Municipal bonds weakened as deals from Cuyahoga County, Wisconsin, Hawaii, the city of Los Angeles, San Francisco BART and New York MTA hit the market on Tuesday.

Bank of America priced and repriced Cuyahoga County, Ohio’s $912.8 million of Series 2017 hospital revenue bonds for the MetroHealth System.

The issue was priced to yield from 2.78% with a 5% coupon in 2023 to 4.21% with a 5% coupon in 2032. A 2037 maturity was priced as 5s to yield 4.49%; a 2042 maturity was priced as 5s to yield 4.61%; a split 2047 maturity was priced as 4 3/4s to yield 4.85% and as 5 1/4s to yield 4.68%; a split 2052 maturity was priced as 5s to yield 4.95% and as 5 1/2s to yield 4.80%; and a split 2057 maturity was priced as 5s to yield 5.03% and as 5 1/2s to yield 4.90%.

The deal is rated Baa3 by Moody’s Investors Service and BBB-minus by S&P Global Ratings and Fitch Ratings. The credit carries stable outlooks from all three agencies.

Since 2007, the county has issued roughly $2.47 billion of securities, with the lowest issuance occurring in 2014 when it sold $14.6 million. Before Tuesday’s sale, the county had already reached its highest yearly issuance total in a decade, with the next highest being $511 million back in 2010.

Citigroup priced Wisconsin’s $291.02 million environmental improvement fund revenue bonds.

The $219.15 million of tax-exempts were priced as 5s to yield from 1.03% in 2019 to 2.84% in 2035. A 2018 maturity was offered as a sealed bid.

The $71.87 million of Series 2017B taxables were priced at par to yield 1.30% in 2018.

The deal is rated AAA by S&P and Fitch.

Ramirez & Co. priced the New York Metropolitan Transportation Authority’s Series 2017B dedicated tax fund green bonds for retail investors.

The $306.94 million of Series 2017B-1 bonds were priced to yield from 0.92% with a 4% coupon in 2018 to 3.58% with a 3.50% coupon in 2038. A 2042 maturity was priced as 5s to yield 3.28%, a 2047 maturity was priced as 5s to yield 3.33%, a 2052 maturity was priced as 5s to yield 3.45%. A 2057 maturity was not offered to retail investors.

The $142.6 million of Series 2017B-2 bonds were priced as 5s to yield from 1.57% in 2022 to 2.57% in in 2028; a 2033 maturity was priced as 3 1/4s to yield 3.33%.

The deal is rated AA by S&P and Fitch.

Barclays Capital priced the San Francisco Bay Area Rapid Transit District’s $380.95 million of general obligation

The $270 million of Series 2017A-1 election of 2016 green bonds were priced to yield from 0.88% with a 4% coupon in 2018 to 2.99% with a 5% coupon in 2037; a 2042 maturity was priced as 4s to yield 3.50%. No retail orders were taken in the 2033-2035 or 2047 maturities.

The $30 million of taxable Series 2017A-2 election of 2016 green bonds were offered as a sealed bid for the 2017 maturity.

The $80.95 million of Series 2017E election of 2004 refunding green bonds were priced as 4s to yield 0.88% in 2018, as 5s to yield 0.98% in 2019 and as 5s to yield 1.10% in 2020. No retail orders were taken in the 2036 or 2037 maturities.

The deal is rated triple-A by Moody’s and S&P.

Morgan Stanley priced Los Angeles’ $333.87 million of Series 2017A wastewater system subordinated revenue green bonds and Series 2017B refunding green bonds for retail investors.

The $225.74 million of Series 2017A bonds were priced as 5s to yield from 2.39% in 2028 to 3.11% in 2037; a 2042 maturity was priced as 5 1/4s to yield 3.13% and a 2047 maturity was priced as 4s to yield 3.63%.

The $108.13 million of Series 2017B bonds were priced to yield from 1.07% with a 4% coupon in 2020 to 1.40% with a 5% coupon in 2022 and to yield from 2.10% with a 5% coupon in 2026 to 3.25% at par in 2032, and to yield from 3.03% with a 5% coupon in 2035 to 3.51% with a 4% coupon in 2039.

