Municipal bonds finished a very active week little changed as participants caught their breath after seeing almost $12 billion of new issues come to market.

In the upcoming week, education and taxable deals dominate a slimmed-down supply slate. IHS Ipreo estimates total volume at $5.8 billion, consisting of about $4.7 billion of negotiated deals and $1.1 billion of competitive sales.

BofA Securities cut its full year 2020 issuance target to $415 billion from $430 billion, but maintained its forecast of second half issuance of $220 billion.

“Strong issuance volumes in January and February led us to increase the yearly estimate to $450 billion, only then did the COVID-19-induced disruption cause dismal issuance from March through May,” BofA said in a research report released Friday. “New issuance volumes for March, April and May were all significantly below our original estimates.”

Year-to-date issuance is about $180 billion, BofA said.

“The primary market looks fully recovered from the COVID-19-induced crisis. The calendar and visible supply index suggest that June's new issuance volume should match or exceed our estimate of $42 billion for the month and bring [the first half] total issuance to approximately $195 billion. This is $15 billion less than we expected,” BofA said in its report.

“Historically, the second half's issuance tends to be higher than the first half, and we expect it to be significantly higher this year,” BofA said. “As such, we maintain our original 2H20 issuance target of $220 billion, bringing our total forecasted 2020 issuance volume down to $415 billion.”

BofA said taxable bond issuance was on track to reach $105 billion for the year.

Despite the typically slow activity for a summer Friday, strong demand and low yields continued to drive the municipal market.

Even the week's arrival of nearly $12 billion in supply wasn’t enough to quench investors’ thirst in the midst of spring and summer redemption season.

“Continued inflows into the muni space helped to drive demand on the week,” said Shaun Burgess, portfolio manager and analyst at Cumberland Advisors. “Deals were consistently oversubscribed, especially where there were attractive spreads to take advantage of.”

Although the new calendar is smaller, investors will be attentive nonetheless as the July 1 redemption date nears with the end of the second quarter.

“Continued inflows should help to bolster demand and contribute to the performance of the municipal space,” Burgess said.

“We are keeping a close watch on COVID-19 infection rates even though markets have shown little reaction to the second wave experienced in a number of states,” he said, adding that Treasuries and municipals displayed little movement in light of the increase in reported cases in some states.

Primary market

The biggest deal on the calendar for the June 22 week is Utah County, Utah’s (Aa1/AA+//) $350 million of hospital revenue bonds. The deal is slated to be priced by JPMorgan Securities on Thursday.

In the taxable sector, Barclays Capital is set to price Northeastern University (Aa1///) in Massachusetts’ $300 million of corporate CUSIP refunding bonds on Tuesday.

Oppenheimer & Co. is expected to price the National Finance Authority in New Hampshire’s (A2///) $200 million of taxable federal lease revenue bonds for the Virginia Kernersville Heath Care Center Project on Thursday.

JPMorgan is set to price IHC Health Services Inc.’s (Aa1/AA+//) $183 million of taxable corporate CUSIP bonds on Thursday.

Waiting in the wings is the Massachusetts-based Children's Hospital Corp.’s $300 million taxable deal, slated to be priced by Goldman Sachs and the District of Columbia’s (A2/A+//) $188 million of taxable revenue refunding bonds for National Public Radio to be priced Morgan Stanley.

In the education sector, Citigroup is set to price the Lewisville Independent School District, Texas’ (/AAA/AAA/) $266 million of unlimited tax school building and refunding bonds. The deal is backed by the Permanent School Fund guarantee program.

Piper Sandler is expected to price three education deals: the Cypress-Fairbanks Independent School District, Texas’ (Aaa/AAA//) $252 million of unlimited tax school building and refunding bonds backed by the PSF; the Salem-Keizer School District No. 24J, Ore.’s (Aa1/AA+//) $236 million GOs backed by the Oregon School Bond Guaranty Act; and the Ysleta Independent School District, Texas’ (Aaa/AAA//) $215 million of taxable unlimited tax refunding bonds backed by the PSF.

And RBC Capital Markets is set to price the Northwest Independent School District, Texas’ (Aaa//AAA/) $176 million of unlimited tax school building and refunding bonds backed by the PSF.

No competitive issues over $100 million are on the slate for the upcoming week.

On Friday, Morgan Stanley received the official award on the New Jersey Educational Facilities Authority’s $182.185 million of taxable revenue refunding bonds for the College of New Jersey.

