017A Group B bonds with a TIC of 3.44%. The issue was priced as 5s to yield from 2.37% in 2030 to 2.78% in 2039.

RBC Capital Markets won the $337.89 million of Series 2017A Group A bonds with a TIC of 2.00%. The deal was priced as 5s to yield from 1.16% in 2021 to 2.25% in 2029; maturities in 2019 and 2020 were sold and not available.

Citigroup won the $72.78 million of taxable Series 2017B bonds with a TIC of 1.71%. The deal was priced at par to yield 1.40% in 2019, 1.70% in 2020 and 1.86% in 2021.

The deals are rated AAA by S&P Global Ratings and AA-plus by Fitch Ratings.

New Mexico competitively sold $383.36 million of bonds in two separate sales.

Citigroup won the $307.56 million of capital projects general obligation and GO refunding bonds with a TIC of 1.56%. The $153.6 million of Series 2017A GOs were priced as 5s to yield from 0.87% in 2018 to 2% in 2027. The $153.96 million of Series 2017B refunding GOs were priced as 5s to yield from 0.87% in 2018 to 1.68% in 2025.

Morgan Stanley won the Series 2017B GO refunding bonds and $75.8 million of Series 2017A severance tax bonds with a TIC of 1.74%.

The GOs are rated Aa1 by Moody’s Investors Service and AA by S&P and the severance tax bonds are rated Aa2 by Moody’s and AA-minus by S&P.

In the negotiated sector, Loop Capital Markets priced the New Jersey Turnpike Authority’s $650.05 million of Series 2017B turnpike revenue bonds.

The issue was priced to yield 2.01% with a 5% coupon in 2025 and from 2.38% with a 5% coupon in 2027 to 3.44% with a 4% coupon in 2037; a 2040 maturity was priced as 5s to yield 3.20%.

The deal is rated A2 by Moody’s, A-plus by S&P and A by Fitch.

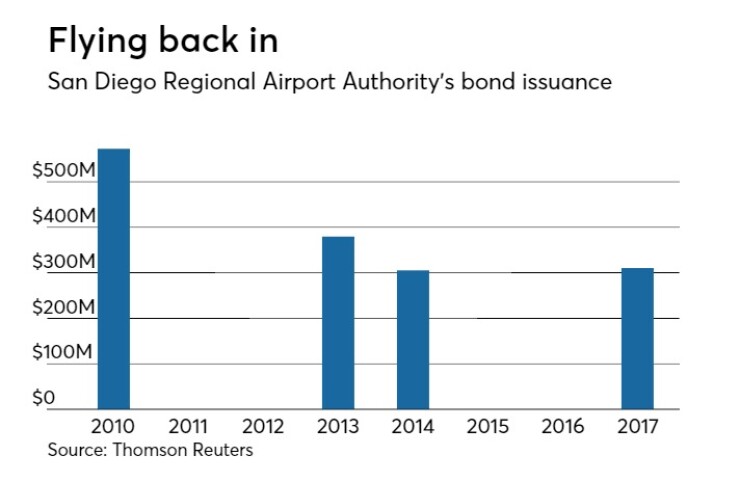

Morgan Stanley priced and repriced the San Diego Regional Airport Authority’s $293.36 million of subordinate airport revenue bonds consisting of Series 2017A bonds not subject to the alternative minimum tax bonds and Series 2017B non-AMT bonds.

The $147.08 million of Series 2017A non-AMT bonds were repriced as 4s to yield 0.87% in 2018 and as 5s to yield from 0.93% in 2019 to 2.97% in 2037, 3.03% in 2042 and 3.08% in 2047.

The $146.28 million of Series 2017B AMT bonds were repriced as 5s to yield from 1.04% in 2019 to 3.21% in 2037, 3.24% in 2042 and 3.29% in 2047.

The deal is rated A2 by Moody’s and A by S&P and Fitch.

Since 2010, the airport authority has issued about $1.5 billion of bonds, with the most issuance occurring in 2010 when it sold almost $573 million of debt. The authority did not come to market in 2011, 2012, 2015 or 2016.

Morgan Stanley also priced the Chicago Transit Authority’s $226.88 million of refunding Series 2017 capital grant receipts revenue bonds.

The $91.06 million of federal transit administration section 5307 urbanized area formula funds refunding bonds were priced as 5s to yield from 2.09% in 2022 to 2.88% in 2026.

The $135.83 million of federal transit administration section 5337 state of good repair formula funds refunding bonds were priced to yield from 1.40% with a 2% in 2018 to 2.83% with a 5% coupon in 2026.

The deal is rated A by S&P and BBB by Fitch.

JPMorgan Securities priced the Indiana Finance Authority’s $110.63 million of Series 2017A hospital refunding revenue bonds for Parkview Health.

The issue was priced as 5s to yield from 0.99% in 2018 to 2.96% in 2030.

The deal is rated Aa3 by Moody’s and AA-minus by S&P.

Barclays Capital priced the Connecticut Health and Educational Facilities Authority’s $250 million of Series 2014A revenue bonds as a remarketing for Yale University.

The bonds were priced at par to yield 1.40% in 2048 with a mandatory put date in 2020. The deal is rated triple-A by Moody’s and S&P.

NYC plans $860M bond sale

New York City plans to sell about $860 million of general obligation bonds next week, the city announced on Monday.

The deal will consist of $800 million of tax-exempt fixed rate refunding bonds and $60 million of taxable fixed-rate reoffered bonds.

The tax-exempt part of the deal is slated to have a two-day retail order period starting on Monday, July 24, and be priced for institutions on Wednesday, July 26, by a group including book-running senior manager Bank of America Merrill Lynch, with Citigroup, Goldman Sachs, Jefferies, J.P. Morgan, Loop Capital Markets, Ramirez & Co., RBC Capital Markets and Siebert Cisneros Shank & Co., serving as co-senior managers.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $91.5 million to $9.19 billion on Tuesday. The total is comprised of $4.16 billion of competitive sales and $5.03 billion of negotiated deals.