The deal is rated AA by S&P, Fitch and Kroll Bond Rating Agency.

BAML priced Hawaii’s $876.185 million of Series 2017 FK, FL, FM, FN, FO and FP refunding and taxable general obligation bonds for retail customers on Tuesday, ahead of institutional pricing on Wednesday.

The $594.915 million of Series FK bonds were priced for retail to yield from 1.19% with a 5% coupon and with a 4% coupon in a split 2020 maturity to 3.64% with a 3.50% coupon in 2037. The 2030 through 2032 maturities, as well as the second half of the split maturity in 2033, the 2034, the second half of the split 2035 maturity and the second half of the 2037 split maturity were not available to retail investors.

The $4.20 million of Series FL bonds was priced for retail as a bullet maturity in 2017 with a sealed bid. The $1.20 million of Series FM bonds were priced for retail as a bullet maturity in 2017 with a sealed bid.

The $230.87 million of Series FN bonds were priced for retail to yield from 1.36% with a 5% coupon in 2021 to 3.01% with a 4% coupon in 2031.

The $37.50 million of Series FO bonds were priced for retail at par to yield 1.95% in 2020 and also priced to yield 2.167% with a 2.30% coupon in 2021. The $7.50 million of Series FP bonds were priced for retail at par to yield from 1.95% in 2020 to 3.94% in 2037.

The deal is rated Aa1 by Moody’s, AA-plus by S&P and AA by Fitch.

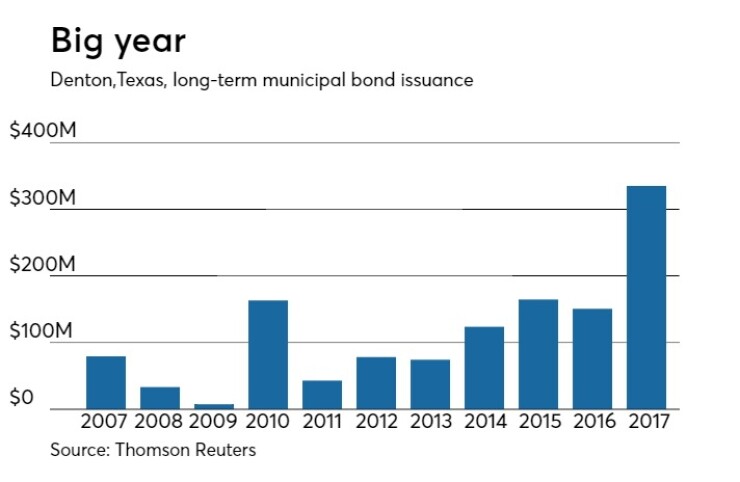

In the competitive arena, Denton, Texas, sold $120 million of debt in two separate sales.

Citigroup won the $90.96 million of Series 2017 certificates of obligation with a true interest cost of 3.34% information on the $29.12 million of Series 2017 GO refunding and improvement bonds was not immediately available.

Both deals rate rated AA-plus by S&P and Fitch.

Since 2007, the city of Denton has issued roughly $1.47 billion of securities, with the lowest issuance occurring in 2009 when it issued $7.5 million. Before Tuesday’s sales, the city had already reached its highest yearly issuance total in a decade, with the next highest being $165 million in 2015.

Bond Buyer visible supply

The Bond Buyer's 30-day visible supply calendar increased $829.9 million to $16.30 billion on Tuesday. The total is comprised of $4.36 billion of competitive sales and $11.94 billion of negotiated deals.

Secondary market

The yield on the 10-year benchmark muni general obligation was as much as one basis point higher from 2.17% on Monday, while the 30-year GO yield was as much as one basis point higher from 3.03%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Tuesday. The yield on the two-year Treasury rose to 1.35% from 1.33% on Monday, while the 10-year Treasury yield gained to 2.40% from 2.37%, and the yield on the 30-year Treasury bond increased to 3.04% from 3.01%.

The 10-year muni to Treasury ratio was calculated at 91.3% on Monday, compared with 92.3% on Friday, while the 30-year muni to Treasury ratio stood at 100.5%, versus 101.4%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 37,337 trades on Monday on volume of $8.62 billion.