The deal (NR/AA/NR/NR) was insured by Assured Guaranty Municipal Corp.

The buy side’s strong appetite can be seen in the volume of institutional inflows, according to a New York trader.

“Demand for the new issues was quite strong as we saw positive cash flow into bond funds,” he said Friday afternoon.

“The high-yield market is definitely back — with heavy oversubscription for the $360 million American Airlines transaction, which traded up from a 5.60% to a 5.15%,” he said.

The trader noted there is noticeably more support for bond insurance in sectors where spreads have widened, such as higher education and health care.

Secondary market

On MMD’s AAA benchmark scale, yields were unchanged throughout the curve. Yields on the 2021 and 2023 maturities were steady at 0.25% and 0.27%, respectively. The yield on the 10-year GO muni was flat at 0.88% while the 30-year yield was unchanged at 1.63%.

The 10-year muni-to-Treasury ratio was calculated at 125.9% while the 30-year muni-to-Treasury ratio stood at 110.9%, according to MMD.

The ICE AAA municipal yield curve showed yields were unchanged, with the 2021 and 2022 maturities at 0.230% and 0.240%, respectively. Out longer, the 10-year maturity was steady at 0.847% while the 30-year was flat at 1.643%.

ICE reported the 10-year muni-to-Treasury ratio stood at 130% while the 30-year ratio was at 110%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.21% and the 2022 maturity at 0.26% while the 10-year muni was at 0.88% and the 30-year stood at 1.63%.

Munis were also little changed on the MBIS benchmark and AAA scales.

Treasuries were stronger as stocks traded weaker.

The three-month Treasury note was yielding 0.162%, the 10-year Treasury was yielding 0.687% and the 30-year Treasury was yielding 1.470%.

The Dow dropped 0.50%, the S&P 500 decreased 0.37% and the Nasdaq declined 0.10%.

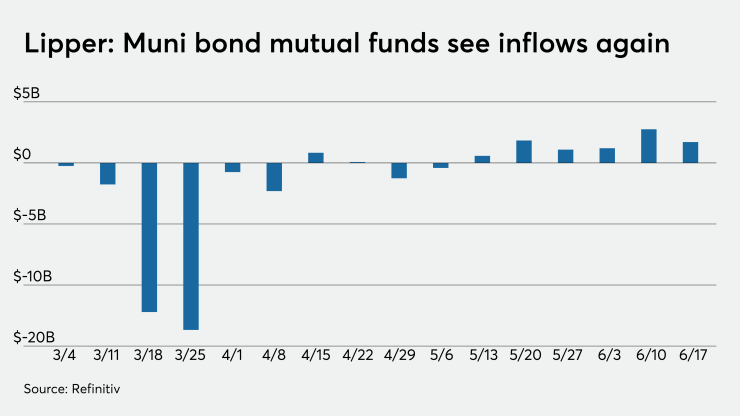

Lipper reports $1.7B inflow

Investors remained bullish on municipal bonds and continued to put cash into bond funds in the latest reporting week.

In the week ended June 17, weekly reporting tax-exempt mutual funds saw $1.710 billion of inflows, after inflows of $2.759 billion in the previous week, according to data released by Refinitiv Lipper Thursday.

It was the sixth week in a row that investors put cash into the bond funds.

Exchange-traded muni funds reported inflows of $470.235 million, after inflows of $528.605 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.240 billion after inflows of $2.230 billion in the prior week.

The four-week moving average remained positive at $1.692 billion, after being in the green at $1.724 billion in the previous week.

Long-term muni bond funds had inflows of $989.972 million in the latest week after inflows of $1.555 billion in the previous week. Intermediate-term funds had inflows of $121.558 million after inflows of $307.069 million in the prior week.

National funds had inflows of $1.589 billion after inflows of $2.560 billion while high-yield muni funds reported inflows of $148.262 million in the latest week, after inflows of $593.509 million the previous week.

Bond Buyer indexes mixed

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 3.64% from 3.69% from the week before.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields rose to 2.21% from 2.19% in the previous week.

The 11-bond GO Index of higher-grade 11-year GOs increased to 1.74% from 1.72%.

The Bond Buyer's Revenue Bond Index was up to 2.63% from 2.61% from the previous week.

The yield on the U.S. Treasury's 10-year note increased to 0.70% from 0.66% the week before, while the yield on the 30-year Treasury rose to 1.47% from 1.41%.