The Utah Infrastructure Agency, a pioneer in financing public broadband, will connect its 16th city to an open fiber network known as Utopia.

UIA expects to price $17.1 million of tax-exempt revenue bonds Wednesday through negotiation with Key Banc Capital Markets.

Roger Timmerman, executive director of Utah Telecommunication Open Infrastructure Agency (UTOPIA), sister agency of UIA, said the financing will bring the city of Pleasant Grove into the rapidly growing network.

As it has done with previous cities along the Wasatch Front, UIA supports the debt with revenues from customers as is common with other municipal utilities. Pleasant Grove also pledges to cover any shortage of debt service with tax revenue, a scenario Timmerman considers unlikely.

“System revenues have always been more than adequate to pay debt service, and the pledges have not been called upon,” he told The Bond Buyer.

The deal is rated A by S&P Global Ratings with a stable outlook, based on the tax pledge by Pleasant Grove.

While Utopia’s open network featuring 100% coverage would appear to be the model for overcoming connectivity problems identified by the Biden administration’s $100 billion broadband proposal, Timmerman said that a recent conference call with the White House proved disappointing.

The money directed at underserved areas would not be available for the Salt Lake City region or the entire state of Utah, where the federal standard for “good” internet download speeds of 25 megabits per second is already surpassed, he said.

That means that a corporate telecom with minimal standards could wave off competition from a network like Utopia offering lightning-fast downloads measured in gigabits per second.

“They put out some rules that are outdated,” Timmerman said. “A lot of communities are complaining that they gutted our ability to take advantage of the federal funding.

“We’re a great candidate for these funds,” he said. “It would be really nice to have a shot in the arm. Without the subsidy, we just go back to what we know works.”

Financial advisor Laura Lewis, principal of Lewis Young Robertson and Burningham, said the rating agencies have not yet developed a framework for evaluating municipal broadband networks based on probable revenues.

“With water bonds, they have their criteria,” she said. “You talk to them about fiber and it’s kind of like a deer in the headlights. They completely ignore what revenue might be generated. They look only at the backstop.”

Utopia’s chief financial officer Laurie Harvey, who joined the agency in 2019 after 20 years in administration with Midvale City, said that the lower ratings provide investors with potential upside as the network grows. UIA bonds not supported by city revenue pledges are rated at the lowest investment grade of BBB-minus by Fitch Ratings.

“Given the growing need for fiber infrastructure and the slow maturation in this market, UIA’s continued growth and investors’ ongoing need for portfolio diversification, UIA bonds continue to add buy-and-hold investors with every offering,” she said. “UIA believes that most enterprises with coverage and projections like UIA would likely be rated much stronger.”

Pleasant Grove, a city of about 38,000 on the Interstate 15 corridor south of Salt Lake City, pledges up to 100% of its municipal energy sales and use tax on natural gas, electricity sales, and phone to support the debt. The city council voted unanimously to join the network April 13, allowing work to begin this month.

Utopia offers 100% coverage to the city with residential speeds of up to 10 Gigabits per second, and 100 Gbps for business, which it claims as the fastest speeds in the United States.

Municipal telecom and broadband enterprises have come to grief in

Utopia has a different business model; as an open access network, Utopia builds the infrastructure and allows competition among private sector internet service providers over its fiber lines.

Pleasant Grove Mayor Guy Fugal said his city decided to join the network after months of vetting.

“Utopia Fiber is both shovel and operationally ready at a time when others are navigating logistical hurdles and crew shortages,” Fugal said in a statement after the decision. “Most importantly, Utopia Fiber has a loyal customer base and has been consistently hitting its revenue marks, which are the ultimate quality measures.”

UIA was formed in 2010 by nine Utah cities to build the Utopia fiber-optic network, which now supports $185 million of debt.

“Utopia struggled due in part to intense backlash from the incumbent internet service providers who were able to garner some legislation that put up some initial roadblocks to what Utopia was trying to accomplish,” Harvey said. “Utopia also experienced problems common to pioneering start-up companies such as system design flaws, investing in faulty equipment, and reliance on the wrong consultants.”

She said marketing to the public was more difficult than anticipated.

“Many potential customers believed at the time that government was overreaching, and they did not see the need for faster, more reliable internet connectivity,” she said.

“Refusing to let the dream die, when there seemed to be no path forward for Utopia, nine of those cities formed UIA,” Harvey said.

UIA’s first bond issue came in 2011 in the amount of $29.5 million, backstopped by revenue pledges from eight of the nine UIA member cities. Additional bonds of $11.2 million were issued in 2013, followed by a $24.3 million issue in 2015 with a revenue pledge from the cities.

In 2017, UIA refunded all of those bonds with its Series 2017 issue of $77.4 million.

More bonds were issued as cities joined the network.

The combined network now has an average residential subscriber rate of 32% of available addresses, Harvey said. Six cities have a “take rate” of over 40%.

“We agree that public fiber networks like UIA have been viewed with skepticism in the past,” Harvey said. “We feel strongly that government does have a role in providing broadband infrastructure that can be accessed by private internet service providers, similar to the way government builds airports that provide access to many private airlines.

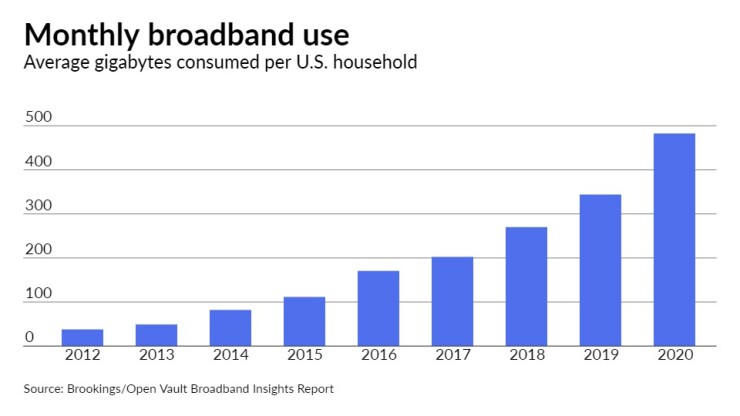

“The COVID-19 pandemic alerted most of the population to the importance of high-speed internet service with the need to work from home and attend school online,” she said. “The number of new subscribers on our network increased from 500 per month to 1,000 per month in the spring of 2020.”